Market Report: Market Transition Approaching

It should never come as a surprise that grain prices decline during the summer. While there are exceptions, seasonal patterns become established because prices behave roughly the same way most years. The timing can be off a little some years due to unusual circumstances, but it’s hard for prices to buck the trend.

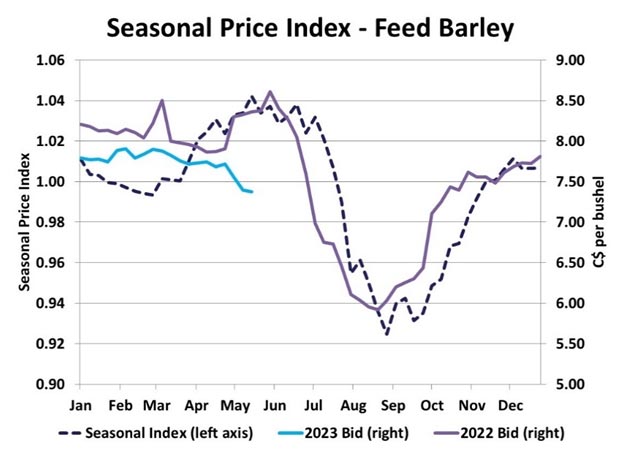

The seasonal highs for feed barley prices tend to last a bit later into the summer than most other crops and normally hold on till the end of June or even early July. In 2022, the seasonal move started a few weeks earlier than usual but the recovery from the harvest lows also was a few weeks early. In 2023, barley bids didn’t see any gains in spring and actually started to turn lower well ahead of the normal declines.

The recent drop in prices wasn’t driven by a change in domestic feed use, as consumption patterns haven’t changed much. This year’s price decline that started in late April lined up with the sharp drop in US corn futures, which made corn imports from the US more affordable and forced Canadian barley to get cheaper to compete. The availability of US corn will likely hang over the Canadian barley market as long as the US crop is doing okay.

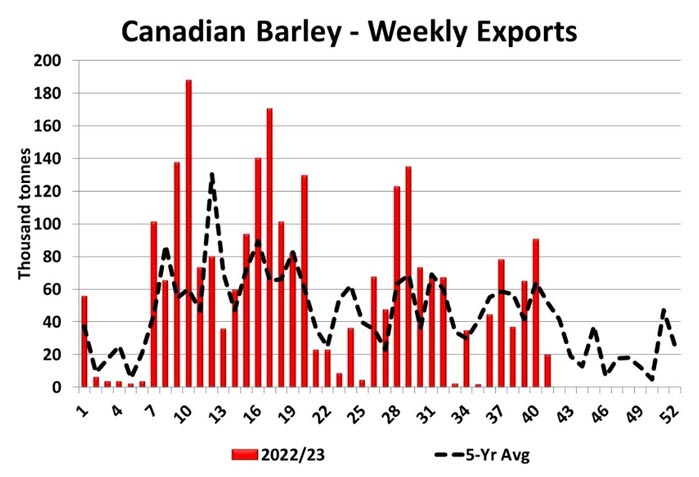

This initial decline in western Canadian barley bids isn’t part of the usual seasonal move though; that’s still a few weeks away. A couple of reasons are behind the normal seasonal weakness that shows up in July and August. For one thing, barley exports tend to get very quiet in the last 10 weeks of the marketing year when buyers have enough barley to cover most of the remaining sales.

The other reason for barley prices to weaken is that buyers are looking ahead to the next harvest when supplies will be rebuilt, and farmers will be more motivated sellers. Unless there’s a big concern about the next crop, most buyers will wait on the sidelines and that allows prices to weaken.

Of course, a big crop is never a given, as we learned in 2021, and there are concerns about dryness in key barley growing areas in western Canada. That said, it’s too soon to write off the 2023 crop and rains are starting to show up again to get the crop up and growing. We also suspect seeded area of barley in 2023 is going to be larger than StatsCan’s early estimate and, with an average yield, would mean comfortable supplies in 2023/24.

While the odds are high that prices will follow the seasonal trend lower, the size of that decline isn’t as clear. One measure is to look at the spread between old-crop and new-crop bids as a gauge of the possible downside risk. New-crop elevator bids across western Canada are roughly $50 per tonne lower than old-crop levels. Prices will eventually meet somewhere within that range. Whether it’s at the higher end or the lower end will largely depend on how the 2023 crop develops in the next few weeks.

While the summer price declines are a regular feature in the barley market, so too is the recovery off the lows that starts to show up in late September once the harvest is complete and barley is binned. There are several factors that determine how strongly the market recovers, including the crop size here and in other exporting countries as well as the strength of export demand, particularly from China. Those events are still too far in the future to predict with any certainty and will be the topic of future reports.