Barley Supplies Low but Market is Already Looking Ahead

By Chuck Penner, Leftfield Commodity Research Inc.

No one should be surprised when a government report shows extremely low barley supplies. Growers have seen record prices for feed and malt barley while feeders have been searching for any kind of alternative to keep their livestock fed. Maltsters have also been scouring the market for any remaining supplies.

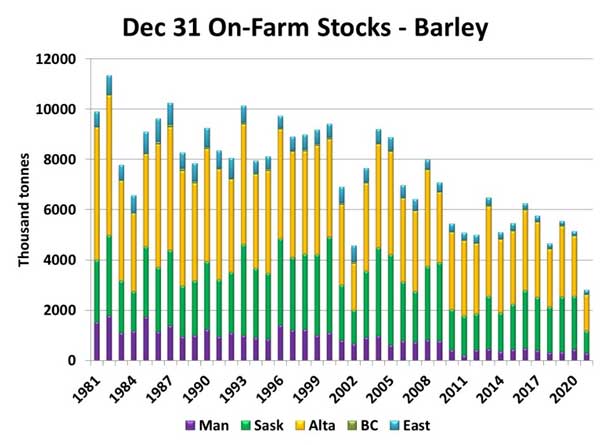

Earlier in February, StatsCan put a number to the tight supplies when it issued its estimate of barley stocks as of December 31. Inventories of 3.15 million M tonnes were reported, including 2.80 M tonnes on farms. Not only were on-farm barley supplies 45% less than last year, the chart shows just how far below this was compared to any previous year. It clearly demonstrates why barley prices reached record levels in 2021/22. But because the situation was well known, the report itself had no real market impact.

The market has already adjusted to this reality of low supplies. StatsCan showed Aug-Dec feed use of barley at only 2.6 M tonnes compared to 4.3 M for the same time last year. In western Canada, corn imports in December alone were 686,000 tonnes, with Saskatchewan the largest destination at 264,000 tonnes. Those large corn imports will need to keep showing up until the next barley harvest. News reports have also suggested barley is being imported from Europe for maltsters.

With only 2.8 M tonnes of barley on farms as of Dec 31, it doesn’t leave much for the last seven months of 2021/22. Depending on seeded area this spring, 275-300,000 tonnes will be needed for seed, another 450,000 tonnes will end up as non-feed domestic use and a further 500,000 tonnes will possibly be exported. If another 400-450,000 tonnes of barley is left on-farm at the end of 2021/22, this would mean only 1.1-1.2 M tonnes are available for feed for the last seven months of the year. Keep in mind feed use for barley during Jan-Jul is normally around 2.5 M tonnes.

The net result of all these calculations is that 2021/22 barley stocks will drop below 600,000 tonnes by the end of July, something that’s never happened in records going back to at least 1980 (and likely longer). Because supplies will need to be rebuilt from this low level, the 2022 crop outlook is far more critical than usual and there are plenty of question marks about the acreage and yield possibilities.

The first question is how barley figures into farmers’ planting decisions this spring. Of course, new-crop bids for almost every crop are looking quite good, so there’s plenty of competition for acres. Some farmers are saying barley performed very poorly in last summer’s drought and because of that, barley will get dropped in their rotations, particularly where things are still very dry. Others had a more positive experience and the new-crop barley bids, especially for malt, are high enough to put barley in the ground.

Odds are that barley will struggle to keep up in the 2022 acreage race, but yields are also questionable. Looking back at the worst droughts in western Canada like 1988 and 2002, crop yields have remained below average even in the year after the drought. Thus, it’s quite possible yields for barley and other crops will still struggle in 2022.

If both acres and yields are on the low side this summer, that will keep barley supplies from fully recovering in 2022/23. Even if this year’s crop improves over 2021, it still may not provide enough barley to meet everyone’s needs. That likely means another year of above-average barley prices and adjusting strategies for keeping livestock fed.