Barley Market Report: Wave of Corn Imports Will Ease Barley Shortage

By Chuck Penner, LeftField Commodity Research

While the final 2021 barley production estimates still aren’t available, it looks like this year’s crop could be as much as four million (M) tonnes smaller than last year. That’s causing a whole lot of reshuffling of demand. If the barley crop ends up at only 6.7M tonnes (versus 10.7 M last year) and supplies are less than 7.5 M tonnes, something has to give.

The biggest change will be a sharp drop in exports. In 2020/21, barley exports were over 3.8 M tonnes, the highest total since the early 90s. Export sales of the 2021 crop were made back in spring and will need to be filled (or shifted), possibly in the order of a M tonnes. Even with that 2.5-3.0 M tonne reduction in exports, domestic feed consumption also needs to be cut. This demand rationing has been happening through price signals.

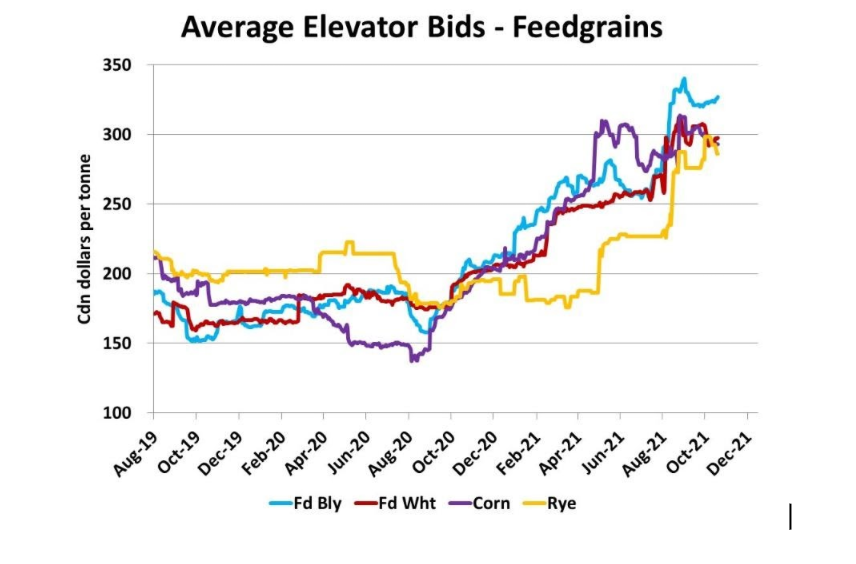

The price chart shows average prairie-wide bids at country elevators for various feed grains, which are typically lower than prices paid by feed mills and feedlots. Even so, they reflect price behaviour fairly well. We see that barley prices since late summer have remained well above other feed grains and that’s already helping ration some demand, but more shifts are likely.

The spread between elevator bids for barley and domestic corn has already been widening, pushing more demand toward corn. So far, there hasn’t been much US corn flowing into western Canada but as the US harvest moves into its later stages, large volumes will start moving north. In the benchmark location of southern Alberta, the price of US corn for November delivery is $40-50 per tonne below spot barley bids. That differential may not be as large elsewhere on the prairies, but will still shift demand away from barley and toward corn.

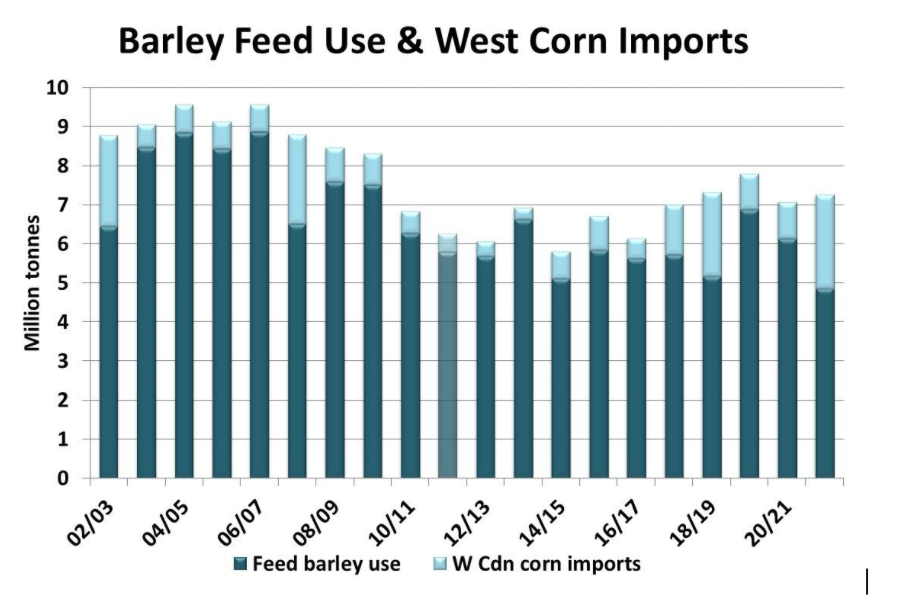

In 2020/21, 925,000 tonnes of corn were brought into western Canada. Even larger volumes of US corn imports aren’t an entirely new concept. Back in 2018/19, a little over 2.1 M tonnes of corn were imported. We’re expecting corn imports into western Canada at 2.4 M tonnes in 2021/22 and some analysts think the amount could climb to 3.0 M tonnes or higher. The 2.4 M tonnes would be a new record but wouldn’t be completely unprecedented

Keep in mind, the US corn crop is expected to top 380 M tonnes this year and the USDA is forecasting US exports at 63.5 M tonnes. The extra 1-2 M tonnes of Canadian requirements won’t exactly strain the US supplies.

In most years, Canadian barley prices have been somewhat related to the US corn market but have been fairly disconnected the last year or two. As imported corn becomes a larger part of Canadian feed grain supplies in 2021/22, that connection will become much closer again. Direction in the US corn market will have a much stronger influence on prices for feed barley and feed wheat in western Canada.

The US corn harvest is more than half finished and there shouldn’t be too many production surprises at this late stage. Corn futures have been running in a sideways to slightly lower pattern since early July, and the market is looking fairly sleepy. The two largest factors to watch in the coming weeks and months are the level of Chinese demand and possible changes to US policy on ethanol requirements.