Barley Market Report: Policy Uncertainty Creates Market Uncertainty for Saskatchewan Producers

Most crop markets have returned to more normal price ranges after the extreme spikes in recent years in response to a series of highly unusual events in succession (COVID, the severe prairie drought in 2021, and invasion of Ukraine). This reflects supply and demand moving to levels that are reasonably balanced, and where in many cases stocks could be considered adequate, but not heavy.

This type of environment often lends itself to values trading in a range, where price breaks find support as end users look to get coverage, while rallies eventually stall out as it spurs farmer selling and buyers pull back. In some ways, this kind of backdrop might almost be described as being a bit ‘boring’.

However, markets will be anything but boring through the balance of the 2024/25 marketing year as supply uncertainty has been replaced with a high degree of government policy uncertainty. In particular, the policies of the new Trump Administration in the US could have a huge impact on Canadian crop prices.

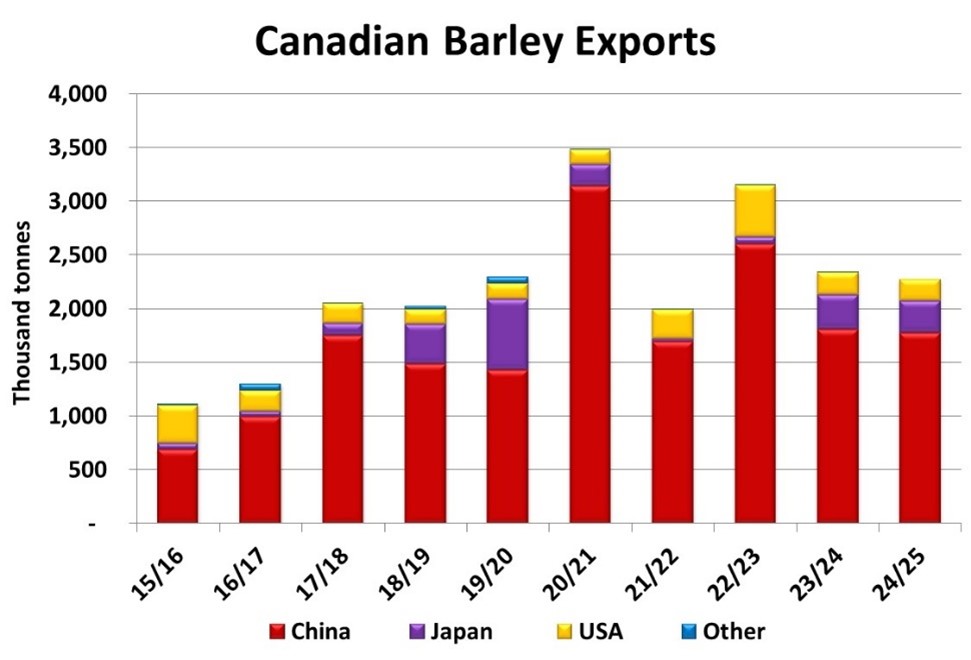

While it’s unknow what exactly will unfold, it looks like Canada could be facing import tariffs on products moving into the US. Crops that are most vulnerable are those where a large portion of exports go to the US. In this sense, barley is less directly exposed than some other as the US has only been around 10 – 15% of Canadian shipments in recent years, and less than 3% of total demand. Even so, reduced movement to the US would have a negative effect on barley prices.

There could be indirect effects for barley as well. For example, most oat exports go to the US. If those volumes slow significantly, it could result in additional feed grain supplies in western Canada. When considering lower barley shipments as well, prices could face pressure. At the same time, if fewer trucks are exporting Canadian grain into the US, this could make the logistics of bringing US corn back more challenging. When combined with a weaker Canadian dollar, imported US corn becomes more expensive, which is supportive for domestic feed barley prices. How the cattle and hog industries are affected could impact western Canadian feed grain consumption. The net effect of these various dynamics is hard to predict.

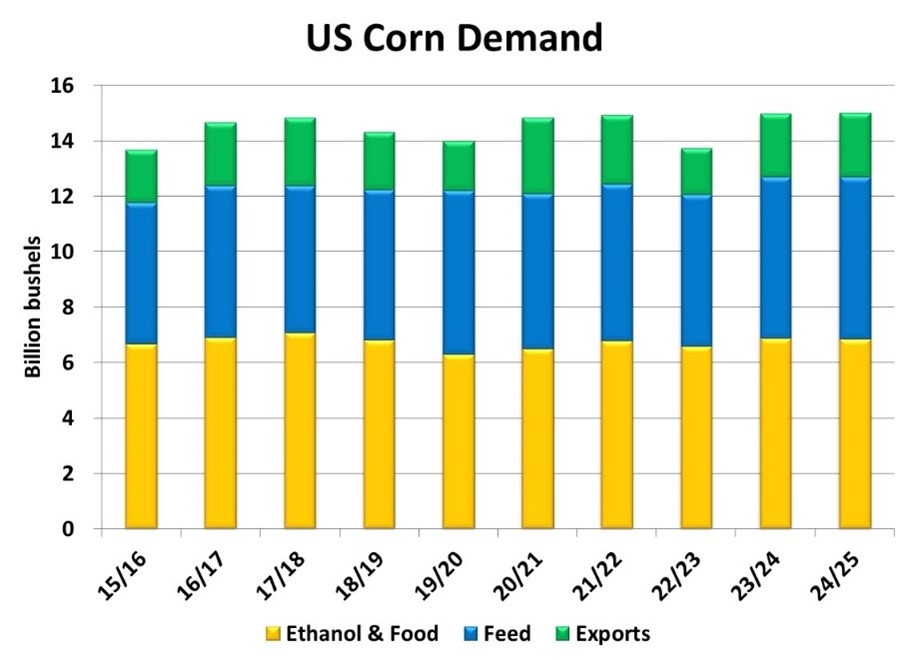

Another potential vulnerability is in biofuels. No one is expecting the biofuel industry will go away, but it’s possible this new US Administration may be somewhat less supportive to increasing mandates than previous ones. Ethanol represents about 36% of total US corn consumption, so even a moderating of usage would have a negative effect on prices. All else equal, lower corn prices typically translates into lower prairie feed barley prices.

Other US policy decisions to monitor include trade with other countries, shifting foreign exchange rates and a host of other issues that could impact Canadian barley prices either directly or indirectly. And yet right now no one knows for certain the details on the ‘if’, ‘what’ or ‘when’ for any of them. And this doesn’t even consider any spillover effects on prairie barley markets from tariff decisions for Canadian canola to China or India and pulses.

The difficult thing about a policy outlook is it ultimately come down to decisions made by people. And often the price response is driven by consequences that weren’t easily foreseen ahead of time. In this environment it’s important to be flexible and maintain good risk management.