More adjustments in the Canadian barley market

Chuck Penner, Leftfield Commodity Research Inc.

The 2021/22 barley story has had a number of twists and turns already and the year is only half over. It started with the highest acreage base in 13 years, which turned into the smallest crop in modern history. The 2021 crop deteriorated very quickly and yields were lost over a short timeframe, catching many off guard.

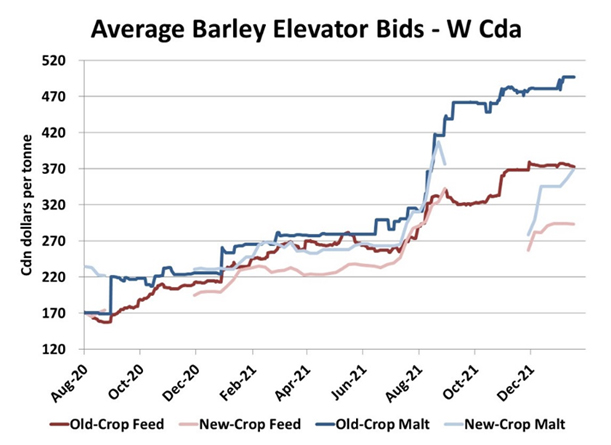

Despite the 3.8 million (M) tonnes drop in the 2021 crop, Canadian exports through the first few months of 2021/22 were the strongest in at least 25 years. As of the end of November, 1.3 M tonnes of barley had been exported, almost double the five-year average pace. Chinese buyers had booked these large amounts before the drought took hold. Finding barley to fill those contracts boosted feed barley bids to record levels.

With all this barley drained out of Western Canada and the crop quality poorly suited for malt, premiums for malt barley jumped to extreme levels and haven’t backed off since. At the same time, feed users have been looking for any and all sources of energy and protein for their livestock. Feed wheat and all other cereal grains are in short supply too, forcing them to hunt further afield.

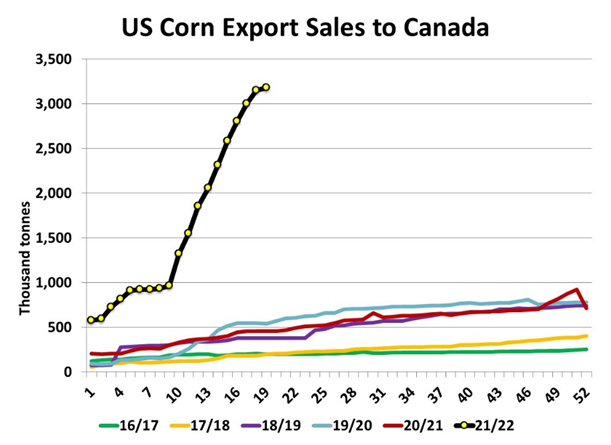

That brings us to corn imports from the United States (U.S.). No surprise to anyone, Canada has been importing massive amounts of U.S. corn already and will need to do so until the 2022 harvest. The chart shows the U.S. has sold nearly 3.2 M tonnes of corn to Canadian buyers already, far beyond any previous years.

While those U.S. sales look impressive, the huge amounts involved are causing huge headaches for buyers and feeders that are counting on getting the corn on time. Simply put, the Western Canadian handling system is built to export grains, not to import them. Rail and truck logistics aren’t able to keep up with the “unprecedented” demand and big delays are developing.

This brings us back to barley. On paper, corn has been the cheaper feed grain in Western Canada and should be pulling barley prices lower. There’s plenty of corn south of the border but the delays in getting it delivered are forcing Canadian feeders to keep bidding aggressively for feed barley to maintain some backstop inventories. Other barley users are getting creative too, with a recent report of European barley coming into Canada. And if the handling system can adapt, it wouldn’t be surprising to see Australian feed or malt barley trading into western Canada, with Aussie barley much cheaper.

Fortunately (for feeders), it looks like the flow of barley exports to China has finally slowed to a trickle so that competition for supplies has faded. The problem is that the heavy exports early in the year have already drawn down stocks, so there’s not much barley left to bid for. This has kept feed barley bids elevated while malt has ticked even higher recently.

Looking further ahead, there are already concerns about the 2022 barley crop. Aside from ongoing worries about low moisture and the possibility of low yields, reports are pointing to fewer barley acres this spring. Maltsters seem to be the most concerned and are more active in new-crop contracting, with more aggressive bids well above the average shown in the chart. It seems that the “excitement” in the barley market isn’t quite over yet.