Barley Market Report: Exports an Important Part of Barley Price Direction

The last several years have seen grain exports make up between 25 to 30 percent of total Canadian barley disappearance. Domestic use is the biggest portion of demand, largely for feeding but also for malting. But exports are still an important part of the outlook for barley prices and have the potential to allow some cushion to build into the carryout if movement falls below expectations, or tip the balance sheet tighter if the demand pull is stronger. For this reason, it’s important to keep a pulse on export potential for the coming season.

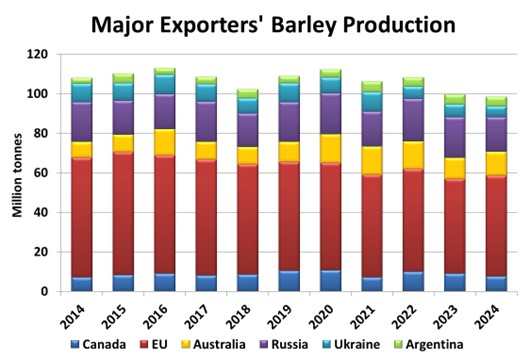

The last USDA figures put global barley production at 142.9 mln tonnes, marginally above last year but otherwise the lowest since 2018. Of the major exporters, USDA data shows the smallest production since 2012. This wasn’t due to a huge decline in any one country, but rather the result of moderately lower crops across several important suppliers. In addition, some key barley exporters such as the EU, Russia and Ukraine are facing smaller corn crops. This may force higher barley feeding within their own borders, further reducing exportable supplies.

The strength of global import demand is also an important part of the equation. China is overwhelmingly the largest importer, with their purchases typically making up as much as the next 4 to 5 largest buyers combined in recent years. Naturally, this makes China the primary destination for Canadian exports as well. It’s always difficult to anticipate what exactly China will do, and the recent drop-off in their corn imports might suggest domestic grain inventories are comfortable. But barley imports in 2024 are easily running at a record pace (11.8 mln tonnes from January through September, compared to the previous record of 7.2 mln tonnes at this point last year), and they have also seen a decline in barley inventories at the ports, which could point to strong usage.

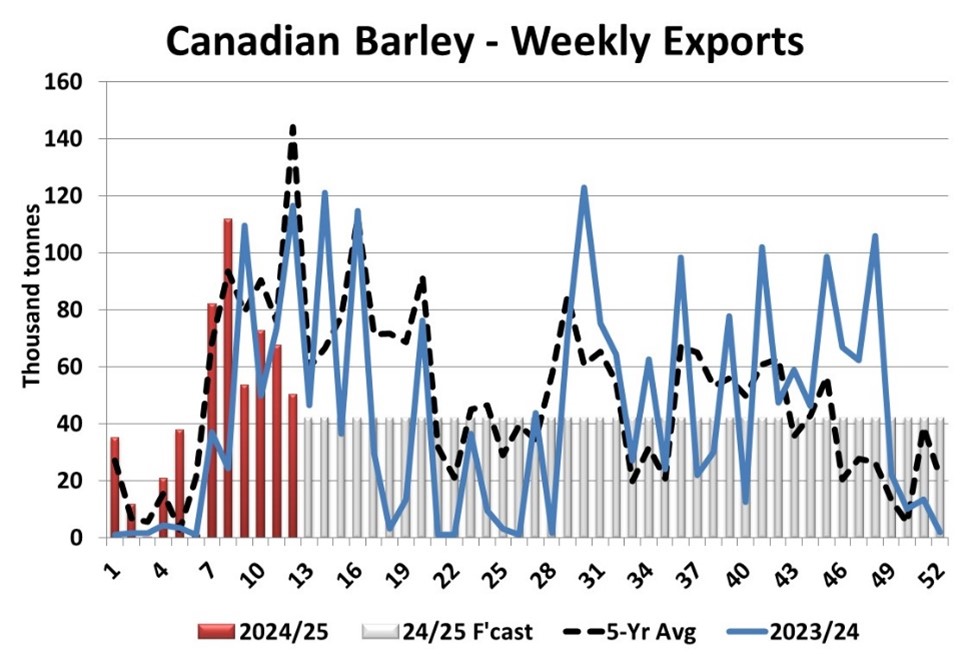

All of this may be contributing to the relatively good start for Canadian barley exports in 2024/25. Statistics Canada showed August exports at 119,00 tonnes. While not large in absolute terms compared to what moves most months, August volumes are typically quite low, making this year’s shipments nearly double the 5-year average. CGC data showed good movement in September as well, and while the pace has dipped in recent weeks, it remains ahead of what is needed to reach current export forecasts.

Our current 2024/25 barley export target is 2.3 mln tonnes. Canada will need to remain competitive in global markets to see movement reach or exceed that level, particularly relative to Australia. There is the potential for a good export pull to work domestic supplies lower, but much of this hinges on China.

Expectations are for the 2024/25 barley carryout to be just over 1 mln tonnes, down slightly from last year but otherwise the largest since 2017/18. However, that is not a burdensome level, and any sense export volumes may exceed forecasts could see the balance sheet tighten, which would be supportive for prices. The domestic feed market will continue to be the primary driver, which in turn makes western Canadian barley prices linked to US corn, but overseas developments will need to be monitored closely as well in the coming months.