Barley Market Both Predictable and Surprising So Far

By Chuck Penner, LeftField Commodity Research

There’s no question the barley market in western Canada is responding to the 2021 drought in “unprecedented” ways this year. Early in December, StatsCan will release its latest production estimate and there’s a good chance the total will be 6.5-7.0 mln tonnes, about four million tonnes less than last year and the smallest crop since the late 60s. That’s triggering a whole lot of moves in the barley market, some expected and a few unexpected.

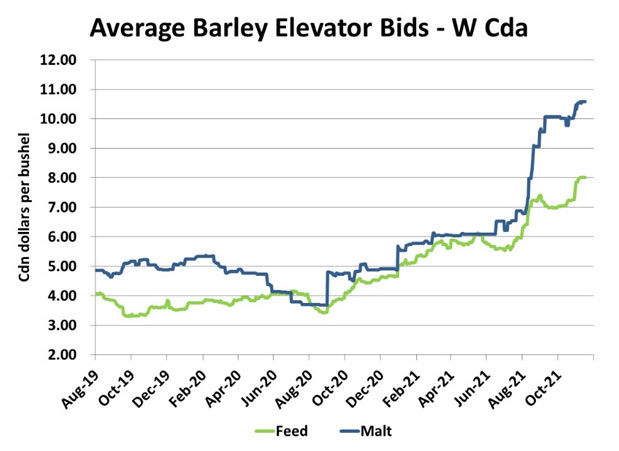

Some of the market response has been predictable. Barley prices have moved above last year’s record levels to set a new record this year. The average feed barley bid at western Canadian elevators is now $8.00 per bushel, with feedlots and feed mills bidding well above the average. That’s not entirely a surprise as feeders scramble to keep their livestock fed with few other substitutes available, at least until now.

The strength in malt barley bids (relative to feed) was a little more surprising. There was almost no malt barley premium relative to feed in 2020/21 but this fall, that spread jumped to $2.50-3.00 per bushel. That’s far above the long-term average of around $1.00 per bushel. The small barley crop along with quality problems of high-protein and thin kernels meant very little barley is available to maltsters, even after relaxing their quality standards. Weekly delivery data from the CGC confirms how difficult it has been for maltsters to find barley this year.

One of the bigger surprises so far in this year’s barley market has been the extremely strong export pace. Through the first quarter of 2021/22, 962,000 tonnes of barley have been exported, actually ahead of last year’s exceptional pace and more than double the 5-year average. Granted, most of these export sales were made back in spring when the barley crop looked positive but they have been acting as a sizable drain on Canadian barley supplies. This is a key reason why bids at country elevators have hit record levels, as shipments are assembled for export movement.

In the last few days, there was another wrinkle in the barley market, as landslides in the BC lower mainland have cut off rail access. With the export pipeline shut down through Vancouver, Canadian barley exports will hit the brakes hard and that could allow elevator bids to soften, although strong domestic demand will replace export business. This impact would last until repairs are made and so far, it doesn’t look like things will be resolved quickly.

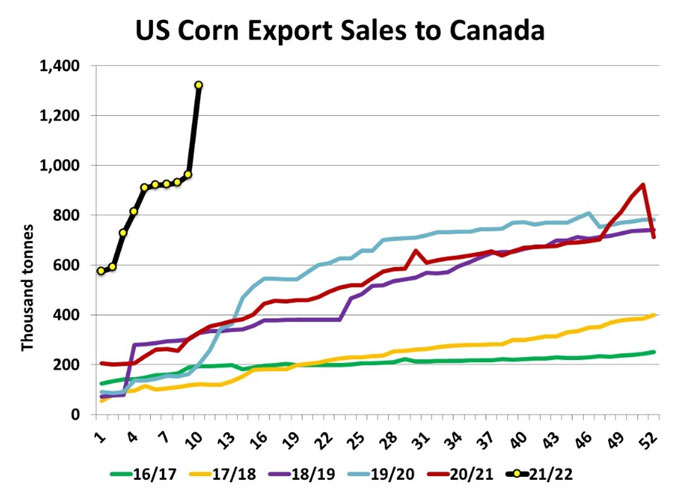

One of the more predictable responses has been an increase in Canadian corn imports from the US, but the amount is eye-opening. According to the USDA’s sales reporting system, sales of US corn to Canada since September 1 hit 1.32 mln tonnes, but not all of that has been shipped yet. This compares to last year at 329,000 tonnes and is already beyond the full-year totals in the last five years. Nearly all of this corn will be coming into western Canada as the Ontario 2021 corn crop is reported to be large.

Despite this anticipated influx of cheaper US corn, it hasn’t been able to cause Canadian feed barley prices to turn lower. That’s been somewhat of a surprise, although once the big volumes of corn actually arrive, there could be some pressure on feed barley bids. It also appears there’s a segment of livestock feeders that are committed to using barley, even though it’s considerably more expensive than US corn. This underlying domestic demand is providing some of that unexpected strength for barley.