Barley Market Report: A Flurry of Crop Estimates Confirm the Obvious

By Chuck Penner, LeftField Commodity Research

In the last few weeks, StatsCan has released three sets of estimates; two yield projections and July 31 stocks numbers. There have also been yield estimates from provincial ag departments, adding more evidence to the mix. Before getting into the 2021 crop outlook though, it’s worth reviewing how the 2020/21 marketing year finished off.

Earlier this month, StatsCan estimated barley ending stocks for 2020/21 at 711,000 tonnes, the lowest in our records going back to the 1970s. That was based on July 31 inventory data from grain handlers and the results of a farmer survey back in June.

At the start of the 2020/21 marketing year, supplies had been the largest in years, but a 3.8 million tonne export program (mostly to China) took care of any concerns about heavy supplies. Domestic feeders had to fight tooth and nail for barley, helping push bids in western Canada to record levels. Feed barley was clearly driving the market, but malt bids were also forced higher to stay just a bit ahead of feed prices.

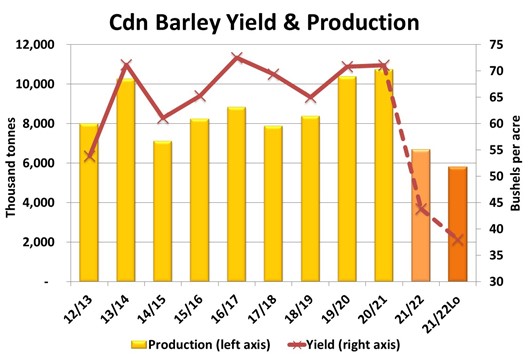

So with record low barley inventories to start 2021/22, the outcome of the 2021 barley crop was even more critical than usual. No surprise to anyone, the 2021 drought quickly wiped out the potential gains from a 10% increase in acreage. In late August, StatsCan reported a Canadian barley yield of 48.1 bu/acre and then lowered it again in mid-September to 43.8 bu/acre. That’s still better than the recent barley yield estimates from Sask Ag and Alberta Ag, both at 38 bu/acre.

The one thing StatsCan hasn’t accounted for yet is the higher-than-usual abandonment. At least 500,000 additional (beyond the normal) acres of barley was cut for greenfeed. Once that’s been adjusted, the StatsCan crop total of 7.1 million tonnes will come down further. Our best guess at this point is that the 2021 barley crop could need to be reduced by another 500,000 tonnes, to 6.6-6.7 million tonnes. And if the provincial barley yield estimates are correct, the crop would drop below 6 million tonnes.

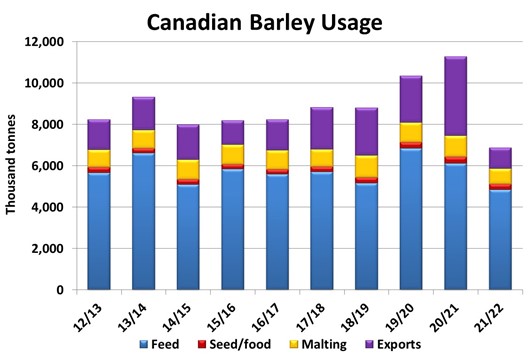

If the 2021 barley crop ends up at 6.6 million tonnes, it would be a full 4.0 million tonnes smaller than last year. And with bare-bones carryover from 2020/21, that means usage would also need to be cut by 4 million tonnes, as shown in the chart above.

The most obvious place to start with the cuts is barley exports. After all, the 3.8 million tonnes in 2020/21 was an anomaly and is unlikely to be repeated this year as China’s feed demand seems to be shrinking. If we could cut exports down to only a million tonnes, that would put 2.8 million tonnes back into Canadian supplies. That’s going to be difficult though, as some barley had already been sold to China earlier this year.

The largest segment of barley use in Canada is for domestic feed, which has averaged around 5.9 million tonnes over the last five years. The problem this year is that there aren’t a whole lot of other feed sources available from western Canada, as wheat, oats and other substitute crops were also reduced sharply.

The other feedgrain source of any size would be US corn and we’re already hearing of large volumes being traded into western Canada for later in fall. This isn’t exactly a surprise either and has happened in the past. As recently as 2018/19, 2.1 million tonnes of corn were imported into western Canada, compared to a more normal level of 900,000 tonnes per year. A total of 2.0-2.5 million tonnes is easily doable and would make up most of the rest of the barley shortfall in 2021/22.

Even once exports have been cut sharply and corn imports boosted, it certainly doesn’t make the barley supply situation in 2021/22 anywhere close to comfortable. After all those adjustments, we still expect very little barley will be left at the end of 2021/22. Those bare-bones ending stocks means that a big barley crop will be needed once again in 2022.