Barley Market Report: Larger Canadian Barley Crop Sees Good Early Season Movement

This barley market report was provided by Leftfield Commodity Research.

StatsCan Reports Point to Larger Barley Supplies

StatsCan put out two reports in the past month that point to larger Canadian barley supplies for the 2025/26 season. The July 31st stocks report (which is the 2024/25 carryout) released September 9th showed barley inventories at 1.25 mln tonnes, up from 1.15 mln last year and the most since 2021/22. This was despite lower production in 2024, as both exports and feed usage were also down.

Updated Production Estimates Suggest Bigger Crop

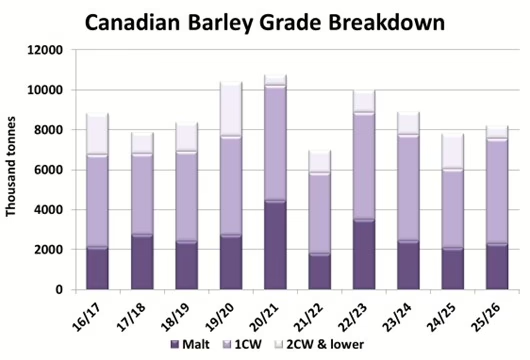

On September 18th StatsCan released an updated model-based production estimate using data to the end of August which pointed to a Canadian barley crop of 8.23 mln tonnes, up from their initial figure of 7.99 mln tonnes, and compared to 8.14 mln tonnes in 2024. It’s quite possible the actual crop size is even bigger. Depending on where final production ends up, the total Canadian barley supply could push to 10.0 mln tonnes or more, over 500,000 tonnes higher than last season. StatsCan will release their next survey-based production estimate in early December.

Quality Breakdown of the 2025 Barley Harvest

Despite reports of some areas seeing quality setbacks due to late season weather challenges, provincial government crop reports suggest the overall grade breakdown of this year’s harvest will be close to the longer-term average. Sask Ag estimated 24% of the province’s barley crop as malt quality, down from the 10-year average of 31%, while 68% graded as 1CW and 8% as 2CW or lower. Alberta Ag showed 31% grading as malt, slightly above average, with 61% as 1CW and 8% as 2CW or lower. If these percentages are applied to the StatsCan production figures, it works back to 2.31 mln tonnes of malt quality, up 9% from last year, and 5.26 mln tonnes of 1CW, which would be 34% higher. Adequate supplies may keep malt premiums mostly steady, as there will be enough high-quality barley to meet end user needs.

Market Implications of Larger Supply

The larger supply means the market will need to see bigger demand to prevent stocks from building even more into the end of 2025/26. Livestock consumption may be down a bit as barley faces competition from sizeable production of other cereals in western Canada, while a big US corn crop acts as a ceiling on feed grain prices as a whole. This could put more reliance on export markets to clear supplies.

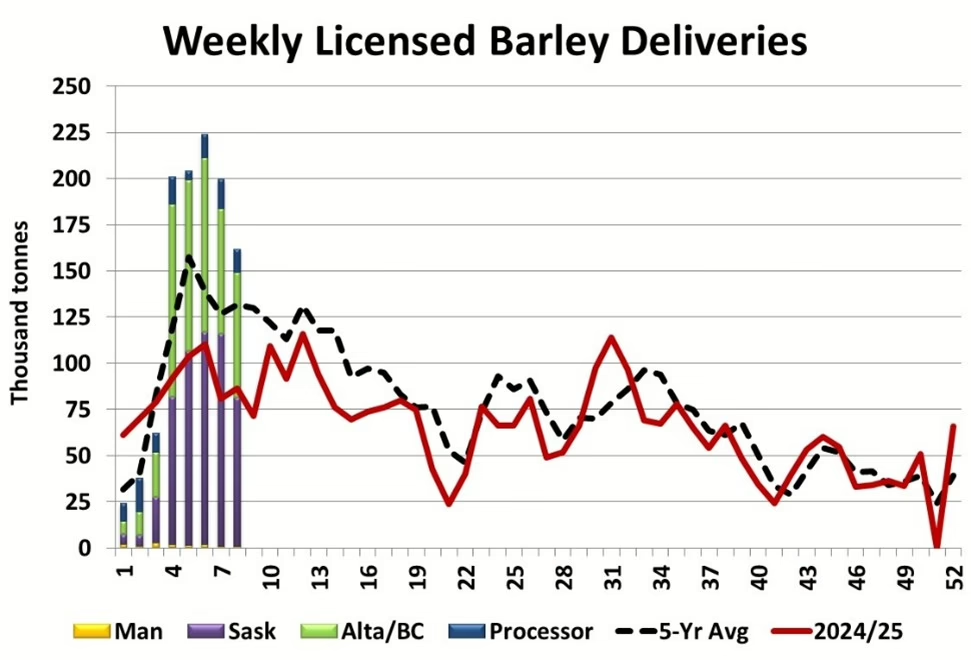

Export Demand and Early Season Movement

Exports typically make up 30% or less of Canadian barley demand, but early season movement gives reason for some optimism in the months ahead. Canadian barley is competitively priced in global markets, and CGC data points to good activity in the first two months of the marketing year. This includes 1.12 mln tonnes of farmer deliveries through week 8, nearly double the total at this point last year and compared to a 5-year average of 828,000 tonnes. This is a clear sign of strong export demand for Canadian barley, which will help in meeting (or exceeding) forecasts for the year. At the same time, Australia is on the cusp of harvesting a large barley crop, making the early movement out of Canada particularly important.

Barley Prices and Market Outlook

Barley prices in western Canada have largely levelled off in the past few weeks after being under pressure through the summer and early fall. Some recovery is possible now that harvest pressure is passed and export markets are drawing supplies into the system. At the same time, stocks are comfortable enough to limit upside potential in the coming months, particularly given big cereal production in Canada and globally. The result could be a barley market that largest trades in a range over the next few months.

Find more barley market reports here:

- Barley Market Report: A Big 2025 Canadian Barley Crop Will Result in Larger Ending Stocks

- Barley Market Report: Could Barley Demand Surprise to the Upside in 2025/26?

- Understanding Barley Price Trends: Marketing Planning Doesn’t Require a Crystal Ball

- Barley Market Report: Larger Canadian Barley Crop Sees Good Early Season Movement

- Barley Market Report: 2025 Canadian Barley Prices Face Harvest Pressure