Barley Market Report: StatsCan Acreage Estimate Still Tentative

By: LeftField Commodity Research

The 2023 planting season is delayed in many areas but is now underway in the western prairies. At this point in the year, essentially all planting decisions have already been made unless (cross your fingers) more serious delays show up in the next few weeks. For now though, the initial planting plan is in place.

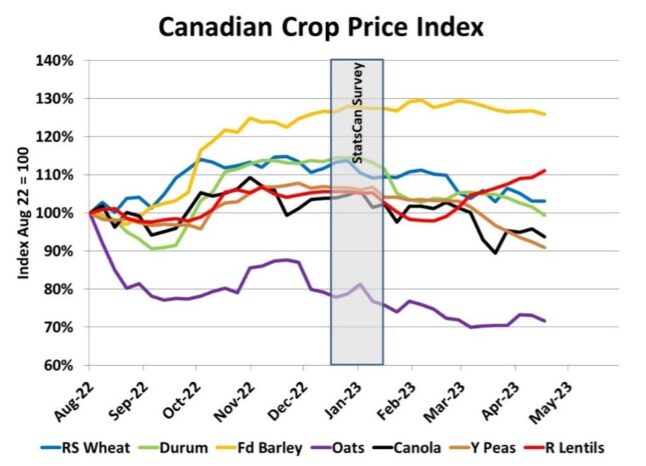

The first StatsCan acreage estimate of the year in late April is supposed to reflect farmers’ decisions just ahead of seeding, but it changed the timing of its survey this year. For 2023, StatsCan’s survey of farmers took place back in mid-December to mid-January. Since then, prices for some crops have seen large changes, which may have triggered adjustments in farmers’ seeding plans, raising questions about the validity of the StatsCan numbers.

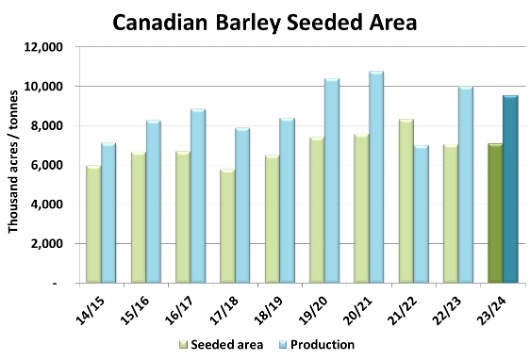

According to StatsCan, seeded area of barley for 2023 is 7.08 mln acres, up less than 1% from the 7.04 mln acres in 2022. This would be lower than the 5-year average area of 7.36 mln acres and the average trade guess of 7.3 mln acres. As seen in the chart above, barley has been the strongest price performer since August 2022 and since the StatsCan survey, has largely held onto its gains. Meanwhile, prices for most other crops have faded over that same timeframe. This makes us suspect that actual seeded area of barley will be higher than StatsCan’s early estimate. But we’ll have to wait until June 28 for an answer, when StatsCan’s next acreage estimates show up.

If we use the StatsCan acreage number and plug in an average yield of 68.7 bu/acre (70.4 bushels in 2022), the 2023 crop would come out just over 9.5 mln tonnes, 450,000 tonnes less than last year. That’s a bit more than the 5-year average (including 2021) and would still be a decent sized crop. Even with small supplies carried over from 2022/23, barley supplies for 2023/24 would still top 10 million tonnes, very close to the 5-year average.

Of course, whether the 10 million tonnes of barley supplies in 2023/24 are adequate depends on the demand side of the equation. There’s likely some room for domestic feed use to increase next year, but there’s also more wiggle room in that part of the balance sheet, especially with more wheat acres in Canada and corn acres in the US. Over the last five years, domestic feed use of barley has averaged 5.6 mln tonnes and we’ve penciled in 6.0 mln for 2023/24.

Meanwhile, exports have become a more critical part of the barley outlook, even though less barley has exported than fed domestically. Compared to the 5-year average exports of 2.6 mln tonnes, we’re a bit more cautious with our 2023/24 export forecast at 2.4 mln tonnes.

It’s no secret that China has been responsible for the lion’s share of the export demand for Canadian barley but this year, there’s added uncertainty about that continuing. As mentioned in previous reports, Australia and China seem to be working out their trade dispute that has kept Australian barley out of China since late 2020. That’s a clear threat to prospects for Canadian barley and is why it’s very difficult to know whether a 9.5 mln tonne Canadian crop in 2023 is enough, too small or too big.

It’s too soon to draw too many (or any) conclusions, especially with the acreage uncertainty and the entire growing season ahead. Still, it’s worth being aware of the potential possibilities and risks for 2023/24 and how they can affect marketing decisions.