Barley Market Report: Seeding Progress, Yield Forecasts, and Global Trends

by Leftfield Commodity Research

It’s always risky to start making crop predictions at this stage of the year. The weather through the growing season can be erratic and crop conditions can change quickly. Despite that caution, it’s time to start looking at crop prospects for 2024 and what it could mean for barley supplies.

This year, seeding has been lagging the average pace across much of the prairies due to on-and-off rainfall events. That said, it’s still relatively early in the planting window, and the moisture has given producers more optimism around new-crop prospects.

There is still some variance in seeded area expectations in Western Canada. Lower prices in 2023/24 undoubtedly decreased growers’ interest in producing the crop in 2024/25. StatsCan estimated seeded area at 7.13 million acres, down just 3% year-on-year, while most industry estimates are in the sub 7-million-acre range. The questions about acreage are adding some uncertainty for the Canadian barley crop, and could be amplified if the wet weather continues, as barley tends to be a late season back-up planting option for those running out of planting window. StatsCan won’t be out with an updated acreage estimate until late June.

Even though it’s still early, there’s a lot more optimism for barley yields in 2024. Soil moisture has been recharged in much of the prairies. Compared to last year, when nearly all the prairies were experiencing below normal soil moisture, this season is starting out considerably better in 2023. The improved moisture profile will set the crop up for a strong start, and help the crop manage increasing temperatures heading into summer.

Percent of normal soil moisture May 2023 versus May 2024 – Western Canada

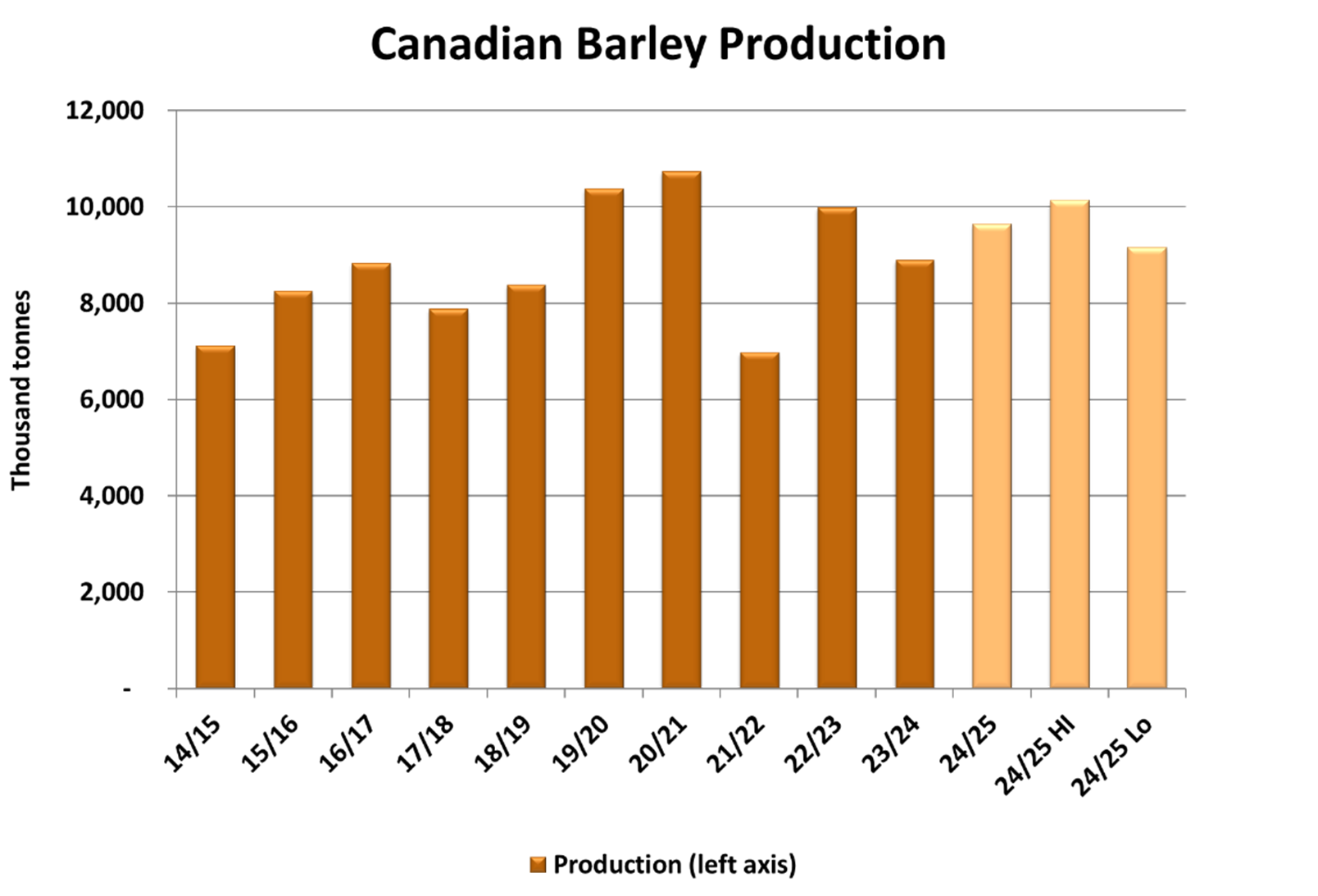

Even though many factors are still up in the air, we can look at a few production scenarios using StatsCan’s early estimate of 7.1 million acres and different yield possibilities. The 5-year olympic average (taking out the best and worst yield in that timeframe) is 67.5 bu/acre. To account for poorer or better growing conditions ahead, we’ve included yields 5% below and 5% above the latest 5-year Olympic average.

The base case, with the latest 5-year Olympic average yield would mean a crop of 9.65 million tonnes, 750,000 tonnes (8.5%) more than last year. Looking at a 5% higher than average yield outcome, production would come in at 10.13 million tonnes, 1.24 mln tonnes (14%) more than last year. On the flipside, assuming a 5% lower than average yield outcome, would result in a crop of 9.16 mln tonnes, just 265,000 tonnes more than last season. On the high end, the crop could be the largest since 2020/21, while lower end yield results would see a crop similar to last year.

Keep in mind, carryover from 2023/24 is expected to be larger than average, which means there will be supply ‘cushion’ if yields falter and will add the total available supplies in 2024/25. The base case points to total supplies above the 11 million tonne mark, which would be the heaviest since 2020/21, and could be considered burdensome without an improvement in the export program and higher domestic feeding.

Supply is only one side of the equation though. In contrast to Canada, where barley supplies will be larger than last year, availability in other exporting countries could take a hit. According to the first 2024/25 global projections from USDA, production in other key exporting countries including Russia and Ukraine will be lower reducing export potential. In Australia, planting is ongoing but despite increased acres, dryness in key areas could keep yields suppressed. The USDA is only projecting a 1% increase in Australian production today, and when combined with tight carryover from 2023/24, will keep supplies and subsequent exports reduced.

With reduced supplies in key exporting regions, importers may increasingly need to look toward Canada for barley. China has shown insatiable demand for barley in 2023/24 and has drained most exporters of their supplies. In 2023/24 China took less Canadian barley because of the mending of trade relations between Australia and China. In this upcoming year, with a larger Canadian crop and potentially constrained supplies in other key regions, China may have to come back to Canada in larger way. In essence, a bigger 2024 Canadian barley crop may not be so burdensome if we see increased export demand absorbing extra supplies.