Barley Market Report: Acreage Clearer but Yields Uncertain

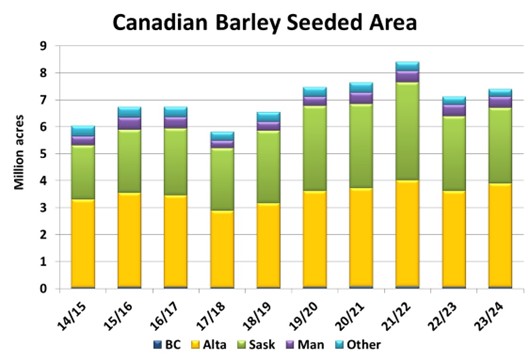

Now that we have StatsCan’s updated acreage estimates, one piece of the outlook is now (more or less) in place. Even though some might disagree, the 2023 seeded area estimate of 7.32 mln acres appears fairly reasonable. This acreage is 4% more than last year but is in line with the 5-year average of 7.36 mln acres.

According to StatsCan, there are some noticeable changes in provincial barley acreage for 2023. Seeded area in Saskatchewan is reported at 2.80 mln acres, up less than 1% from 2022, while seeded area in Alberta is 8% larger than a year ago. The result is that Saskatchewan barley acres are 38% of the 2023 Canadian total versus the 5-year average share at 42%. It looks like most of that shift is due to increases in Saskatchewan spring wheat and durum acres.

At first glance, the 4% increase in Canadian barley acreage should help boost supplies in 2023/24, but there are a couple of large unknowns. The first question mark is the percent of barley acres that are actually taken to harvest. On average, 90% of barley acres are harvested as grain but that has ranged from 84% to 92% in recent years, depending on crop conditions and price signals. From the bottom to the top of that range, it would mean a difference of 600,000 acres or 800,000 tonnes of barley, enough to affect the outlook in a meaningful way.

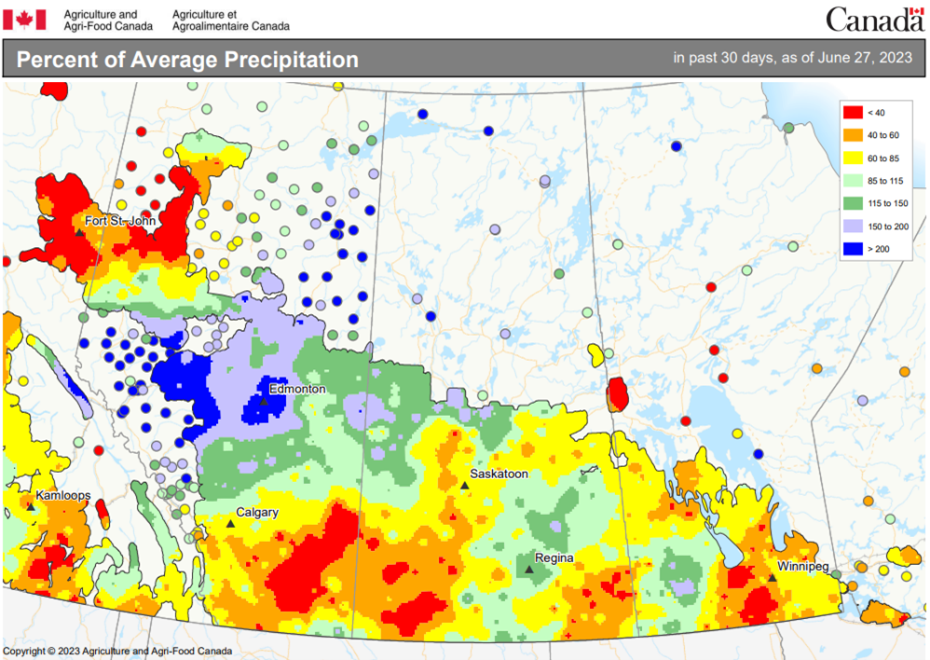

As always, the yield outcome is the most important part of the outlook. And this is where the uncertainty is the greatest. Every year, some parts of the prairies do better than others, but it seems the differences in 2023 are more extreme.

At the beginning of the 2023 growing season, dry conditions were a serious concern in the northern half of the prairies, while things looked more positive in the southern half. Rains in the last 30 days have flipped that situation around, with the north looking better but serious concerns in the south. And now that the crop has further advanced, there’s less opportunity for a recovery in barley yields if rains would show up in the drier areas.

It’s always tricky to sort out yields at this stage of the growing season, but the extreme differences in the various parts of the prairies make the yield outlook even more difficult to predict. Yields will be reduced in the south but the question is how much of that will be offset by better yields in the north.

In 2022, the Canadian barley yield ended up at 70.4 bu/acre, which included below-average yields in Saskatchewan and above-average in Alberta. The “olympic average” yield – the last five years with the high (2020) and the low (2021) yields eliminated – works out to 68.7 bu/acre, almost two bushels less than last year.

If we adopt the olympic average yield and the average abandonment, the 2023 Canadian barley crop would work out to 9.87 mln tonnes. Even with a 4% increase in acreage, this would still be a 1% drop in production compared to last year. And every loss of a bushel per acre trims another 150,000 tonnes from the production total. It doesn’t take much of a yield loss for the Canadian barley supply situation to move from comfortable to snug.

For now, our assumptions work out to Canadian barley supplies for 2023/24, right around 10.5 mln tonnes, compared to 10.7 mln tonnes in 2022/23. But supplies closer to 10.0 mln tonnes are certainly within reason. Of course, this is just the supply side of the equation and there are plenty of question marks about the demand portion, especially exports. But that’s a topic for another time.

Read the full July e-Newsletter here.