Barley Market Report: Canadian Barley Faces Renewed Export Competition

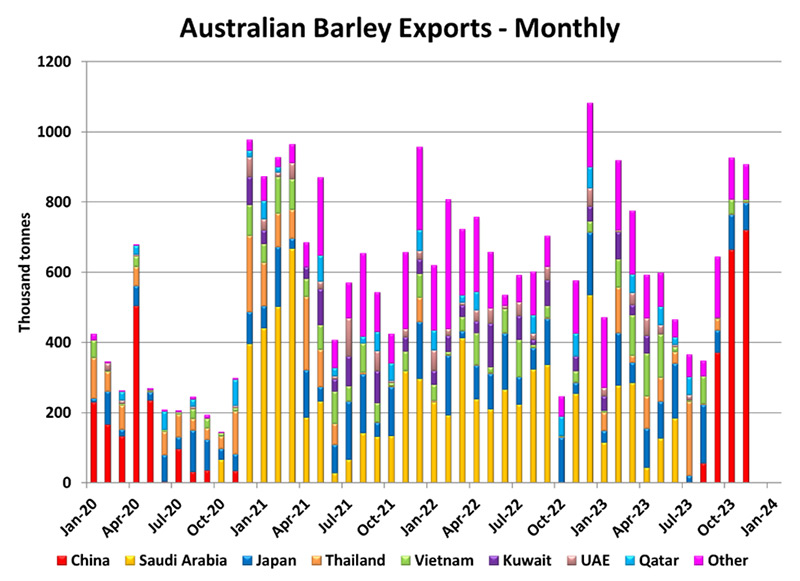

Over the past few years, Canadian barley exports have expanded significantly. Beginning in the 2017/18 marketing year, export volumes started to exceed 2 million tonnes– spiking to a high of 3.534 million tonnes in the 2020/21 season. Prior to the upswing, yearly exports ranged from 1.1-1.5 million tonnes. It’s no coincidence that Canadian barley exports jumped during this period – as it overlapped with China’s implementation of an excessive (80.5%) tariff rate on Australian barley. Australia had been China’s largest barley source; however the countries barley exports fell from 2.37 mln in 2018/19 to zero in the years post-tariff. Overall, Australia exports didn’t suffer, and movement picked up to other destinations, such as Saudi Arabia, Japan, Vietnam and Thailand.

Following the tariff enactment, China began swiftly scooping up Canadian barley to fill the gap. China continued to dominate Canadian business over the next few years, taking up to 90% of all exports. However, in August 2023 China and Australia made amends, and the tariff on Australian barley was lifted. This has resulted in a material shift in trade flows. Australian exports have since soared, coming in at 1.832 mln tonnes in the first two months of the 2023/24 marketing year, compared to just 822,000 tonnes during this period last year. China represents 76% (1.32 million tonnes) of Australian exports so far this season.

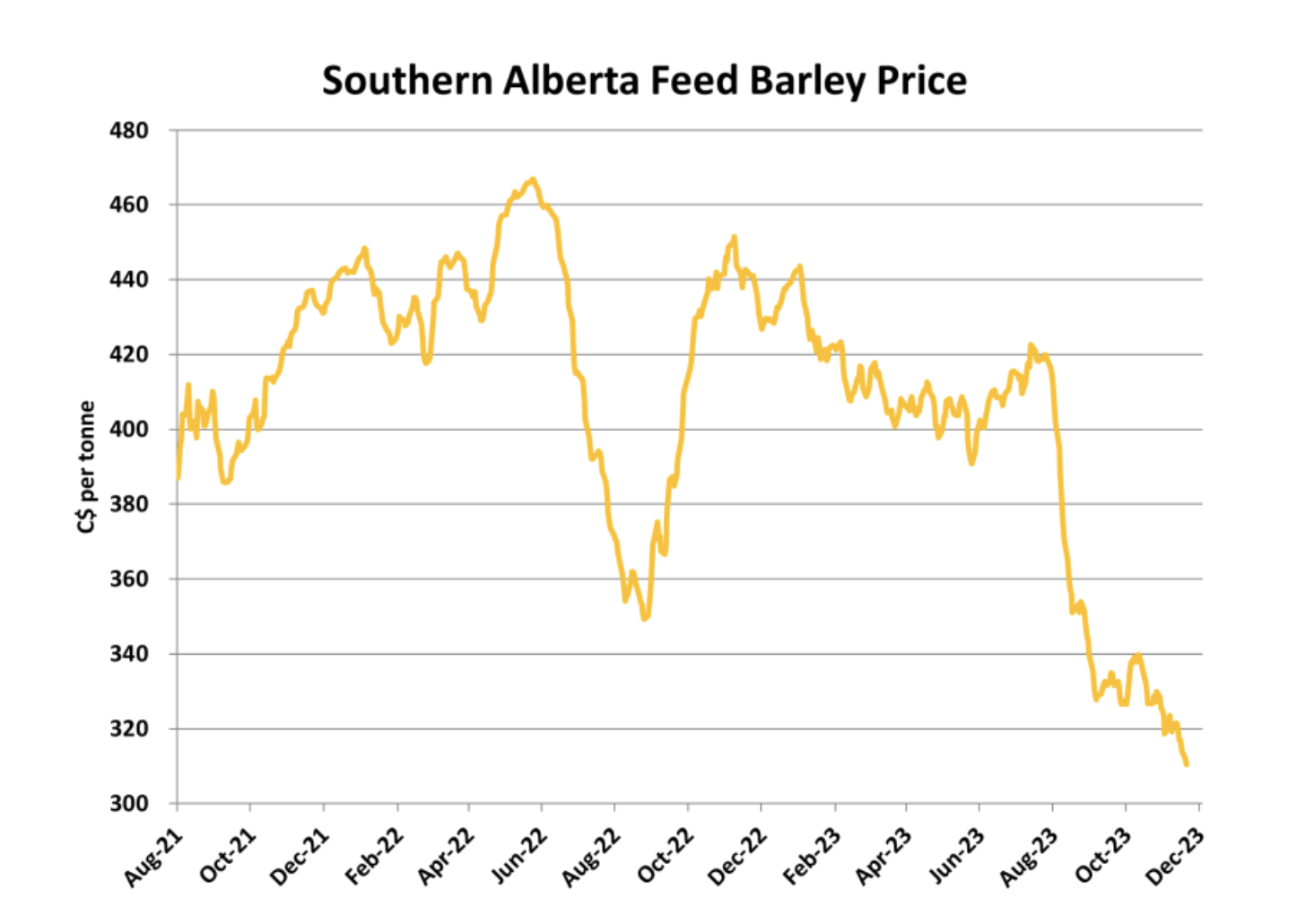

Canadian exports have been suffering because of the reopening of trade and increased competition, totaling just 786,000 tonnes (Aug-Nov 2023), down 40% from this time last year. China is still the dominant buyer of Canadian barley, purchasing over 90% of all exports so far this marketing year, but in that lies the problem – Canada is lacking other export outlets, especially at a time when faced with increased competition. Unlike, Australia, Canada hasn’t ‘adapted’ with new export channels. Canadian exports are forecast at 2 million tonnes in 2023/24, down from 3.27 mln tonnes in 2022/23, as a result.

In the short-term continued competition from Australia into the Chinese market is expected, however opportunities for improved Canadian business may surface in the months ahead, as Australia’s exportable surplus is depleted. Australian barley production fell 29% year-on-year in 2023/24 – coming in at just 10 million tonnes, well below the 2022/23 crop of 14.4 million tonnes. Looking longer-term, the strong demand and decent prices for barley has Australian growers keen to expand acreage in 2024/25. Early estimates point to barley seeded area jumping 10-15% next season. Assuming normal yield results, production could jump to 11.5 – 12 million tonnes next year. This would keep competition elevated.

Domestic feed use is still the largest source of demand for Canadian barley but in recent years, the strong export pull has been the main reason for stronger prices. As a result, anything that affects Canadian export potential has an outsized impact on prices. The mended trade relationship combined with larger Australian production, is a sizable risk for barley prices in the longer-term outlook. Canadian barley needs to be priced competitively in order to maintain export volumes as well as gain access to other markets.