Barley Market Report: Canadian Barley In and Out of the Export Market

By Chuck Penner,

LeftField Commodity Research

It’s been quite the year for Canadian barley. StatsCan recently reported the 2021 crop at 6.95 million (M) tonnes, the smallest in our records going back to the mid-70s. Even though farmers planted 10% more barley in spring, the yield of 43 bushels an acre (bu/ac) was the lowest since 2002 and lower than 1988. And it’s possible actual production could be even lower, as StatsCan didn’t adjust harvested area to account for more barley cut for greenfeed or simply not taken to harvest.

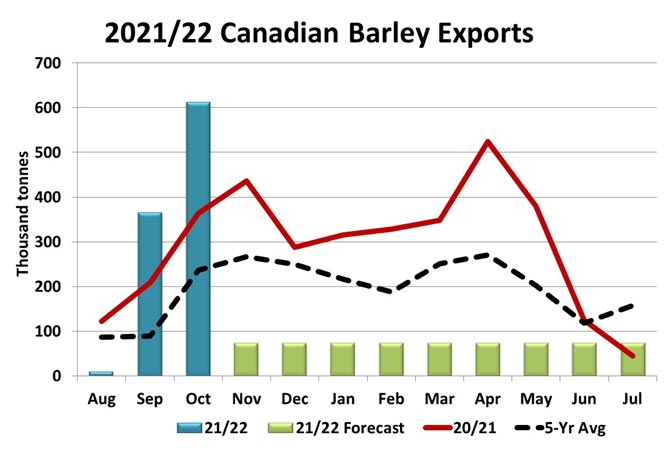

Despite the smallest crop in many years, Canadian barley has been moving out the door at an extremely fast pace since harvest. After a very quiet August, volumes jumped sharply in September and even more in October. In fact, the 611,000 tonnes exported in October was the largest amount for any month on record by a sizable margin and the 988,000 tonnes in the first quarter of 2021/22 is the strongest start ever. Over 95% of Canadian exports so far have been destined for China.

The export pace is going to need to hit the brakes hard, as supplies simply aren’t available. That said, the CGC weekly export data shows another 300-350,000 tonnes in November, which will force an even sharper slowdown in the later months.

We expect most, if not all, of those export sales were made back in spring when it looked like there would be plenty of barley. Clearly, that hasn’t been the case. Between exporters needing to cover those sales and domestic feeders and maltsters trying to keep operating, Canadian feed and malt barley prices shot up to record levels.

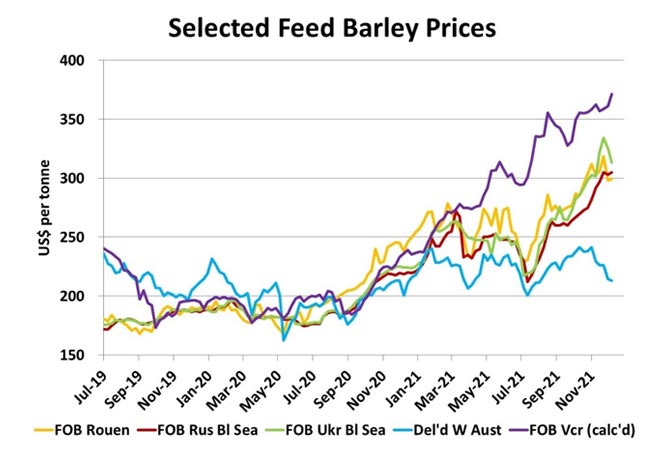

Those extremely high prices have largely shut Canadian exporters out of making any fresh sales as Canadian barley has simply become uncompetitive with other origins. As the summer progressed, the premium for Canadian barley expanded and other exporters became the preferred origins.

That gap between Canadian and competing barley actually started to narrow again in past month or two. Even though Canadian barley prices were rising, Black Sea and French barley was rallying even more but still haven’t caught up to Canadian prices. And in the last couple of weeks, there’s been a dip in some of these other origins, which will still restrict Canadian barley export sales.

The main price outlier is Australia which is at a sharp discount to every other exporter. Largely, that’s because Australian barley faces an 80% tariff going into China, which limits where Aussie barley can be exported. It also doesn’t help that Australia is still harvesting a near record crop. Those low prices will act as a drag on the rest of the market, likely a factor behind the latest dip in Black Sea barley. In fact, Aussie barley is so cheap, there are rumours small amounts could be moving into Western Canada, especially for maltsters.

Of course, Canadian barley doesn’t really need (or can’t handle) any more export business. Feeders are already paying large premiums for barley over corn or have switched to corn and a few other feed sources. Maltsters may need to bring in barley from Europe or Australia. By the end of the year, barley bins will have been swept bare. That means a large acreage base will be needed in 2022, along with much improved weather to get back to a more normal situation.