Market Report: No Relief for Global Barley Supplies

By Chuck Penner

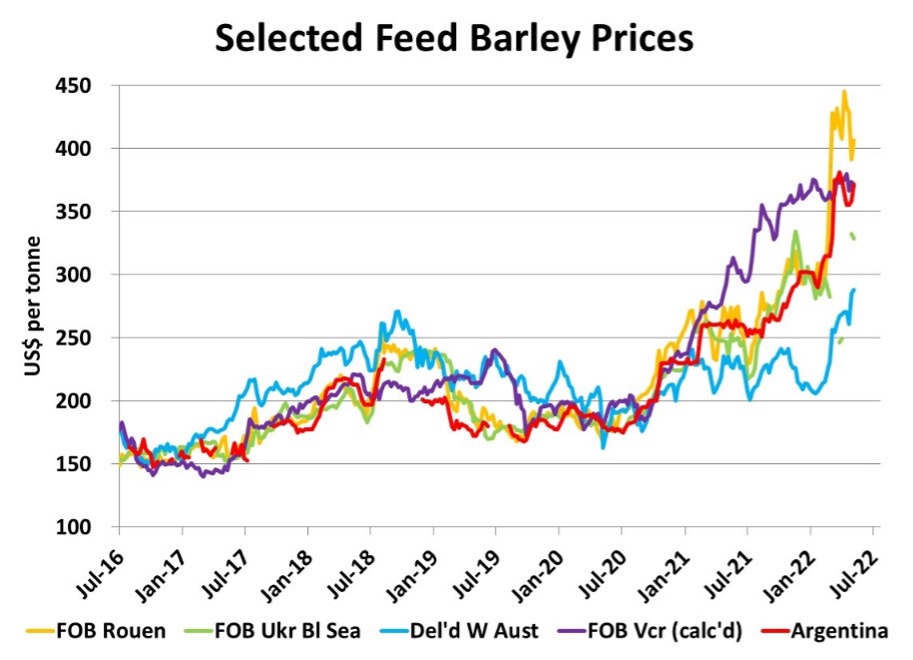

In fact, the barley rally already started back in the fall of 2020 when, in spite of a big Canadian crop, Chinese demand took off and drained barley supplies. That was followed by the 2021 drought in Canada along with lower barley production in the EU and Russia. More recently, Russia’s invasion of Ukraine triggered the latest spike in French, Argentine and Australian prices, as importers were forced to look elsewhere for supplies.

The effect of this series of unfortunate events was to draw global ending stocks of barley down to 16.5 mln tonnes in 2021/22, the lowest since 1983/84. Looking ahead, odds are that barley supplies won’t be able to recover in 2022/23 either.

Last week, the USDA issued its first global production estimates for 2022/23. The USDA pegged the upcoming barley crop at 149.0 mln tonnes, up 3.9 mln tonnes from last year’s low point, but hardly enough to rebuild inventories. There’s also a good chance the USDA is too optimistic with its 2022 barley crop forecast.

For example, the USDA is forecasting the Canadian barley crop at 10.5 mln tonnes, which would require the second highest Canadian barley yield ever. Based on current dry conditions in Alberta and planting delays elsewhere, a near record yield seems a stretch. Our LeftField barley crop forecast is a lot more cautious at 8.9 mln tonnes, two million tonnes more than last year but well below the USDA.

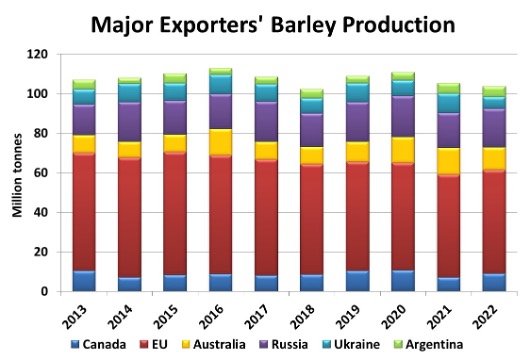

Of course, it’s far too early in the season to issue any firm estimates and outcomes will certainly be different than the forecast. For now, the USDA is showing Ukrainian barley production at 6.0 mln tonnes, compared to 9.9 mln last year. In other countries, a 2.2 mln tonne decline is expected for Australia based on the idea that last year’s extremely high yields will be hard to repeat. A small 500,000 tonne increase is forecast for the EU while the Russian crop is projected to expand by 2.0 mln tonnes and Argentina would remain steady.

For major exporters (using the LeftField estimate for Canada), barley production is forecast to slip by 1.5-2.0 mln tonnes. In most years, that decline would hardly be noticeable but the extreme tightness in global supplies means there’s no room for smaller crops.

In its global barley estimates, the USDA is showing 2022/23 ending stocks at 16.9 mln tonnes, up only 400,000 from the current year. And that assumes most everything goes well from here on, but there are no guarantees of that.

So what does this mean for the price outlook? Grain markets are currently very jittery, especially for wheat and corn that are traded on futures exchanges. For the most part though, this can be viewed as “short-term noise”. Crops like barley are certainly influenced by wheat and corn but largely avoid the investor-driven volatility.

Heading into 2022/23, barley and other grains will have little if any ability to rebuild supplies to comfortable levels. There will be at least one more year of low inventories and that will keep a solid floor under prices. That’s not to say there couldn’t be any dips, but they should be fairly minor. And if some of the early threats to barley (and other cereal) crops come about, prices could see even more strength.