Barley Market Report: Barley Supply Levels a Bit Clearer As Harvest Progresses

There has been a flurry of StatsCan estimates in recent weeks and despite the usual “questions”, the information provides some direction for the market. There are many unknowns about barley demand for 2024/25 but the supply picture is becoming a bit clearer, especially now that the harvest is moving into its late stages.

The feedback we’ve been receiving about the barley harvest is that yields and quality have generally been getting better as the season has progressed. The earliest harvest reports indicated lightweight and high-protein barley with low yields but the crop further north appears to have higher test weights, with better yields.

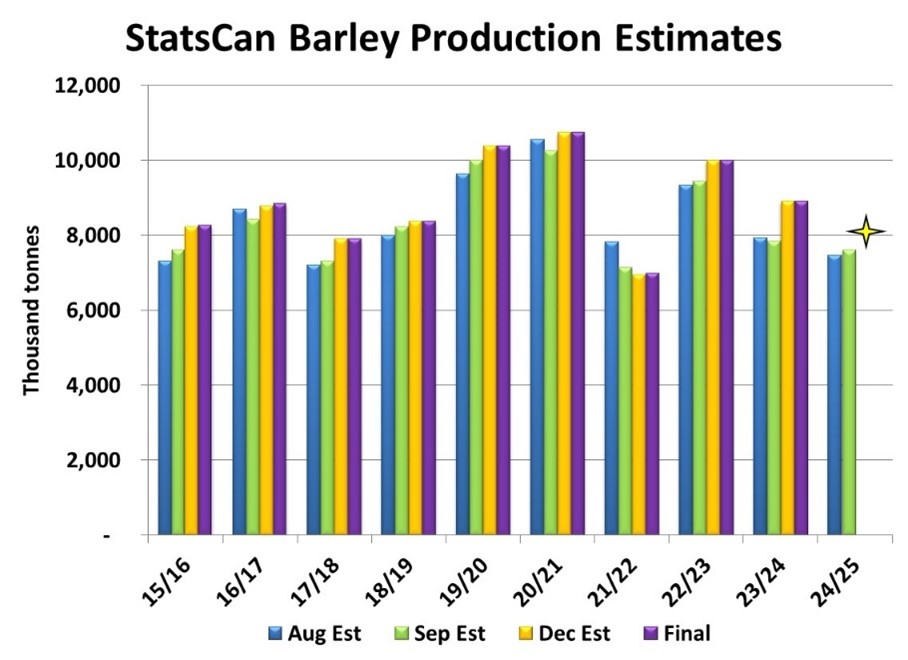

In its latest model-based production estimate in mid-September, StatsCan reported the 2024 barley crop at 7.60 mln tonnes, up slightly from its August estimate of 7.47 mln tonnes. This was based on a western Canadian yield of 61.0 bu/acre, very close to last year but below the 5-year average of 63.3 bu/acre. StatsCan’s track record of barley production estimates shows that the December survey-based production number is usually higher, which suggests a bump up is likely in its next report. But even if that happens, the 2024 Canadian barley crop would still be one of the smaller ones of the last five years.

In terms of quality, Sask Ag’s crop report from earlier in September provided some direction. For the provincial crop, the report indicated 27% was malt quality, slightly lower than the 10-year average of 30%, with 48% as a 1CW and 25% as 2CW or lower. If this same grade breakdown fits for the rest of the prairies, it would mean that just over 2.0 mln tonnes of the 2024 Canadian crop would qualify as malt barley. Keep in mind that last year, total malt barley demand (domestic malting plus malt barley exports) totalled 2.1 mln tonnes, which means there’s not much of a supply cushion.

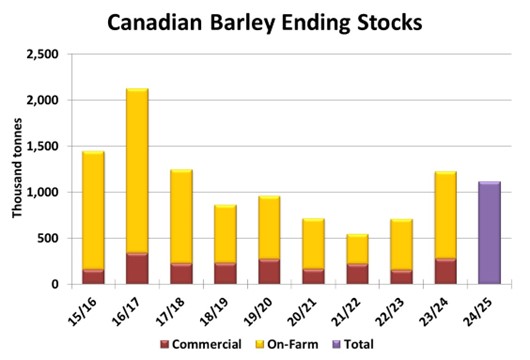

In early September, StatsCan also issued its estimates of July 31 stocks, which serve as the opening stocks for 2024/25. For barley, StatsCan reported inventories of 1.22 mln tonnes, the highest since 2017/18. We don’t consider these inventories as “heavy”, but they do help offset the smaller 2024 crop. Total supplies (old-crop carryover + imports + production) in 2024/25 would be around 8.9 mln tonnes, down from 9.7 mln in 2023/24 and well below the 5-year average of 10.3 mln tonnes. Not burdensome by any means.

Because of the forecast for smaller supplies this year, it looks like 2024/25 ending stocks could also dip. That would be the case even if this year’s total usage is lower. Our current forecast for 2024/25 ending stocks is 1.1 mln tonnes, but that could easily shrink further depending on demand for Canadian barley.

Of course, the 2024/25 outlook for domestic use and exports is still full of unknowns. Domestic feed use of barley could be pressured by the availability of more feed quality wheat, durum and oats. As always, the larger question mark revolves around export demand, particularly from China, with many different opinions about the strength of that market. Some of that situation we’ll only learn as the market year progresses. But again, even if usage slips in 2024/25, the lower supplies will keep the barley market from feeling too heavy.