StatsCan Estimate A Starting Point

By: Chuck Penner, Leftfield Commodity Research

Even though they’re often criticized, crop estimates coming from StatsCan are still closely watched by most in the grain trade. At this stage of the year though, there are plenty of questions about how accurate (in hindsight) the numbers are.

In the last few years, StatsCan has switched to using computer models to generate its first two yield and production estimates of the year. These models are based on satellite images of crop vegetation, which are then compared to long-term average conditions. Depending on how much better or worse conditions are than usual, StatsCan determines a yield for the crop.

There are a couple of reasons to question the initial 2022 results. For one thing, the satellite images used to generate the recent yield estimates were from late July. We know crops in the west and southwest were deteriorating then, with the full effect only showing up later. If so, there’s a good chance yields in those areas were overestimated by StatsCan.

On the flipside, crops on the eastern side of Saskatchewan, especially in the northeast, are several weeks behind normal development. Because of that, the satellite images from the end of July wouldn’t show a “normal” crop canopy, meaning yields could be underestimated there. And since the province’s heaviest concentration of barley acreage is in the northeast, there’s a good chance final yields will end up larger.

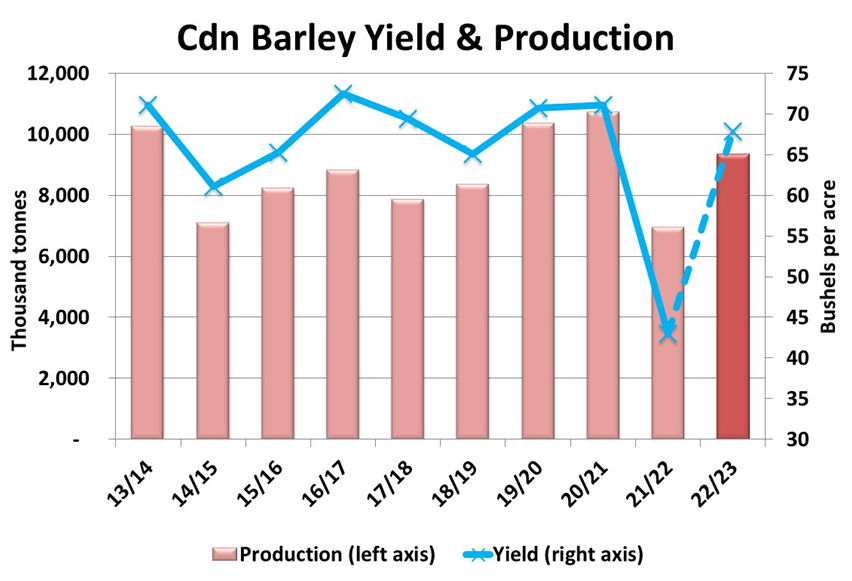

StatsCan estimated the 2022 Canadian barley crop at 9.35 million tonnes, 2.4 million tonnes (34 per cent) larger than last year’s disaster and just slightly more than the pre-2021 five-year average crop. This estimate is based on a Canadian yield of 67.8 bu/acre, a couple bushels lower than the pre-2021 average. For Saskatchewan, the 2022 yield was pegged at 60.9 bu/acre, well below the five-year average yield (prior to 2021) of 67.4 bu/acre. Again, there’s a good chance that yield will be bumped up in later estimates.

Even if the production estimate is raised later, the 2022 crop will still likely be smaller than the two years before 2021. That’s a key comparison because during those two years, barley demand from domestic feeders and Chinese importers was exceptionally high, and that will likely be the case this year, too.

For 2022-23, domestic feeders will be looking to switch back to barley from higher-priced U.S. corn, especially with dropping corn crop estimates in the U.S. and a weaker loonie, which makes corn imports even more expensive. At the same time, China will be looking for more Canadian barley again this year. Less barley and corn will be available from its traditional suppliers like Ukraine and France, which will amp up demand for Canadian barley.

The bottom line is that the market could easily absorb a much larger Canadian barley crop, if it was available. Even if StatsCan does raise its crop estimates later this year, it won’t put any meaningful pressure on the market. Prices may not get back to last year’s extremes, but the outlook is friendly again for barley growers.