Barley Market Report: Mid-Year Barley Market Performance

Chuck Penner, LeftField Commodity Research

Now that the second half of the 2022/23 marketing year is underway, it’s worth evaluating how Canadian barley has fared in the first half. Yes, this is a look in the rearview mirror, but usage and supplies of barley through the first part of the year can help determine what’s possible during the second half.

While StatsCan’s December 31 stocks and usage estimates aren’t technically at the midpoint of the marketing year, they’re a helpful measure of the pace of usage. The StatsCan Dec 31 S&D is based mainly on a combination of farmer and industry surveys, export/import data and CGC reporting.

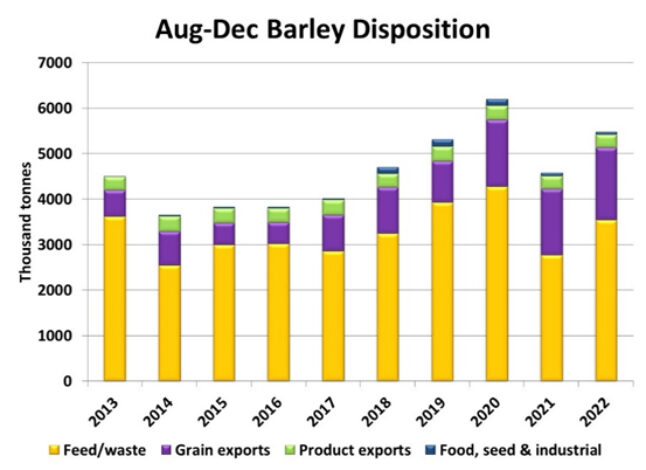

Overall barley usage for Aug-Dec was 5.5 mln tonnes, no surprise that it was higher than the drought year of 2021. The more useful comparison is how it stacks up against more normal years before the drought. For the five years prior to 2021/22, total usage averaged 4.8 mln tonnes, so the 2022/23 performance has been even stronger than usual.

When we drill down further into the numbers, we see that exports have been leading the way at 1.6 mln tonnes, the highest Aug-Dec total in at least 20 years. The feed consumption of 3.5 mln tonnes is solid but still just close to average. That’s not a big surprise as feed wheat and imported corn have been more readily available.

While the 10.5 mln tonnes of barley supplies for 2022/23 are close to the pre-drought average, the above-average Aug-Dec consumption means that Dec 31 stocks at 5.1 mln tonnes, are down from the 5-year average of 5.8 mln tonnes. Although this is more comfortable than 2021/22, these stocks are still low enough to provide support for prices.

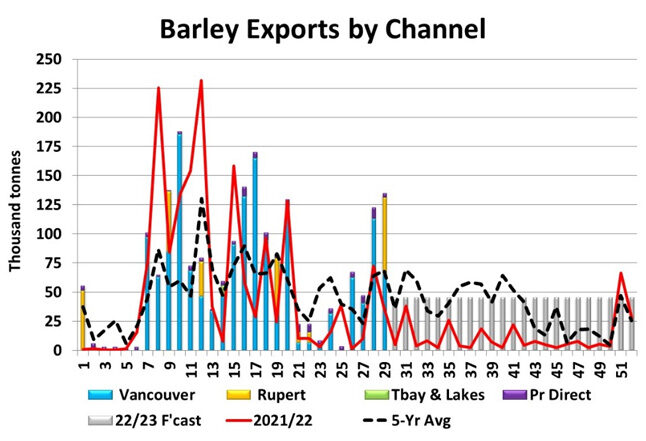

The weekly CGC data is more current. Starting in late December, export movement had dropped off, raising concerns about demand through the second half of the year. In the past two weeks though, exports have rebounded sharply, creating more optimism. While China is still the dominant destination, exports to the US have also been running at the quickest pace in 10 years.

Other signs are pointing to a solid export pace for at least the short-term. Farmer deliveries of barley are continuing to run at above-average levels for this time of year. Commercial barley inventories at country elevators and export terminals are also well above normal, suggesting a buildup of stocks to meet upcoming export shipments.

If there is an area of concern, it would be consumption by domestic maltsters, where volumes haven’t really recovered since reduced consumption during the Covid lockdowns. It appears changing consumer tastes have caused softer demand for malt-based beverages.

When we look at overall consumption so far in 2022/23 and use that as a bit of guidance for the second half of the year, final (July 31) ending stocks will be a bit larger than 2021/22. Keep in mind, that’s a pretty low bar. We’re looking at 2022/23 ending stocks somewhere in the neighbourhood of 750,000 tonnes, 200,000 tonnes more than last year but lower than the average of 1.18 mln tonnes prior to the drought year. While barley prices have come off the earlier highs, these low stocks are the main reason that prices remain historically strong.