Barley Market Report: StatsCan Plugs in a Smaller Crop

This week, StatsCan issued its first production estimates for the 2023 crop. StatsCan’s August yield report uses a model-based approach, relying on satellite vegetation images as of the end of July. By that point of the year, the barley crop was well advanced, but this is still viewed as a preliminary estimate. The next estimate will be issued in mid-September, based on conditions at the end of August, which may not show much difference. In early December, StatsCan releases its “final” crop estimate based on a large farmer survey and that could be more revealing.

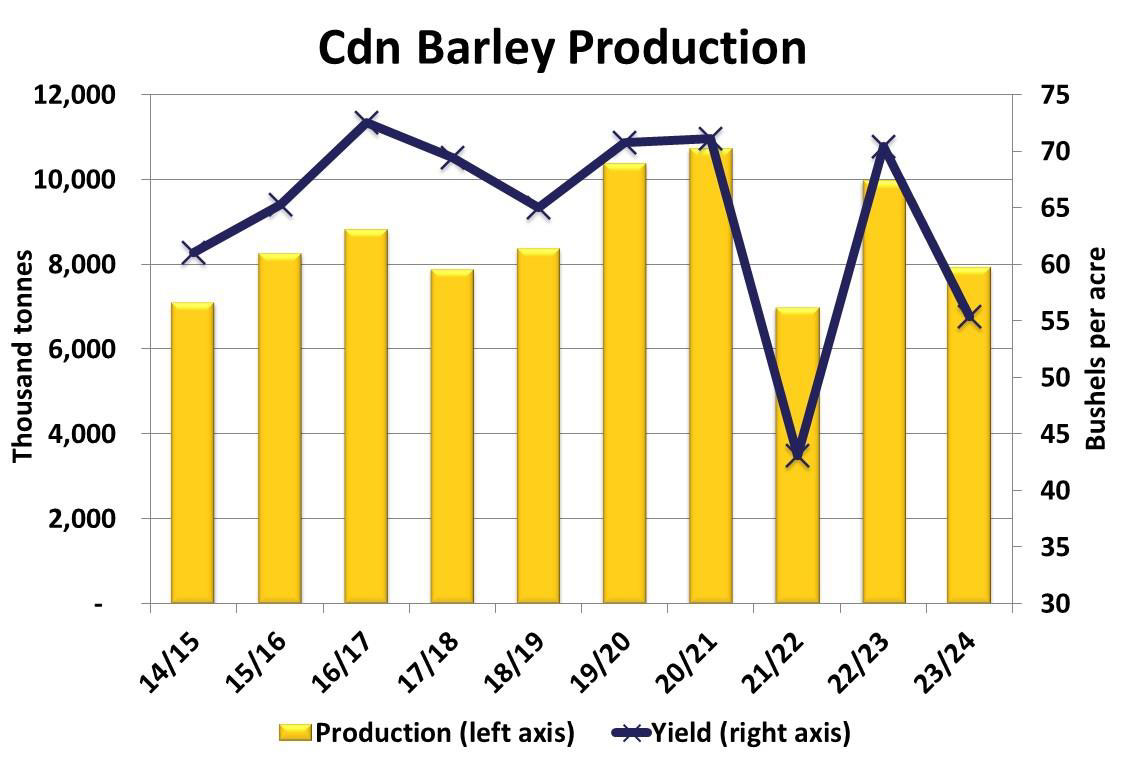

It was no surprise that StatsCan’s barley yields in this report were well below average; that was a given. It was just a matter of how low they would go. At 55.3 bu/acre, the 2023 yield was a full 15 bushels less than last year but still 12 bushels higher than during the 2021 drought. Seeded area of barley in 2023 was up about 4% from last year but that wasn’t nearly enough to offset the lower yields.

Canadian barley production for 2023 was pegged at 7.92 mln tonnes, over two million tonnes (21%) less than last year’s crop. The biggest hit showed up in Saskatchewan, where the barley crop was 2.5 mln tonnes, almost 30% smaller than last year’s 3.6 mln tonnes. Again, that’s not a surprise, given where the driest conditions and the worst grasshoppers were this summer.

Besides the size of the crop, this year’s conditions also raise concerns about the quality of the crop. While we don’t have any hard estimates yet, there have been reports of thin and high-protein barley, which isn’t good for malt acceptance. While maltsters will be able to make do with what’s available, it won’t be a good year for malt barley supplies.

Now that we have an initial idea of the crop, the next consideration is how barley users will respond to the limited supplies. Because it was already clear earlier this summer that barley yields would suffer, domestic feeders started adjusting their plans. The lessons learned during the 2021/22 drought year caused feeders to book large volumes of corn earlier, either from the US or the eastern prairies, to avoid getting caught short. Now that they have more coverage, feeders are less concerned about locking in large amounts of barley.

On the export side, the biggest development is that China has now officially dropped its 80% import tariffs on Australian barley. Reports indicate that ships are already being loaded with Australian barley for China and large volumes are on the books. Old-crop Australian supplies are limited and the bigger impact will be seen once its new-crop barley is available in the next 2-3 months. This will mean stiffer competition in China, which has been the main destination for Canadian barley the last 2-3 years.

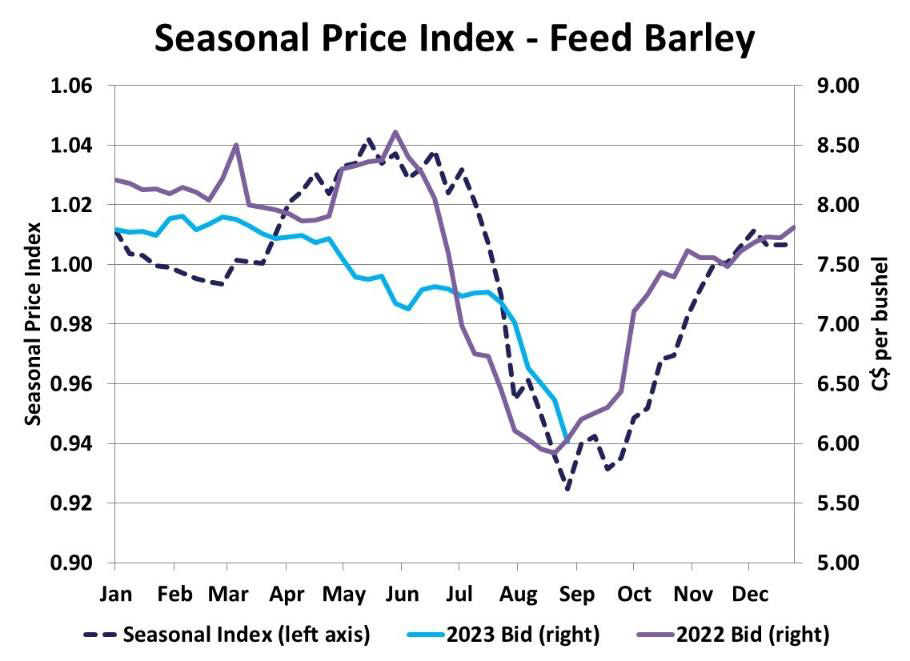

The combination of barley displaced by corn in western Canadian feed rations and reduced demand from China means the market is already finding a way to deal with a smaller Canadian barley crop. This explains why, even as the crop withered in the field, feed barley prices turned lower and reinforces that more factors determine barley prices than simply the size of the Canadian crop.

The good news for barley growers is that the recent declines in the market fit the seasonal timing almost to a T. In fact, the pattern developed over many years is that the low in feed barley prices tends to show up at the beginning of September. It takes a few more weeks after harvest for prices to start turning higher. For 2023/24, there’s no reason to think this same price behaviour won’t show up again.