Barley Market Report: Shrinking Barley Crops in Western Canada – Impacts on Yield, Domestic Use and Export Potential

Barley crops in western Canada have suffered due to dryness and heat, with the worst conditions in the southern prairies. According to provincial crop reports from mid-July through August, barley’s ‘good/excellent” ratings fell substantially from well above average to below. As a result, yield estimates are being cut and the 2024 crop will be smaller than last year. The main question is how much smaller.

StatsCan’s first estimate of 2024 Canadian barley production came in at 7.5 mln tonnes, based on satellite vegetation maps from late July and was well below the average trade guess of 8.3 mln tonnes. Barley yield was estimated at 59.9 bu/acre, lower than 2023 at 61.2 bu/acre and below the 5-year average of 63 bu/acre. This crop estimate is more than 1.4 million tonnes smaller than last year but sizable carryover stocks from 2023/24 will insulate some of the production loss, with total supplies falling 4% year-on-year. Anecdotal harvest reports indicate crop quality is an issue, with barley largely coming in with light test weight and high protein.

If this crop estimate is the starting point, the demand side of the 2024/25 Canadian barley balance sheet will need to see changes from earlier expectations. The largest part of Canadian barley consumption is domestic feed use. Over the past five years (other than 2021/22), barley feed use has averaged 5.5 mln tonnes. Due to the reported quality problems with this year’s crop (light test weight, higher protein), less could be suitable for malting or malt exports, and more fed domestically. We are projecting feeding at 5.5 mln tonnes today, in line with the average. So far, less US corn has been booked for import into western Canada this fall, which will also help with domestic feed demand.

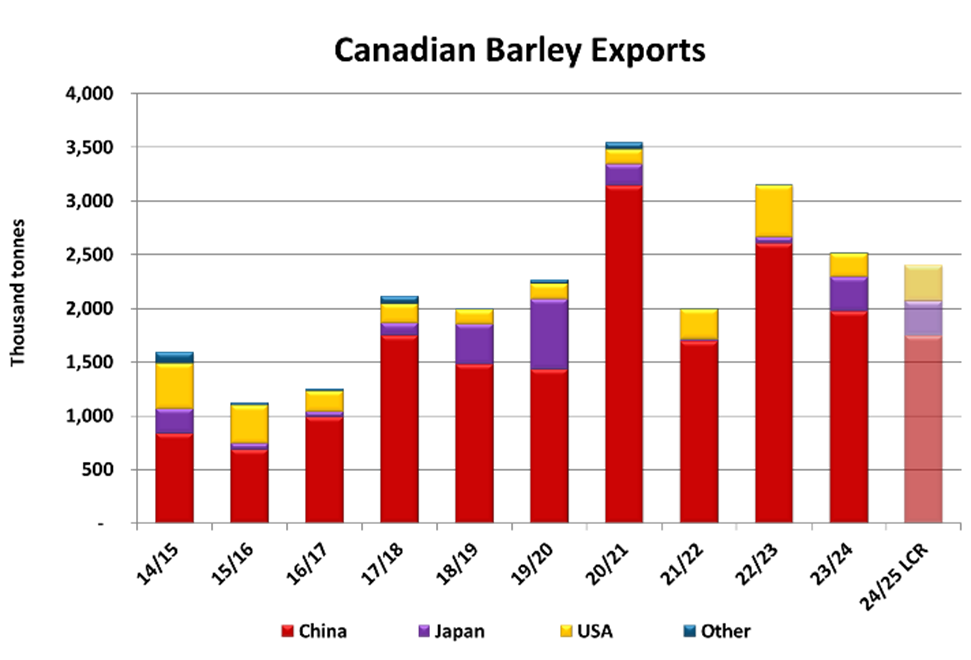

The second biggest part of Canadian barley use is the export channel for both feed and malt barley. Exports in the last five years have averaged 2.7 mln tonnes. However, one sticking point this year could be the fact that China has announced it has ‘asked’ domestic traders to purchase less foreign grains in 2024/25, including barley. Apparently, the Chinese government is preparing for a bumper domestic grain harvest this year and wants to bolster local prices. Sales already on the books shouldn’t be affected, but arrivals from November forward could be stifled. This is obviously a major risk to Canadian export potential as China typically represents 80% of the country’s total volume. Canada really can’t afford to lose this major market, as other avenues are limited. We have made some changes to our export forecast, currently sitting at 2.4 mln tonnes, however additional changes may need to be made depending on how the situation plays out over the months ahead.

That said, barley production among key exporting countries, particularly the EU and Argentina, is expected to shrink noticeably in 2024, which could keep demand for Canadian barley on the strong side, especially if China remains in the game.

The remaining parts of Canadian barley usage are malting, seed and food consumption. Seed and food use are steady from year to year and won’t be affected by a smaller than expected barley crop. Domestic malt use has been edging lower in the last couple of years and this trend is likely to continue going forward. Ultimately, there’s potential for larger barley ending stocks in 2024/25, but with lots of unknowns.