Seasonal Factors Kicking Into Gear

By: Chuck Penner, LeftField Commodity Research

Coming off a year of extreme prices, it wasn’t entirely clear how the barley market was going to respond this summer and early fall. After all, those rallies were triggered by a lot of unusual situations. What would the market do once those circumstances – especially a recovery in the Canadian crop – changed?

One helpful tool we refer to is the seasonal price tendency. This tool is based on prices over many years to see if there are established patterns that offer clues about timing and direction in the market. There are some consistent buying and selling behaviours that tend to show up in most (but not all) years and these give shape to the seasonal tendencies.

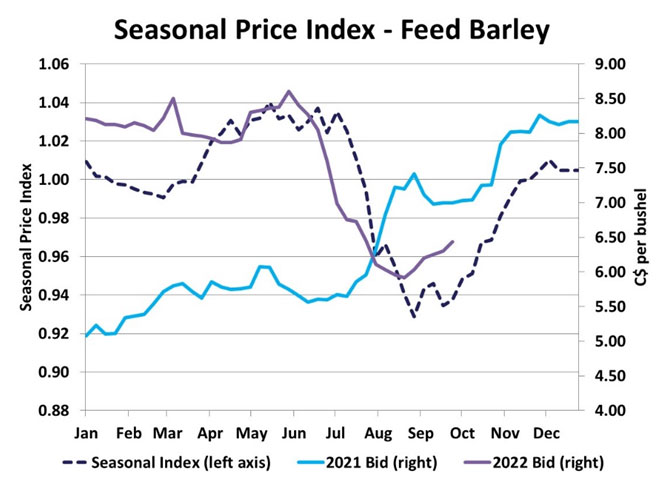

The dotted line in the chart shows the seasonal price strength and weakness that we have calculated with barley elevator bids, starting in 1992. While there are a few years that don’t follow the pattern closely, the highs and lows of the year tend to occur at a similar time, whether barley is $1.50 or $8.50 per bushel.

Prices don’t follow the pattern every year, and 2021 was one of those exceptions, as there was nothing remotely normal about the year. In particular, the second half of the year was dominated by the drought, which caused prices to spike already in early July. That was followed by record corn imports, herd liquidations and the war in Ukraine.

Even so, after the initial shock of the drought, prices in late 2021 started following the seasonal pattern more closely and that carried forward into 2022. The seasonal price index shows that feed barley prices normally start tipping over in early July. In 2022, that move started a few weeks earlier, possibly because the extreme prices caused buyers’ behaviour to change. Or maybe it was because there was simply no barley left to buy at that point.

Regardless, 2022 feed barley prices followed the seasonal tendency lower until late August, within a week or so of the normal lows in the market. The index shows that barley prices tend to stay near those lows until late September before heading higher but in 2022, feed barley bids aren’t waiting around and are already turning higher. There are a few likely reasons why that move is happening a bit earlier than usual.

For one thing, even though the 2022 crop is bigger, barley feeders’ experience last year could have them more motivated to get their needs covered earlier than usual. Second, the rally in corn futures and weakness in the Canadian dollar has made corn imports from the US a lot more expensive, choked off that feed source and shifted demand back to barley. And possibly most important, China is back as a large buyer of Canadian barley and competing with domestic feeders.

So where to from here? Well, the seasonal pattern shows the market doesn’t normally level off until early December and there aren’t any reasons, we can see why that should change.

What the seasonal index isn’t very good at is showing how high prices will go before they turn sideways. A strong export pull will keep upward pressure on prices, but the availability of more feed wheat in Canada could also limit the upside. And who knows what else will crop up over the next year? Questions and uncertainty will always be part of the outlook.