Trends in Barley Varieties for 2025

By Mitchell Japp, Research & Extension Manager

I always look forward to the variety acreage reports in the fall. SaskBarley invests significantly in both variety development and in gaining market acceptance for new malt varieties. It has been rewarding to see continued growth in new varieties that SaskBarley funding has contributed to – CDC Fraser, AAC Connect, CDC Churchill, and AAC Prairie on the malt side, and CDC Durango, AAC Lariat and AAC Stockton on the feed side.

The Canadian Grain Commission has been summarizing the variety acreage data from the provincial crop insurance organizations since 2008. Taking a closer look at the trends helps give signals on what is happening in the industry. I think it is helpful for farmers to know, on a prairie-wide scale, what varieties their peers are choosing.

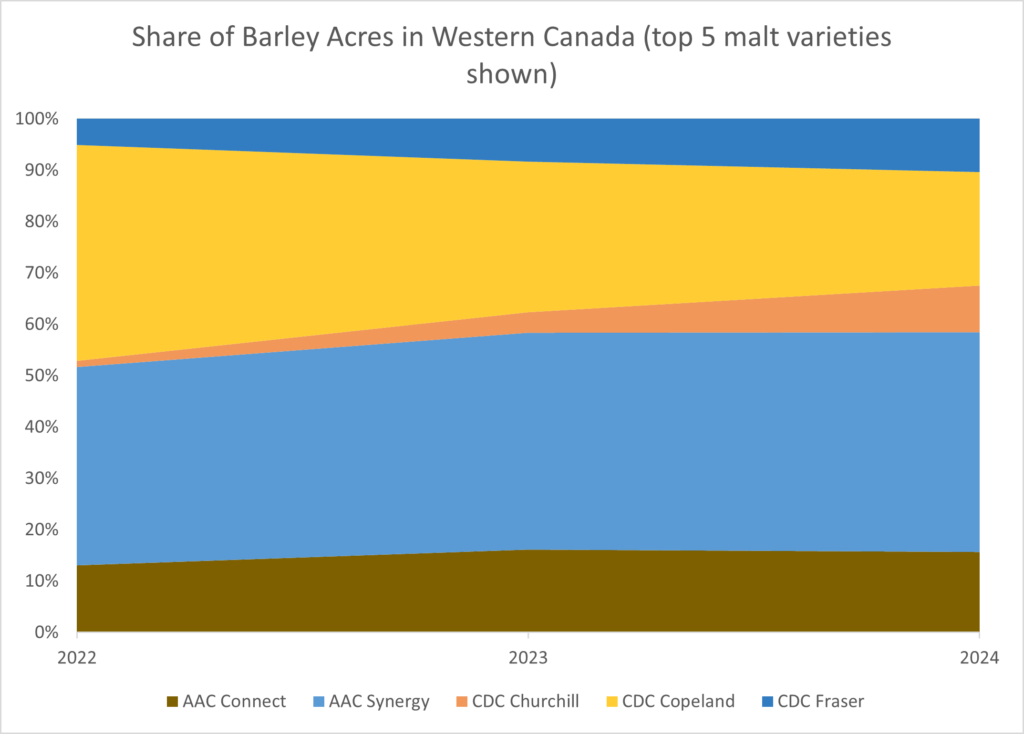

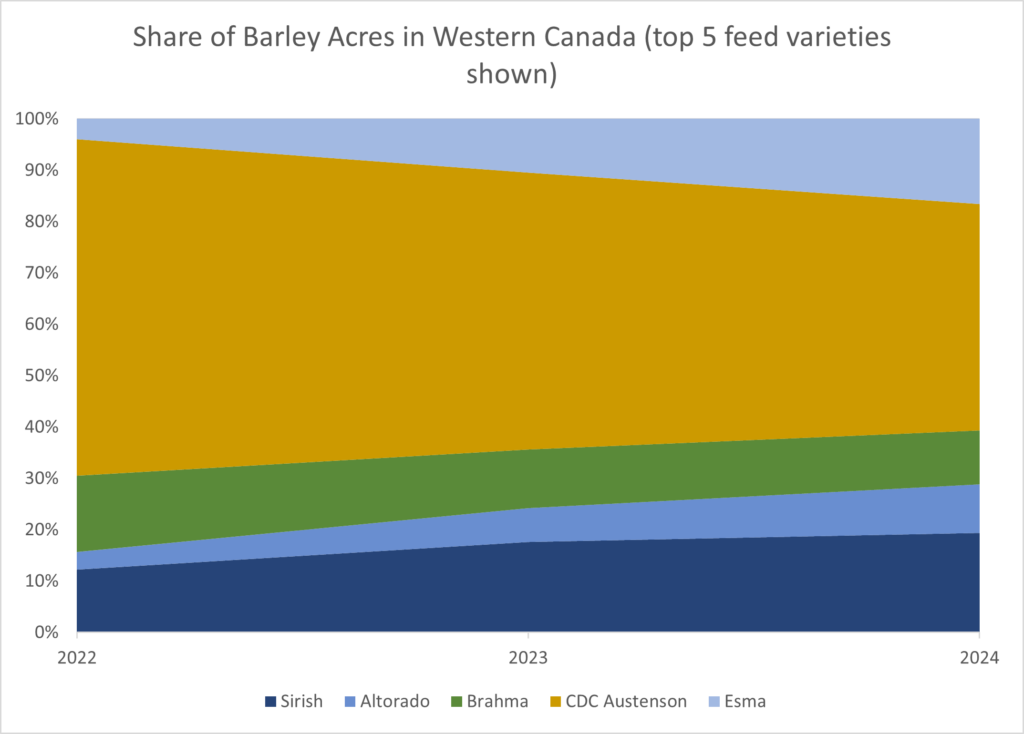

The 80:20 rule seems to apply in variety selection practices. The top five malt barley varieties comprised 77% of malt acres (AAC Synergy, CDC Copeland, AAC Connect, CDC Fraser, and CDC Churchill. The feed side is slightly more diverse – with the top five varieties planted taking up only 59% of feed acres (CDC Austenson, Esma, Brahma, Altorado, and CDC Maverick).

See how this compares to the Canadian Malting Barley Technical Centre’s (CMBTC) 2025-26 Recommended Malting Barley Variety List.

Read more: Unlocking Barley’s Potential: New Varieties and Advances in Plant Breeding

Movement in the malt category

It is surprising to see how rapidly varieties like AC Metcalfe and CDC Copeland can move from a top variety to an insignificant market share in a few short years. CDC Copeland acreage has nearly halved in the past two years!

AAC Connect has secured 3rd place on the variety acreage summary in recent years. In 2024, AAC Connect retained a consistent share of the acreage alongside growing domestic and export demand by end users. Although, actual acres planted have decreased slightly, this is consistent with barley acres overall.

Similarly, the current top variety, AAC Synergy has maintained a proportional share of acres since last year, although, CMBTC reports it’s export and domestic market demand has peaked (or is in decline). CDC Fraser slightly gained acres in 2024, which resulted in a 2% increase in its share of seeded area, as well as experiencing growing domestic and export demand from end-users.

CDC Churchill doubled in acres, coming close to CDC Fraser in total acres last year. This high yielding variety seems to be popular with farmers and was able to gain significant acres, despite a decrease in overall barley acres from 2023-2024.

Saskatchewan feed producers have a favourite

On the feed side, the prairie-wide trends are driven by Alberta’s feed barley acreage. I think it’s interesting to take a prairie-wide approach, because Saskatchewan barley acres tend more towards malt varieties while Alberta’s tend towards feed varieties. For example, Saskatchewan has more malt acres than Alberta, while Alberta’s feed acreage is double Saskatchewan’s. If we looked specifically at feed acres in Saskatchewan, CDC Austenson was over 1/3 of the feed barley planted in Saskatchewan last year at almost 268,000 acres. No other feed barley variety exceeds 100,000 acres in the province.

Read more: Why CDC Austenson Won 2025 Seed of the Year from SeedWorld

As some of the new feed varieties start to enter the market, I expect there will be increased interest in feed barley in general due to the notably higher yield potential compared to malt varieties. A change is coming, we already see CDC Austenson starting to lose some market share (Figure 2, below).

Combining multiple sources can be helpful while considering any variety changes for 2025. Here are some suggestions:

- Canadian Grain Commission – Grain varieties by acreage insured

- CMBTC’s recommended malt varieties list

- Canadian Grain Commission’s barley harvest summary

- SaskSeed Guide