Barley Market Report: Drought Shrinks Crops and Impacts Economics

By LeftField Commodity Research

Barley crops in western Canada are suffering due to drought and heat, with the worst conditions in the southern prairies. According to crop reports from mid-July, less than 50% of barley in Saskatchewan and Alberta were rated good or excellent, well below average levels around 65-70%. As a result, yield estimates are being cut and the 2023 crop will certainly be smaller than last year. The main question is how much smaller.

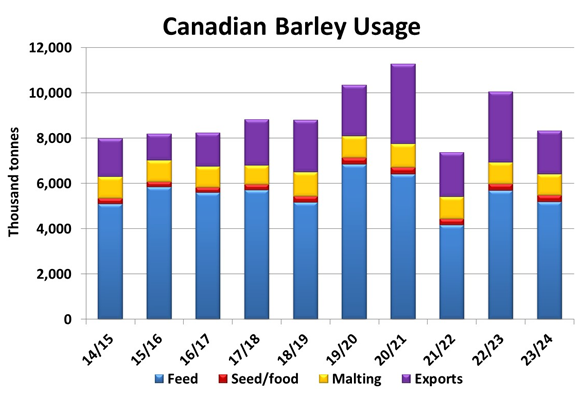

Our current guesstimate of the 2023 barley crop is 8.3 mln tonnes, down 1.7 mln tonnes or 17% from last year, but could drop further. If that’s the starting point though, the demand side of the 2023/24 Canadian barley balance sheet will need to see sizable changes. The shifts that occurred during the disastrous 2021/22 crop year when the crop was only 7.0 mln tonnes can provide some guidance about how markets could respond this year.

The largest part of Canadian barley consumption is domestic feed use. Over the past five years, other than 2021/22, feed use has averaged 6.0 mln tonnes. In that last drought year, feed use dropped to 4.2 mln tonnes as a record 5.8 mln tonnes of corn were imported into western Canada to make up the shortfall of barley (and feed wheat). For 2023/24, large amounts of corn are already being traded into southern Alberta for delivery in fall and winter, and that’s earlier than 2021/22. There’s a good chance feed barley use in Canada will end up close to 5.0 mln tonnes, roughly a million below average.

The next biggest part of Canadian barley use is the export channel for both feed and malt barley. Exports in the last five years (excluding 2021/22) have averaged 2.8 mln tonnes. In 2021/22, exports managed a relatively impressive 2.0 mln tonnes, with much of that barley already sold before the drought hit. For 2023/24, we don’t think forward selling has been as strong and exports could actually dip to 1.9 mln tonnes, even lower than 2021/22.

Aside from the smaller Canadian crop, we were already nervous that Canadian exports could slip this year as it looks like China will drop its 80% tariffs on Australian barley, allowing trading to start again. That’s not a done deal yet but is quite likely. Canada has been relying very heavily on China as a barley customer, accounting for nearly 85% of 2022/23 exports and it can’t afford to lose a major market. That said, barley production among key exporting countries is expected to shrink noticeably in 2023, which could keep demand for Canadian barley on the strong side.

The remaining parts of Canadian barley usage are malting, seed and food consumption. Seed and food use are steady from year to year and won’t be affected by a small barley crop. Domestic malt use has been edging lower in the last couple of years and this trend could continue, regardless of the size of the crop.

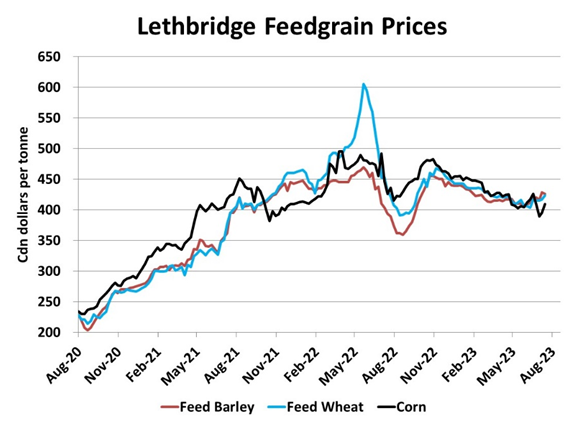

The experience of 2021/22 shows that the barley market can adapt to low supplies and that will need to happen again in 2023/24. The main question is whether barley prices this year will repeat the experience of 2021/22, when prices hit record levels. If farmers watching their crops shrink have that as an expectation, selling will be very reserved and will help support prices. But that won’t be the only driver.

In this type of situation with western Canada is facing smaller barley supplies, the US corn market has an even stronger influence on barley prices. Some dedicated barley users will not switch, but the availability of imported corn will act as a governor on barley values. In 2021/22, corn prices were in the middle of a strong rally that took futures to multiyear highs. The 2023 US corn crop is far from assured, but the global supply situation doesn’t look nearly as tight this time around. If so, Canadian barley prices will remain strong, but it will be difficult to get back to the 2021/22 highs.