Barley Market Report: March Barley Stock Estimations and Outlook

This barley market report was provided by Leftfield Commodity Research.

Mid-Season Data Helps Refine Barley Stocks and Outlook

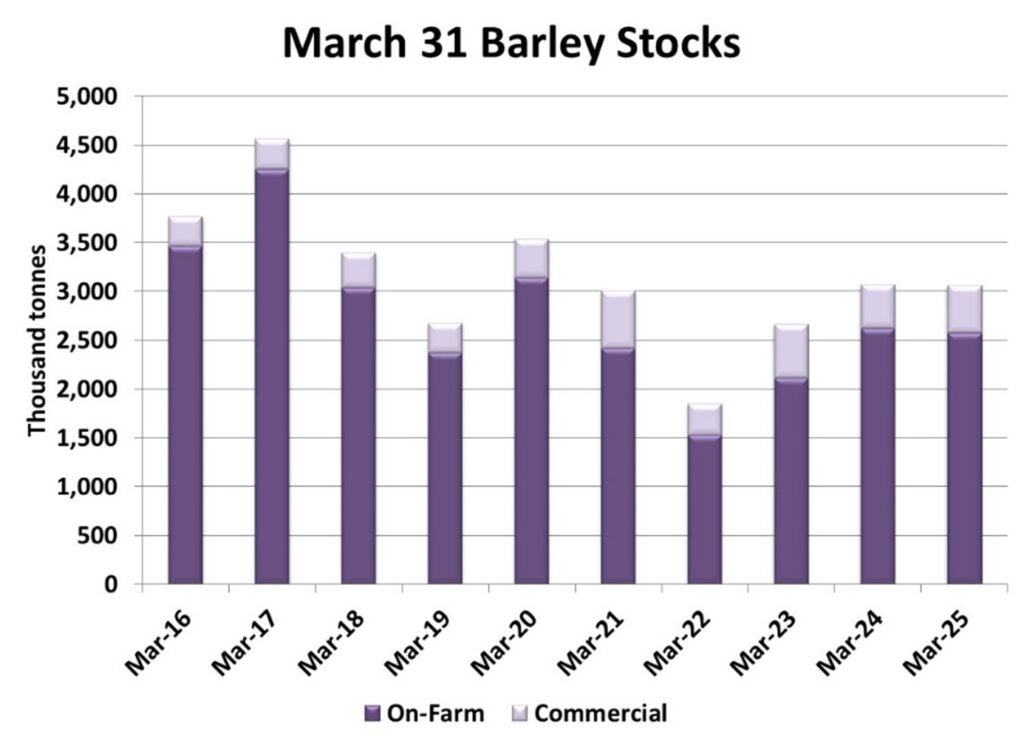

Last month StatsCan gave an estimate for March 31st barley stocks and an updated supply and disposition table. While mid-season stocks reports aren’t as anticipated in the same ways as acreage or production releases are during the year, they are useful for recalibrating S&Ds, which in turn shapes the market outlook going forward.

March 31st stocks were shown at 3.07 mln tonnes, essentially flat from last year and above the 5-year average of 2.83 mln tonnes. This is despite the fact StatsCan’s 2024 crop size estimate of 8.14 mln tonnes was 770,000 tonnes smaller than in 2023, as this was partially offset by a larger old-crop carryin.

Usage Trends Behind Stable Barley Stocks and Exports

One contributing factor to stocks staying flat despite smaller supply is because total usage was shown to be lower in the August to March period. Barley exports were up slightly to 2.00 mln tonnes, from 1.86 mln the previous year. This included 1.53 mln tonnes of grain exports and 471,400 tonnes of product exports (primarily malt). However, domestic disappearance was down to 4.33 mln tonnes, compared to 4.74 mln tonnes in 2023/24.

Feed Demand Drops but May Be Understated

FWD (feed, waste and dockage) is the largest source of Canadian barley demand (human and industrial use is relatively small, as much of Canada’s malt production is exported, which is then recorded as ‘product exports’). StatsCan showed 4.27 mln tonnes of feed usage for August to December, down 410,000 tonnes from last year and the second-lowest in a decade, behind only 2021/22 when drought greatly reduced prairie barley supplies.

Implications of Questionable Feed Use Estimates on Barley Exports

Barley feeding can vary from one year to the next due to available supply, fluctuating livestock numbers and its price competitiveness relative to other grains. However, there is reason to believe the feeding number is understated. Wheat feeding was also estimated to be 600,000 tonnes lower at the same time corn imports were down 1.12 mln tonnes and oat feeding was smaller as well. In total, this suggests well over 2.0 mln tonnes less grain was used to feed livestock in western Canada from August to March—an unrealistically large decline.

It’s important to remember StatsCan doesn’t measure FWD specifically but instead derives the number after working through supply and other sources of demand that are more directly reported. In this sense, FWD almost acts as a ‘catch all’ category to make the rest of the balance sheet work. In the case of barley, the small FWD number may be an indication of supply being understated (e.g. the 2024 crop was larger than shown) rather than feed demand being significantly lower. This is likely also the case for wheat and some other crops.

Why Mid-Season Numbers Still Matter for Barley Exports Strategy

Drilling into the finer points of a mid-season stocks report might elicit a ‘who cares?’ response, particularly as attention is primarily focused on 2025 production. However, the details matter for a couple of reasons. First, when projecting future crops, one relies on previous years’ data to come up with longer-term averages and calculate trendline yields. If there appear to be some inconsistencies in official numbers or production in earlier years has been underreported, it impacts forecasts if adjustments aren’t made. Also, from a more practical perspective for many farmers, part of an effective marketing plan includes understanding the current supply and demand balance, as this affects the outlook for the upcoming season—including prospects for barley exports.

Find more barley market reports here:

- Barley Market Report: March Barley Stock Estimations and Outlook

- Barley Market Report: Barley Production May Increase Across Major Exporters in 2025

- Barley Market Report: StatsCan and USDA Provide 2025 Barley Acreage Estimates

- Barley Market Report: StatsCan Shows Lower December 31st Barley Stocks for 2024

- Barley Market Report: Possible Impacts of US Tariffs on Canadian Barley