Barley Market Report: Barley Production May Increase Across Major Exporters in 2025

This barley market report was provided by Leftfield Commodity Research.

Barley Exports and Global Supply Trends

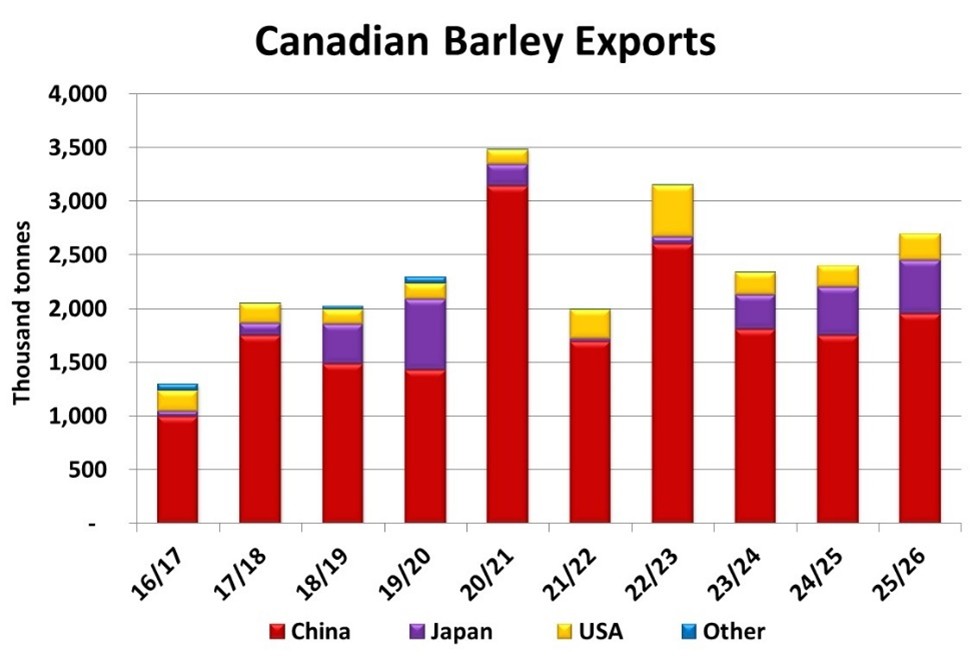

While livestock feeding represents by far the largest share of Canadian barley demand, typically at around 60% of total usage, exports are a critical part of the outlook for prairie values. For this reason, it’s important to get a sense of what production might be across other major exporting countries when considering price scenarios for the coming year.

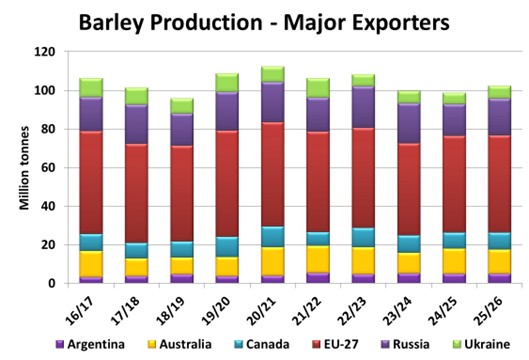

Production in the major exporters in 2024/25 was the second lowest in the past decade at just under 100 mln tonnes. Despite a dip in global imports, ending stocks across these countries in aggregate may end up being record-low, leaving little cushion going into the next harvest. It’s very early in the growing season and the most important weather is still ahead, but initial indications point to a small rebound in production in the key growing regions.

Country-by-Country Outlook for Barley Exports

Looking at specific countries, much of the production increase could come from Russia and Ukraine, where crops are forecast to be 16% and 12% larger, respectively, although still below the longer-term averages. Canada may grow just under 9.0 mln tonnes of barley if seeded area ends up larger than the initial StatsCan estimate, compared to 8.1 mln tonnes in 2024. EU production could be roughly flat from last year. Initial indications point to a small bump in Argentina, while Australia’s crop could be lower. Current expectations point to total production across the major exporters of around 102 – 103 mln tonnes, the highest in three years but still not particularly large, leaving supplies quite tight again in 2025/26.

Global Demand and Its Impact on Barley Exports

Early estimates point to global import demand being similar to this past season. However, this largely hinges on China, as in recent years their share of world imports has ranged from 30% to as high as 50%. It’s always difficult to predict what China will do, but the fact they have continued to be strong importers of barley even as wheat and corn purchases dropped sharply suggests buying interest could continue to be strong. Any shortfall in their domestic grain production would further support barley import demand. The Middle East and North African countries represent the next largest barley market and imports can vary as well, although the impact on Canadian shipments is lower as they are largely supplied by the other exporters.

Canadian Barley Exports: 2025/26 Outlook

Our expectation is for Canadian barley exports to increase moderately to 2.7 mln tonnes in 2025/26, the highest in three years. However, much depends on China, as they take over 70% of Canada’s shipments. China takes sizeable volumes from all the major exporters. This means Canada will need to be competitive if our target is going to be reached. Canadian exports into Japan and the US are much smaller, but still important. USDA is estimating a small drop in US plantings, and early conditions are dry across some of the key growing areas. This could result in a bump in imports from Canada. Lower Australian production might allow for a bit more volume to Japan as well. If the Canadian export target is hit, this could mean a relatively tight carryout again in the coming season.

Over the next few months price direction will primarily be driven by weather conditions in western Canada and the outlook for the US corn crop. But keeping tabs on how barley crops are faring in other regions, and the resulting outlook for Canadian exports, will shape longer-term price projections.

Find more barley market reports here:

- Barley Market Report: USDA Increases US Corn Production Estimates

- Barley Market Report: A Big 2025 Canadian Barley Crop Will Result in Larger Ending Stocks

- Barley Market Report: Could Barley Demand Surprise to the Upside in 2025/26?

- Understanding Barley Price Trends: Marketing Planning Doesn’t Require a Crystal Ball

- Barley Market Report: Larger Canadian Barley Crop Sees Good Early Season Movement