Barley Market Report: Statistics Canada Increases Barley Production Estimate in December Update

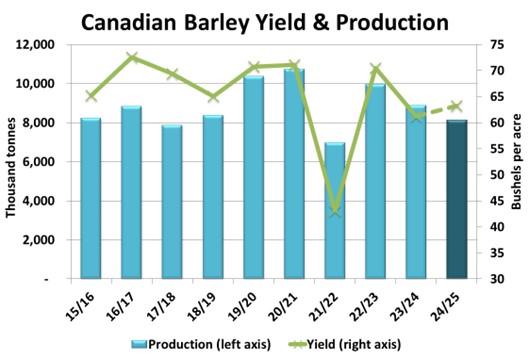

StatsCan increased their estimate for the Canadian barley crop in the December update, bumping the figure to 8.1 mln tonnes, from 7.6 mln in September. This is based on a yield of 63.2 bu/acre, slightly higher than in 2023, but below what was common prior to the 2021 drought when the 5-year average was close to 70 bu/acre. The December number is based on farmer-surveys, compared to previous reports that were model-based. Even with the increase, the barley crop is the second lowest since 2017.

The adjustment was largely expected, based both on anecdotal reports from farmers and due to the fact StatsCan has increased the barley production figure from the September to December report in 9 of the past 10 years. Unlike some other crops, StatsCan typically does not make sizeable revisions to barley in future updates, so this will likely be very close to the final ‘official’ number going forward.

Larger production tends to weigh on prices, all else equal. However, the market may be able to absorb the additional supply without negatively impacting values. A relatively tight global market lends support for export potential, although China is the key driver and what they do in the coming months is uncertain. Livestock feeding, by far the largest source of barley consumption, could also rise, particularly as a firming futures market and weak Canadian dollar increase the cost of importing US corn. Prairie wheat supplies are also getting drawn down due to robust export movement, tightening domestic feed grain supplies. At the same time, malt barley demand has been a bit lackluster.

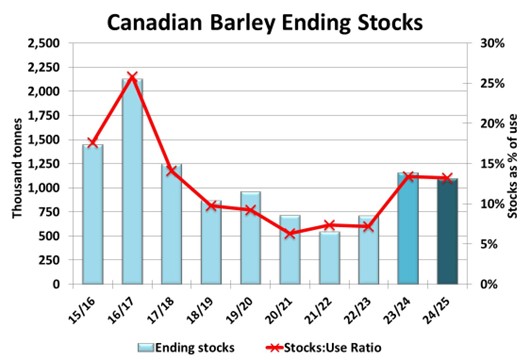

Based on current demand estimates, it’s possible the Canadian barley carryout for 2024/25 could come in at just over 1 million tonnes, essentially flat from 2023/24. While nearly the largest in 7 years, this is still relatively snug in an environment where demand is mostly steady.

The current supply and demand balance could see domestic barley prices trade mostly sideways in the short-term. This also fits the normal seasonal pattern of bids tending to drift in a range through mid-winter before turning higher into early spring. But while January is often ‘routine’ in terms of Canadian barley fundamentals, there are many external factors that could spill into the market, including both direct and indirect effects of political dynamics in Canada and the US.

Looking ahead to next season, it’s possible Canadian barley plantings come in above the very low 6.4 mln acres of 2024, with some very preliminary guesstimates suggesting area could be a little below 7.0 mln. When considering the pre-2024 5-year average is 7.5 mln acres, there is room for area to see a year-over-year increase without causing supplies to get heavy. But the current environment is highly uncertain on multiple fronts, which means early acreage estimates are hard to pin down and the potential for farmers to make last minute changes to seeding plans is higher than most other years. StatsCan is scheduled to come out with their first 2025 seeded area estimate on March 12th.

Of course, yield will be even more important than acres in determining production in 2025. Moisture conditions are better than they have been in several years through many of the key western Canadian barley growing areas, but it would take a big rebound in yields to see a crop size that is similar to what was typical in most seasons prior to 2024. Weather in spring and summer will ultimately drive the production outlook.

Find more barley market reports here.

Wondering what variety of malt barley to grow this year?

Wondering what variety of malt barley to grow this year?

Check out the Canadian Malting Barley Technical Centre’s Recommended Variety List for 2025-26.