Barley Market Report: Corn Market Helping Cap the Barley Rally

By: LeftField Commodity Research

Even though the 2022 barley crop was much larger than the drought-reduced harvest of 2021, feed barley prices in western Canada have staged an impressive rally from the August lows. Prices in the prairies have bounced back strongly to the tune of $90-100 per tonne and are within spitting distance of last year’s highs.

The move higher this fall was quite strong, considering a bigger barley crop coming in, and there were even questions about whether the upward momentum could take prices up through last year’s highs. In the last few weeks, though, the rally ran out of steam and feed barley prices have turned sideways.

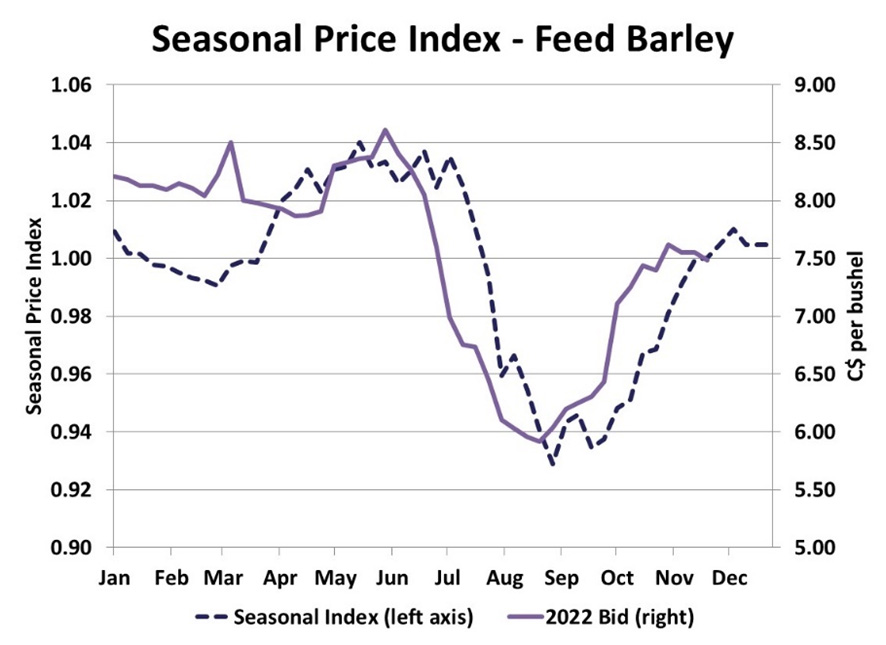

This year’s price behaviour actually fits the seasonal tendencies. All through 2022, barley has followed the seasonal price index quite closely, although it made its moves a few weeks earlier than usual. Prices typically rally through the fall and flatten out or even drift lower through the winter. Typically, seasonal highs don’t show up until late spring or early summer.

A few factors have helped reinforce the seasonal tendency so far in 2022/23. This fall’s strong rally was supported by concern about available supplies among domestic feeders and barley importers. To avoid repeating the 2021/22 supply problems, both quickly started locking in barley and building coverage. This flurry of buying helped push the market firmly higher, but the pace has slowed more recently.

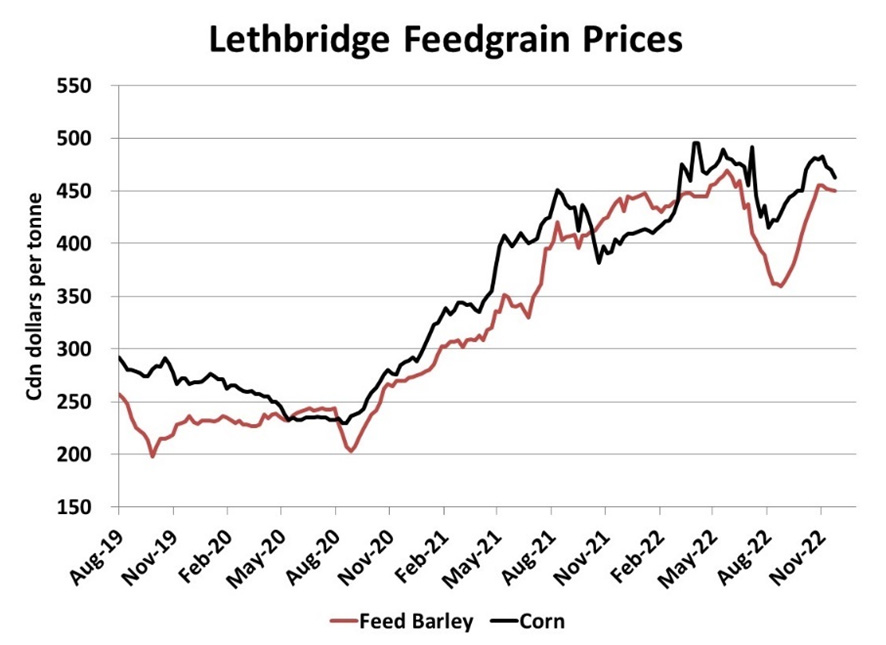

Domestic feeders have been able to slow down their barley purchases as imported corn becomes more affordable. In 2021/22, corn imports into western Canada hit 5.8 mln tonnes, far beyond the 5-year average of 1.2 mln tonnes. Now that this flow of corn from south to north has become well established, there’s a greater willingness to bring in corn as a feed substitute whenever prices are more favourable.

Corn futures have been mainly moving sideways since late summer, and the US corn harvest has caused the market to soften a bit more. While corn futures have remained steady, the Canadian dollar bounced back from its October lows, gaining more than three cents by early November. In Lethbridge, the benchmark for western Canadian feed grain prices, this strength in the Canadian dollar caused US corn prices to decline, making imports a bit more affordable. According to traders, this latest drop in US corn triggered a flurry of buying, which slowed barley demand.

Looking at price direction for the next few months, it’s hard to ignore the normal seasonal tendencies, which would be flat in the short term with some possible upside heading into late spring. At the same time, the corn market will continue to have a strong influence on barley. Beyond the US situation, developments in South American crops will be key, and those are far from a sure thing.