Black Sea conflict adds uncertainty to barley outlook

By Chuck Penner, Leftfield Commodity Research Inc.

The 2021/22 marketing year was already quite remarkable for barley, with record prices caused by last summer’s drought. Just when things seemed to be settling down, partly as United States (U.S.) corn imports fill the supply gap in Western Canada, Russia’s invasion of Ukraine triggered more action in barley markets.

Some of the latest volatility was part of a broad-based global rally in feedgrain markets, especially in Europe. The sudden stoppage in Black Sea shipping and longer-term production threats had a large impact on corn, with feed barley and feed wheat caught up in the rally. Western Europe is dependent on feedgrain shipments from the Black Sea, and the disruption caused prices of all three crops to spike. For example, since the invasion began, French prices have gained US$90-100 per tonne.

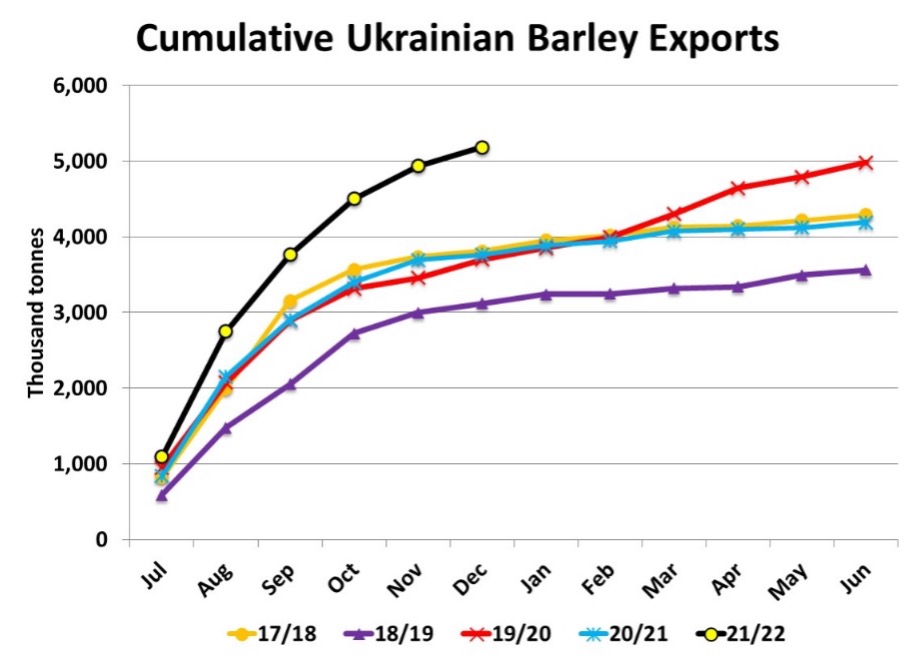

For barley in particular, Ukraine is a major producer and exporter. Last year, its crop was estimated at a historically large 9.4 million tonnes and exports were expected to hit nearly six million tonnes. Russian barley production is larger, with 17.5 million (M) tonnes in 2021, but exports were projected to be lower at 4.5 M tonnes. Between the two countries, that’s roughly 30% of global exports.

The majority of Ukrainian barley exports have already moved out. In the first half of 2021/22, exports were already 5.2 M tonnes and by the end of February, the total would have been even closer to the full-year projection of six M tonnes. While there isn’t much Ukrainian barley left to move, exports of Russian barley tend to be steadier throughout the year and interruptions at this point are having a larger effect.

Countries in the Middle East and North Africa are some of the largest customers for Black Sea barley and are pushing their business to other origins. These other suppliers include Australia, France and Argentina, with Canada unable to find any exportable surplus. This shift away from the Black Sea to other origins has caused export barley prices to spike in these exporting countries.

Countries in the Middle East and North Africa are some of the largest customers for Black Sea barley and are pushing their business to other origins. These other suppliers include Australia, France and Argentina, with Canada unable to find any exportable surplus. This shift away from the Black Sea to other origins has caused export barley prices to spike in these exporting countries.

The shutdown in Black Sea shipping has caused a sharp reaction in the old-crop market, but concerns about extended disruptions are causing ripple effects further out. China’s appetite for barley has been growing by leaps and bounds, with imports so far in 2021/22 ahead of last year’s record pace by 25-30%.

Ukraine has been one of the larger sources of Chinese barley imports. In addition, China and Russia recently announced an agreement to end phytosanitary barriers and allow Russian barley (and wheat) from all growing regions to enter China. China had been expecting Ukraine and Russia to fulfil a large part of its barley needs, even more so in 2022/23. With that supply now threatened, Chinese buyers are looking elsewhere, and those price effects are becoming noticeable.

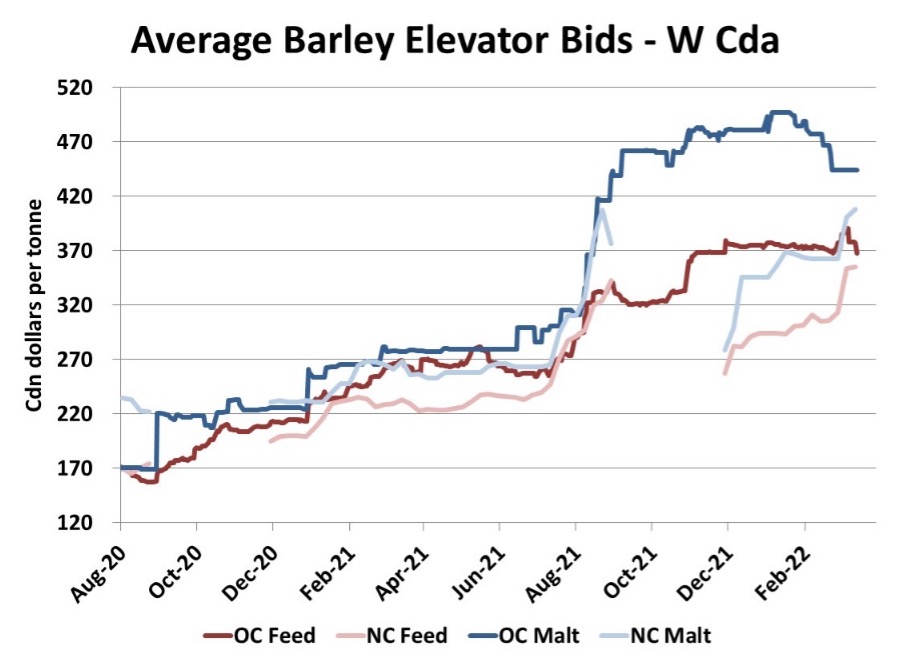

For the 2021/22 market, Canadian feed barley bids saw a small bump last week, but that’s already faded, largely because Canada doesn’t have old-crop supplies left to sell. The more noticeable reaction has been in new-crop bids for both feed and malt barley. Since the beginning of March, the average new-crop bid for feed barley has jumped $40-45 per tonne or roughly a dollar per bushel. In order to stay at a reasonable premium, malt barley bids have also risen by that same amount. Our view is that most of this price reaction has been caused by fresh interest from Chinese buyers.

These price moves may have come too close to the planting season to shift many acres back toward barley. We’ve been hearing from most sources that fewer barley acres will be planted in 2022. If so, any threats to barley supplies in the Black Sea region will tend to amplify concerns about smaller crops in Western Canada.

These price moves may have come too close to the planting season to shift many acres back toward barley. We’ve been hearing from most sources that fewer barley acres will be planted in 2022. If so, any threats to barley supplies in the Black Sea region will tend to amplify concerns about smaller crops in Western Canada.