Barley Market Report: Every Year is Different

There’s been a lot of StatsCan information the last few weeks that confirm the low supply situation for Canadian barley. StatsCan trimmed its latest 2023 production estimate to 7.84 mln tonnes. That’s 2.1 mln tonnes smaller than last year’s crop and well below 5-year average production of 9.29 mln tonnes, a serious shortfall. It’s still better than the 2021 crop of 7.0 mln tonnes, but not by much.

StatsCan also showed 2022/23 ending stocks just over 700,000 tonnes, a bit more than last year but still historically low. Total supplies for 2023/24 are estimated at 8.65 mln tonnes, down nearly two million tonnes from the previous year but a bit more than 2021/22 at 7.92 mln tonnes.

Early in the summer of 2023 as the drought got worse and crops deteriorated, barley prices behaved as expected, firming up as livestock feeders got more concerned about supplies. But then in early August as crop losses were locked in, feed barley prices started dropping hard, not really what was expected. After all, feed barley prices in 2021 had rallied from mid-July until early September and then went even higher until the following spring when the 2022 crop looked more certain. So why the different price behaviour during the 2023 drought?

Unlike 2021, barley prices in 2023 are simply following the seasonal tendencies that were discussed in last month’s report. In most years, barley prices start fading in early July, find a bottom somewhere in the month of September and then turn higher. If that’s the case, the good news (for barley growers but not for feeders) is that the market should be close to its lows right about now.

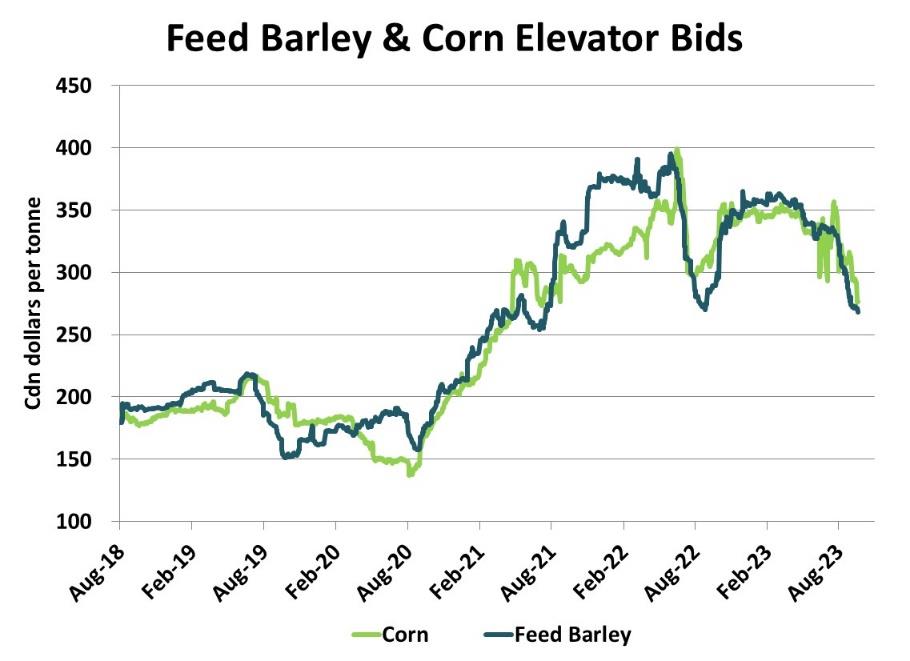

Besides the seasonal, a larger underlying factor is very different for 2023. Back in 2021, as that year’s drought was developing, the US corn market was also rallying. From the beginning of July to the end of December, US corn futures gained 75 cents per bushel and corn bids in western Canada were up C$40 per tonne. The corn rally wasn’t as strong as the one in barley, but it certainly provided support. And the gains in corn continued well into the spring of 2022, keeping barley prices high.

In 2023, the corn market has been dropping, especially since the end of June. Barley prices tried to avoid getting caught in that downdraft, but as imported US corn became cheaper, especially in the southern Alberta market, feeders stopped buying barley and started booking large volumes of corn. As more corn started to displace barley, suddenly there was less concern whether there would be enough barley to keep livestock fed. That’s when barley prices began falling. Now, barley has dropped to a sizable discount in key feed markets in western Canada. Because it’s now the cheaper feed, barley demand is starting to pick up again and should mean prices are finding a bottom (as long corn is also finding its footing).

Aside from the domestic feed market, there’s one other factor that’s different in 2023/24. Back in 2021/22, China had cut off Australian barley imports and was buying large quantities of Canadian barley. That extra demand added to the 2021/22 barley rally. This year however, China has reopened the doors for Australian barley and now, Canadian barley prices had to drop to stay competitive. Canadian exports will likely be lower in 2023/24, which means domestic feeders won’t need to compete as much against a strong pull from the export channel.

These differences mean that this year’s barley market won’t be a repeat of 2021/22 and may even struggle to keep up with 2022/23. That’s the bad news. The good news is that most of these negative issues have now been factored in and seasonal patterns are pointing to a modest price recovery.