Bigger Influence from International Markets in 2022/23

By: Chuck Penner, Leftfield Commodity Research

There are some years when most of the direction in Canadian barley prices is dictated by the situation within our own borders. Largely, that happens when Canadian supplies are low, as the extreme case of 2021/22 showed in spades. In other years, barley prices have been supported by low supplies coupled with steady feed demand, although not nearly as noticeable as in 2021/22.

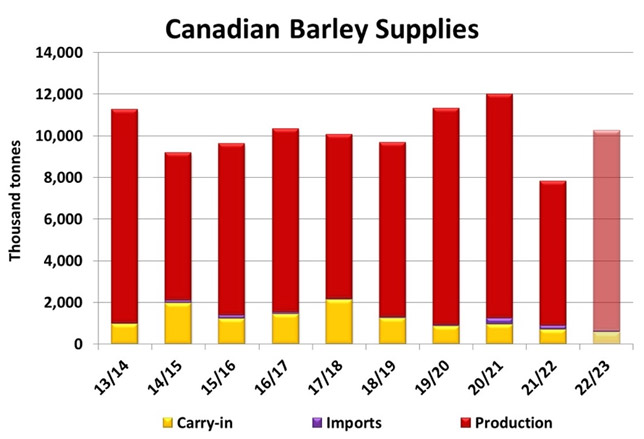

Projections for 2022 barley production still aren’t clear but even with 15% fewer acres, the crop will certainly be bigger than last year. Our current barley crop forecast is 9.6 mln tonnes, up from only 6.9 mln tonnes last year. Carryover will be smaller but total supplies should be a bit over 10 mln tonnes, 30% more than last year.

One thing that’s been very different in the past five years has been much stronger export demand. Total Canadian exports the last five years have averaged 2.4 mln tonnes. In the five years before that, annual exports averaged 1.4 mln tonnes. That extra million tonnes of demand has been enough to drain Canadian barley supplies. And frankly, export volumes would be even higher if Canada would have had more barley available.

That stronger export pull has come almost exclusively from China, which is now the dominant global buyer. In 2020/21, Chinese barley imports topped 12 mln tonnes, far more than the Saudi’s purchased when they were the big deal in barley. So far in 2021/22, China’s import pace is trailing last year, but only because exporters’ supplies aren’t available. China has drained barley out of Ukraine, France, Canada and most recently, Argentina. The only other country with supplies left is Australia and a diplomatic dispute caused China to slap 80% tariffs on Australian barley, so that’s not available either.

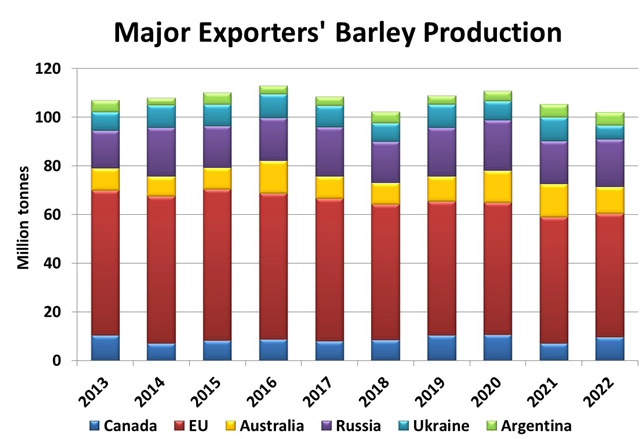

According to the USDA, 2022 barley production among major exporters will be 3% smaller than last year, so China will have fewer supplies available in 2022/23. The next barley crop is now being harvested in Europe and Ukraine. The problem is that the 2022 crops are smaller and, in the case of Ukraine, difficult and costly to access. That leaves Canada’s upcoming harvest as the next source for Chinese buying.

The bottom line is that even with a bigger Canadian barley crop in 2022, there will be a lot of pressure again on supplies in western Canada. Between the steady pull from domestic feeders and a likely boost in exports, there won’t be much barley left by the end of 2022/23. Very much a similar situation as the last couple of years.

For feeders, there should be a few more options in 2022/23. Besides the continued availability of US corn that was so essential in 2021/22, bigger crops of other cereal grains should allow for a larger pool of feed sources available. That’s especially the case for feed wheat, which almost disappeared as a feed source this past year.

While Canadian barley prices have come down sharply in the last month or two, those declines might not be extended much further as global barley markets seem to be stabilizing after coming off last year’s highs. Getting back to the “drought highs” could be a challenge, especially if other feed grains are more readily available, but there’s still plenty of support ahead for 2022/23.