Heavy Buying Early in 2022/23

Chuck Penner, LeftField Commodity Research

The extreme market situation of 2021/22 was certainly a learning experience for both buyers and sellers of Canadian barley. Record high prices, record low ending stocks and unprecedented trade flows forced everyone to adapt. The lessons learned won’t be forgotten quickly and are having an influence on the barley market for 2022/23.

For one thing, farmers are more reluctant sellers, quite understandable given the production risks and missed pricing opportunities of last year. Dry conditions so far this fall are adding extra nervousness to the outlook. This is providing an earlier and stronger price response from the harvest lows.

On the other side of the transaction, buyers are afraid of a repeat of last year’s experience when supplies became extremely scarce. As a result, there’s been more of a scramble to build coverage, both in the short-term and for the rest of the marketing year. This applies to domestic feeders, maltsters and importers of Canadian barley.

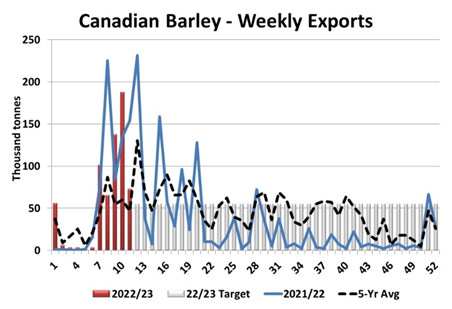

Through the first 11 weeks of 2022/23, farmers have already delivered 1.12 million tonnes of barley, well above average, although still behind last year’s frantic pace. Shipments out of country elevators are nearly 850,000 tonnes, compared to the average of less than 700,000 but again, a bit less than last year. Exports started slowly this year because supplies weren’t available but have since caught up in a big way. As of week 11, 640,000 tonnes have been exported, just behind last year and well ahead of the 5-year average of 408,000 tonnes.

Statistics to track domestic feeding of barley aren’t available, but we’re hearing that the volumes traded are higher than usual. This includes barley for immediate delivery but also booking well into 2023 as feeders try to avoid a repeat of last year. That’s especially the case since imported US corn has become more expensive with a weak Canadian dollar.

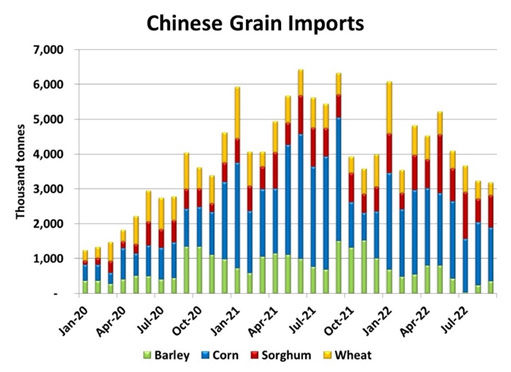

One big unknown in the market is what China will do later in 2022/23. China’s main sources of barley, including Ukraine, France and Argentina will all have less barley available for export this year, which should push more demand toward Canada. Of course, that assumes Australian barley will continue to be shut out of China by import tariffs. That said, Chinese imports of various feed grains have been more muted in the last few months.

The size of the Canadian barley crop in 2022 still hasn’t been nailed down but even with a solid production increase, supplies won’t be enough to allow domestic use and exports to bounce back to pre-2021 levels. This is going to keep the supply side tight, with 2022/23 ending stocks close to last year’s record lows.