More Barley Supplies but Demand Up Too

By Chuck Penner, Leftfield Commodity Research

It’s always risky to start making crop predictions at this stage of the year. Invariably, the weather changes and crop conditions take a turn. We learned that in spades in 2021, when crops deteriorated incredibly quickly. Despite that caution, it’s time to start looking at crop prospects for 2022 and what they could mean for barley supplies.

This year, questions about acreage are adding uncertainty for the Canadian barley crop. Back in April, StatsCan reported 2022 barley plantings would be 7.5 mln acres, down 10% from last year. But that was before the wet conditions and planting delays in the eastern prairies started to shift things around. Some farmers reported putting in barley to replace crops they couldn’t get planted, although some of those acres could get cut for greenfeed. In the end, it might not make a huge difference.

Even though it’s still early, there’s a lot more optimism for barley yields in 2022. Some areas are still a concern, but soil moisture has been recharged in much of the prairies. Compared to last year, when nearly all the prairies were extremely dry, the majority is looking considerably better in 2022. The improved moisture profile will help the crop manage the heat in July, which hopefully won’t be as extreme as 2021.

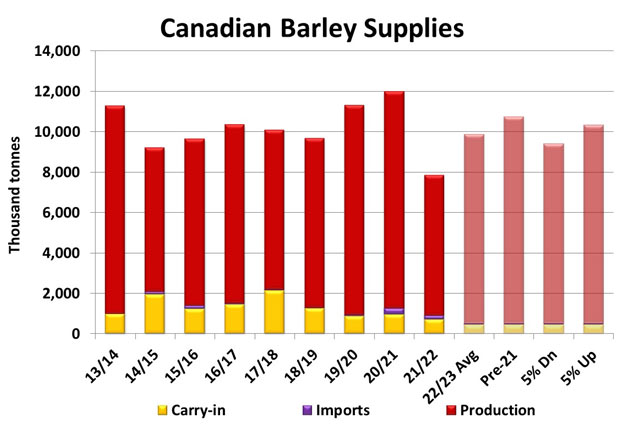

Despite all those question marks, we can try out a few production scenarios using StatsCan’s early estimate of 7.5 mln acres and a few yield possibilities. The latest 5-year average yield (including 2021’s 43.0 bu/acre) is 63.9 bu/acre. The 5-year average prior to 2021 would be 69.8 bu/acre. To account for poorer or better growing conditions ahead, we’ve included yields 5% below and 5% above the latest 5-year average.

The base case, with the latest 5-year average yield would mean a crop of 9.4 mln tonnes, 2.4 mln tonnes (35%) more than last year. The highest estimate based on the pre-2021 average yield would come in at 10.74 mln tonnes, 3.3 mln tonnes (47%) more than last year while the lowest case would mean a crop of 8.9 mln tonnes, 1.9 mln more than last year. Bottom line is, the 2022 crop will be considerably larger than 2021; it’s just a matter of how much.

Keep in mind, carryover from 2021/22 is less than 500,000 tonnes, which means almost all of 2022/23 supplies depend on the crop in the field. It’s also worth noting that even under the most optimistic scenario, supplies would still be lower than the two years before the 2021 drought. So the supply situation would hardly be burdensome.

Supply is only one side of the equation though. In contrast to Canada, where barley supplies will be larger than last year, availability in other exporting countries could take a hit. That’s especially the case in Ukraine, where production will be lower and export channels are constricted. The next crops from Australia and Argentina could also be smaller.

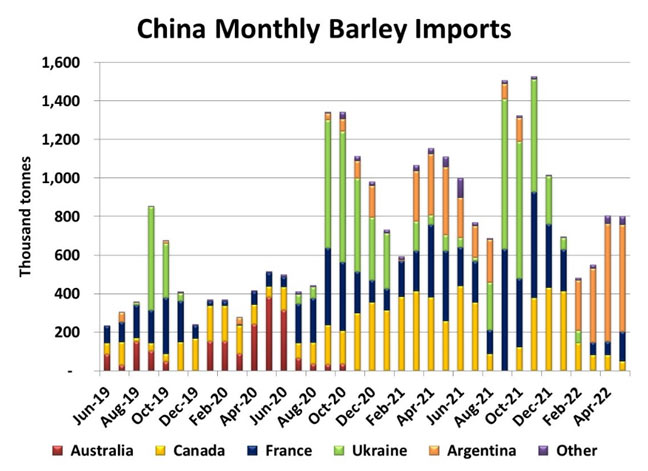

With reduced global supplies, importers will increasingly need to look toward Canada for barley. In the past couple of years, China has dominated demand for barley and has drained most exporters (other than Australia) of their supplies. Essentially, whoever has barley available will have China knocking on their door.

In 2021/22, China took less Canadian barley but that’s only because the drought reduced available supplies. In this upcoming year, with a larger crop, China will be back for more barley. In essence, a bigger 2022 Canadian barley crop isn’t going to feel all that much heavier, with export demand absorbing any extra supplies.