Barley Market Report: Western Canada a Bright Spot Amid Declining Production in Key Exporting Regions

It’s natural to focus mainly on crops close to home. That’s especially the case for barley, since a good portion of its use is right here within western Canada. However, in recent years the export market has been an important factor for domestic prices, making it important to keep track of what’s happening in other countries as well.

There’s still much of the growing season ahead for the western Canadian barley crop but so far conditions are mostly favorable. In Saskatchewan, provincial crop ratings are well above average, although there are areas in the north facing delays in development due to excess moisture and cool temperatures. Crops in central and southern regions are looking better. The overall crop rating for Alberta barley is also above average with the bulk of the province in great shape, although some of their crops are also seeing delayed development due to wet weather and cooler than normal temperatures. Across the prairies, springtime moisture has recharged soils and set the crop up for a strong start.

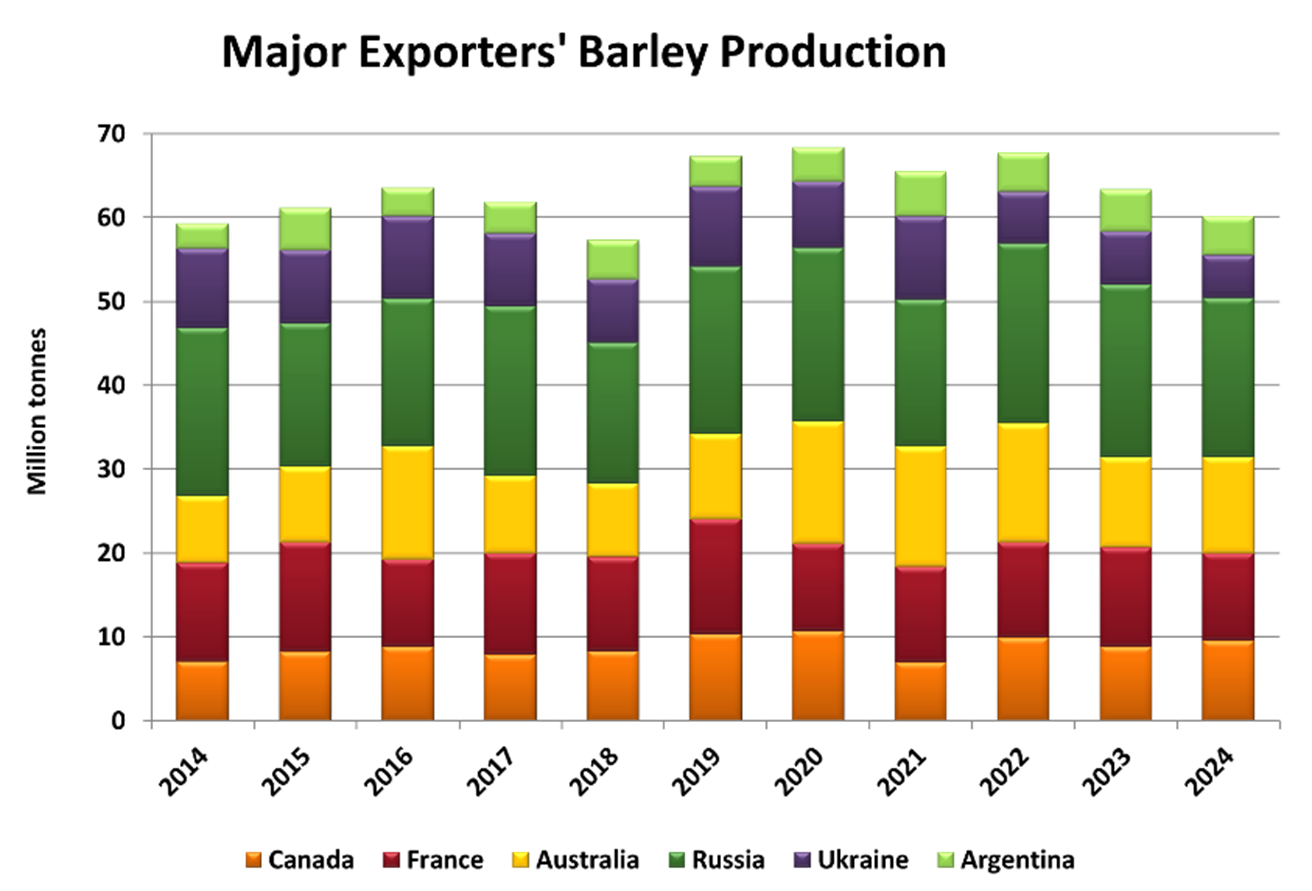

Western Canada is one of the bright spots globally. Barley production estimates in most other key exporting regions were reduced in the latest report from USDA. There are a few problem areas in western Europe, particularly France. USDA cut EU barley production by 700,000 tonnes to 53.8 mln tonnes, down from 54.5 mln tonnes previously. In the Black Sea region, conditions were unfavorable to start the season, which hindered early development. USDA reduced the Russian crop by half a million tonnes to 19 mln, the lowest since 2021/22. Ukraine’s crop was also reduced by 200,000 tonnes, to 5 mln.

Conditions are also mixed in the Southern Hemisphere, with the 2024/25 Argentine crop reduced by half a million tonnes to 4.7 mln, and below the 5.1 mln tonnes grown last year. USDA did post an increase in Australian production, now forecast at 11.5 mln tonnes, up from the previous estimate of 10.9 mln and 10.8 mln last season. Conditions in Western Australia were very dry to start the season, but moisture has improved in recent weeks.

Overall, total 2024/25 production in key exporting regions is now expected to be the lowest since 2018. As a result, 2024/25 export forecasts were lowered for Argentina, Russia, and the EU. Total global exports in 2042/25 are now projected at 28.6 mln tonnes, down from 30.1 mln tonnes in 2023/24. The reduced production and export potential in key regions could open opportunities for increased Canadian exports in 2024/25. Canadian exports are currently forecast at 2.4 mln tonnes this coming crop year, up from 2.3 mln in 2023/24, but given the large production potential in western Canada there is room for a further increase in shipments.

China is still the dominant factor for the global barley market, currently on a trajectory to import 15 mln tonnes in 2023/24, which is a record pace. In the latest report from USDA, China’s forecast barley import demand for 2024/25 was increased to 10.2 mln tonnes, from 10 mln previously. China’s domestic corn crop is also facing some challenges, which could further increase import requirements. There will still be competition into the Chinese market this coming year, but smaller crops in many key exporting regions could push more demand Canada’s way.