Barley Market Report: Rising Prices, Export Trends, and Drought Concerns

by Leftfield Commodity Research

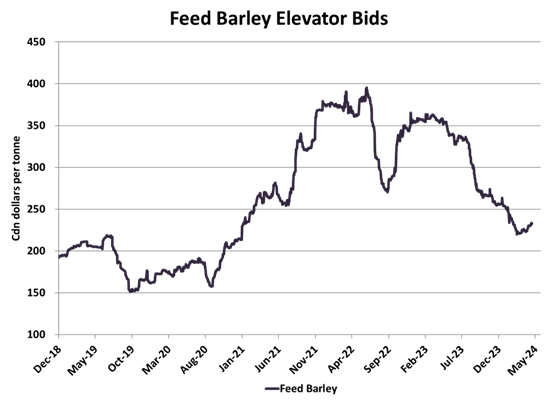

Barley prices in the southern Alberta feed market and at western Canadian elevators have moved higher, off the winter-time lows, as both domestic feeding and export demand has improved over the past weeks. Increased export demand seems to be one of the main drivers.

StatsCan February data showed a large improvement in export volumes, totalling 239,000 tonnes. The CGC data also points to improved export performance through March and April, with cumulative exports as of Week 38 totalling 1.5 mln tonnes. The CGC weekly data is more current than StatsCan but doesn’t necessarily capture all exports, only those through licensed facilities, meaning total export volume for this period would be slightly larger. Terminal stocks have also been rising, indicating steady export volumes in the weeks ahead. The bulk of export volume continues to move to China, despite the renewed competition from Australia this marketing year. While cumulative exports are still lagging last year and the average, movement is on pace to reach 2.25 mln tonnes this marketing year.

High barley prices during the summer of 2023 triggered increased imports of US corn this season. Corn imports into western Canada from August through February total 1.98 mln tonnes, up dramatically from the 1.05 mln tonnes during the same period in 2022/23. However, volumes have started to show signs of slowing with StatsCan reporting February corn imports at 227,940 tonnes, the lowest since September.

Corn imports will likely drop further in the months ahead, as much of the movement so far has been the execution on early commitments. At this point there are less than 200,000 tonnes of official outstanding export sales (USDA) to Canada that haven’t shipped, with negligible fresh business being done. The official data doesn’t capture all sales, but it’s a reasonable proxy for the broader trend. Price behavior and anecdotal reports further support the idea that corn imports into western Canada are slowing sharply. Domestic barley demand into Southern Alberta’s feedlot alley has started to pick up as a result.

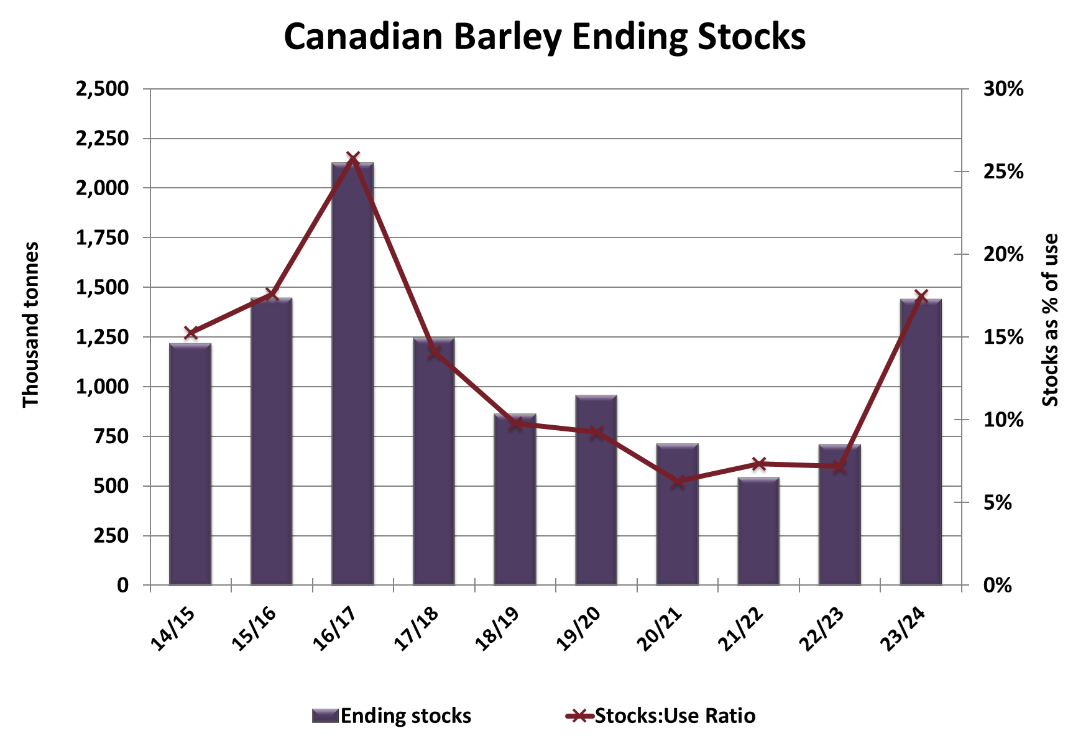

The improved exports and domestic demand have improved the ending stock outlook for 2023/24. As it stands today, 2023/24 carryout is forecast at 1.4 mln tonnes, which is still fairly heavy, at more than double last year but an improvement from a few months ago when expectations were closer to 1.8 mln tonnes. The heavier carry-over supplies will provide act as a buffer to small production hiccups or issues in 2024.

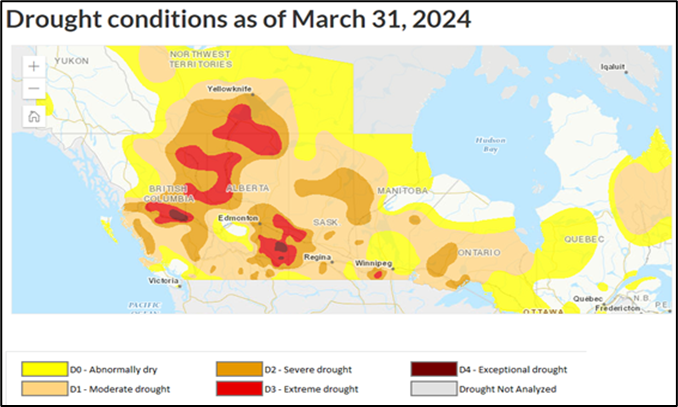

The latest drought monitor (March 31, 2024) from AAFC showed some level of abnormal dryness or drought across the entire Prairies. Some of the most severe drought conditions remain in east-central areas of Alberta, up into the Peace River region. So far in April, there has been some light precipitation through central areas, but not enough to move the needle. In the Peace River region moisture totals have been nil. Parts of the barley belt across northern Saskatchewan have received meaningful rain in April, with a more optimistic outlook.

With seeding just a few short weeks away, conditions are setting up for a potentially shaky start. Looking at StatsCan’s small area data from previous seasons, we see that just over one million acres of barley are typically planted in the dry areas of Alberta. This equates to about 30% of provincial barley acres that would be planted under significant dryness concerns this season. We haven’t seen the drought concerns in Alberta materially impacted new-crop prices yet, but it will be something to watch going forward, as old-crop ending stocks can only provide so much of a cushion.