Barley Market Report: Mixed Conditions, Global Competition, and Export Potential

There are some years when much of the Canadian barley price direction is dictated primarily by our domestic situation. Largely, that happens when Canadian supplies are tight. In other years, barley prices are supported by steady export interest and local feed demand.

Projections for 2024 barley production still aren’t clear. StatsCan significantly dropped barley seeded area in their second iteration of 2024 acreage projections, now estimated at 6.4 million acres, down from 7.3 million acres last year and below trade expectations. Leftfield is maintaining a slightly higher seeded acreage estimate of 6.7 mln acres.

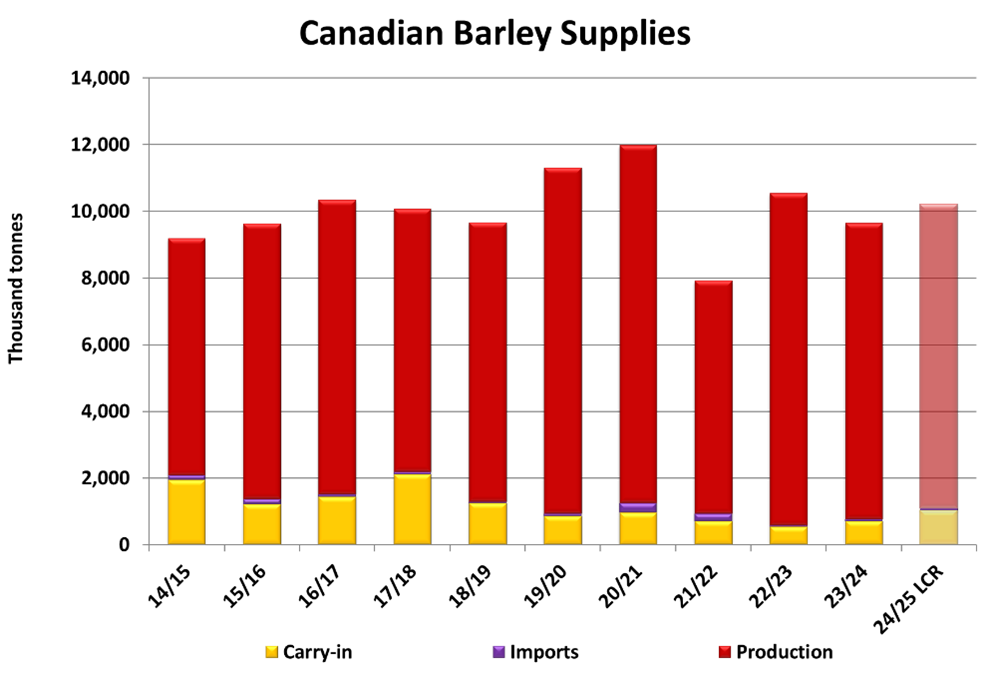

Conditions have been mixed across the prairies, with pockets of excess moisture in eastern areas, while dryness is mounting in the many western areas. Temperatures in June were largely below normal, which resulted in lagging crop development. Conditions then flipped in July, with temperatures trending well above average during the month, advancing crop development but also worsening conditions in the drier areas. That being said, provincial crop ratings are still trending above the 10-year averages, and continue to point to relatively strong yield outcomes. LeftField’s current barley crop forecast is 9.1 million tonnes, up from 8.9 million tonnes last year. A higher 2023/24 carryover will also add to the 2024/25 total supply, projected to increase 9% year-on-year to 10.2 million tonnes.

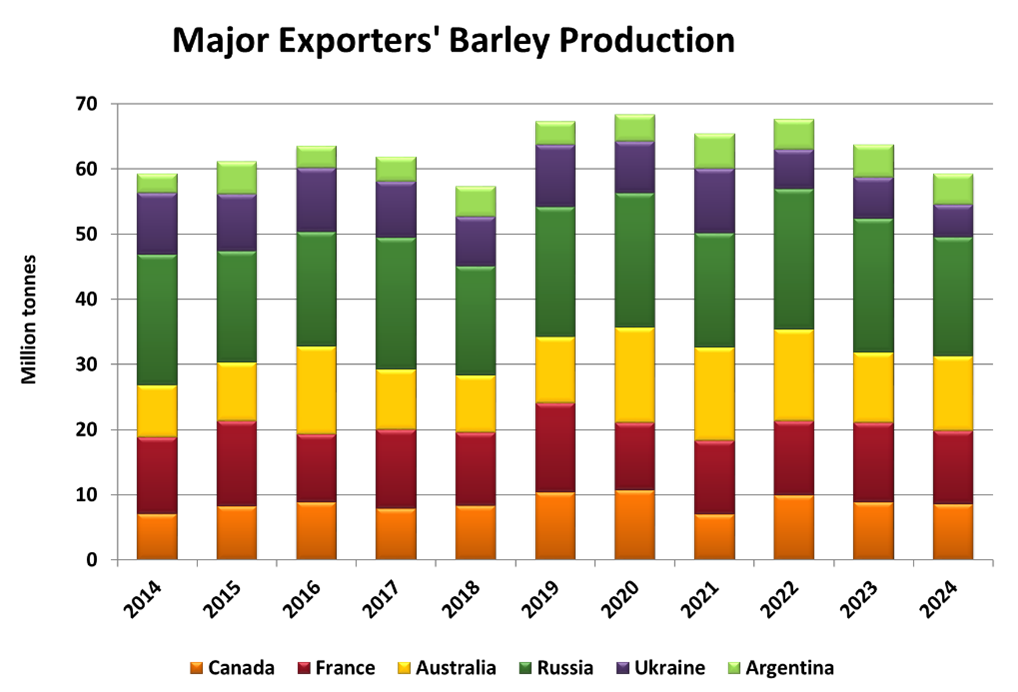

One thing that was different in the 2023/24 marketing year was the re-emergence of Australia as a major exporter to China after trade relations between the two nations were mended last fall. This led to increased export competition and ultimately stifled Canadian barley exports, as China is the country’s largest export destination. Total Canadian exports in recent years have come in over 3 million tonnes. The final 2023/24 export figure isn’t yet known but is pointing to a reduced outcome of around 2.5 million tonnes. At the same time, 2023/24 Chinese barley imports are projected to be a record, estimated by USDA at 14.5 million (up from 8.9 million the year prior). China has drained barley out of Australia, France, Argentina and the Black Sea this season, while buying of Canadian barley was subdued. This could be a factor at play again in 2024/25, however smaller supplies among major global exporters could push more demand to Canada.

According to the USDA, 2024 barley production among major exporters will be 7% smaller than last year. Barley production in Ukraine, Russia, France, and Argentina are all expected to fall year-on-year. This ultimately means China will have less availability from some key suppliers in 2024/25. This may favor Canadian export potential next season. As a result, LeftField is estimating a slightly increased export program in 2024/25 at 2.7 million.

On the domestic front, feeders will have more options in 2024/25. Western Canadian feed grain supplies are forecast to expand, and the continued availability of US corn should allow for a larger pool of feed sources.

While Canadian barley prices have come down sharply in the last month or two, those declines may not be extended much further as global barley markets seem to be stabilizing as crop prospects in key regions have been underwhelming. However, getting back to the “drought highs” is unlikely, especially if other feed grains are more readily available.