Barley Market Report: Far-off Trade Deal A Possible Risk For Canadian Barley

by Check Penner, LeftField Commodity Research

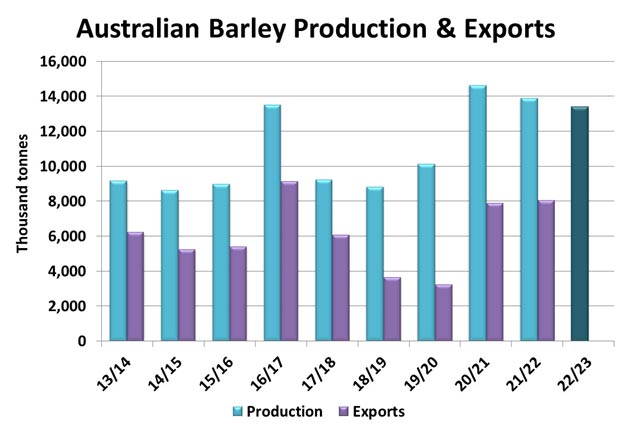

Over the last few years, Canadian barley exports have expanded sharply. Back in 2015/16, Canada exported less than 1.2 mln tonnes of barley but that spiked to over 3.5 mln tonnes in 2020/21. The drought did a number on exports in 2021/22, but they were still 1.9 mln tonnes and in 2022/23 are back on track to hit 3.1 mln tonnes.

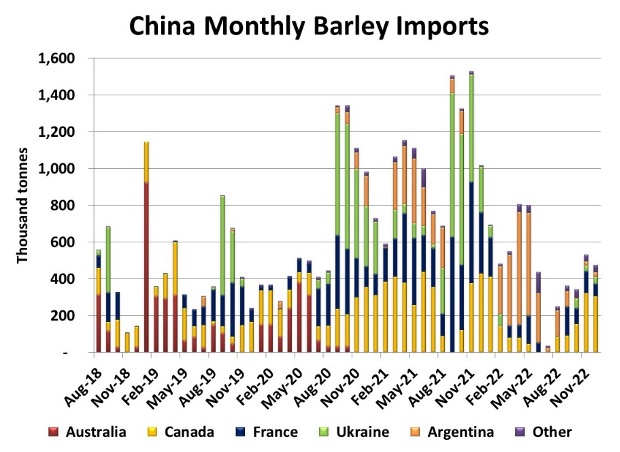

It’s no coincidence that Canadian barley exports spiked in 2020/21. China is the dominant buyer of Canadian barley, taking nearly 90% of Canadian exports. In May 2020, China suddenly imposed an 80.5% tariff on barley imports from Australia in response to several diplomatic irritants between the two countries. Besides barley, China imposed restrictions on several key Australian products, including coal, wine and beef.

Prior to these import tariffs, Australia had been the largest source of barley to China, with Canada filling in smaller amounts. Not only was Australia shut out of China in mid-2020, but Chinese barley imports surged to record levels. Canada received a good chunk of this bigger business, along with France, Ukraine and Argentina, with monthly origins shifting based on the timing of harvest.

In the first half of 2022, Canadian barley exports to China dropped off as the 2021 drought cut supplies. Volumes only started to recover late in the calendar year. Meanwhile, other origins can offer only small supplies. The Argentine crop was reduced by drought, Ukraine faced a smaller 2022 harvest and Europe is facing feed grain shortages due to a sharp drop in its 2022 corn crop. This leaves China with fewer sources of barley, which could make it rethink its trade dispute with Australia.

Recently, Chinese and Australian trade officials have met, suggesting a possible thaw in relations. Trade in coal is now resuming after several years and some observers are hoping this will open the door for Chinese imports of other Australian commodities, including barley.

In late 2020, Australia launched a WTO challenge over China’s barley import tariffs and after several years of back-and-forth, a ruling is expected within the first three months of 2023. Even when the trade ruling comes down, it doesn’t mean trade would restart immediately, as challenges and other delays can extend the process for months or longer. That said, if relations between the two countries are actually improving, it’s also possible the tariffs could be dropped even before a ruling is announced.

While a resolution of some sort is looking more likely, there’s still no certainty about how or when barley trade could resume between Australia and China. A quick diplomatic resolution would allow China to bring in large volumes of Australian barley immediately, with another large crop available, while a longer drawn-out process would blunt the impact.

Back in Canada,domestic feed use is still the largest source of demand for barley but this “bonus” export business to China has really been the main reason for stronger prices, even before the 2021 drought. As a result, anything that affects Canadian export potential would have an outsized impact on prices. Currently, Australian barley has been forced to find a home in other destinations and is priced well below other origins like Canada. The potential for Australian barley to move into China, Canada’s main customer, is a sizable risk for barley prices in the coming months and into 2023/24.