Barley Market Report: Weak Export Demand and Quiet Domestic Market a Headwind for Barley

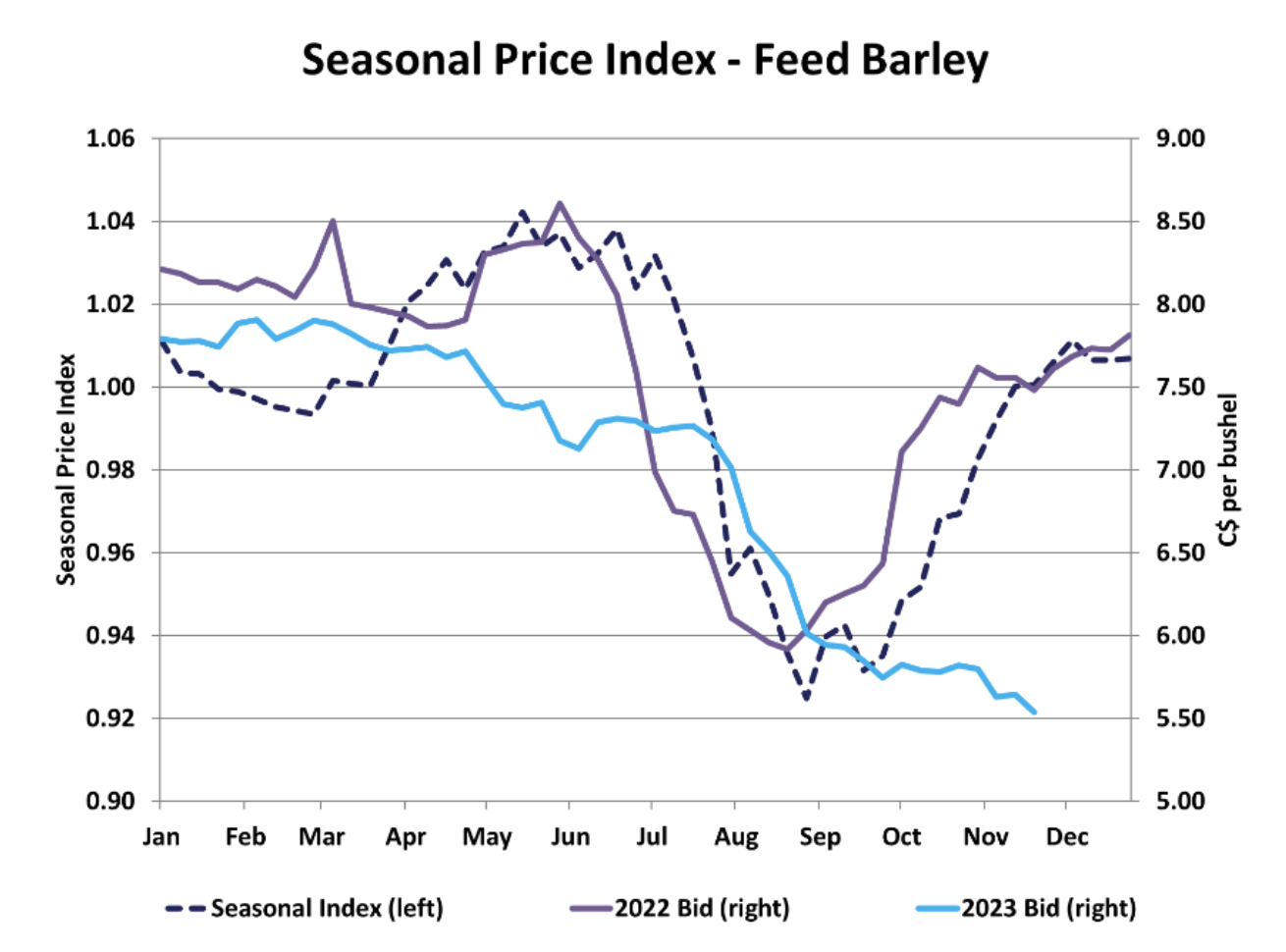

This year has been different for the Canadian barley market. Seasonal trends would typically point to higher prices at this juncture in the marketing year, but barley price behaviour hasn’t followed the typical seasonal tendencies. Usually, barley prices rally through the fall and flatten out or inch lower throughout winter. However, this season’s bids have marched steadily lower from the growing season until now — a result of lacklustre demand.

After three years of exceptional exports amid Australia and China’s trade conflict, export demand for Canadian barley in 2023/24 has waned. Australia and China have mended fences and resumed their previous trade relationship. Now, Canada is without a robust export outlet, as in the previous few years, China had accounted for close to 90 per cent of all Canadian barley exports. According to the latest trade data from the Canadian Grain Commission, cumulative barley exports total 742,000 tonnes (as of week 16), which is down 29 per cent from this time last year.

The weaker barley exports have been a result of reduced Chinese purchases and Canada’s uncompetitive pricing. Throughout fall, Canadian export ranked as one of the highest worldwide, limiting appeal to importers. As of late, we’re seeing Canadian values align with other exporting nations. If this trend continues, it should help Canada gain traction in the export market for weeks and months ahead, especially as supplies are exhausted in places like Australia and the Black Sea.

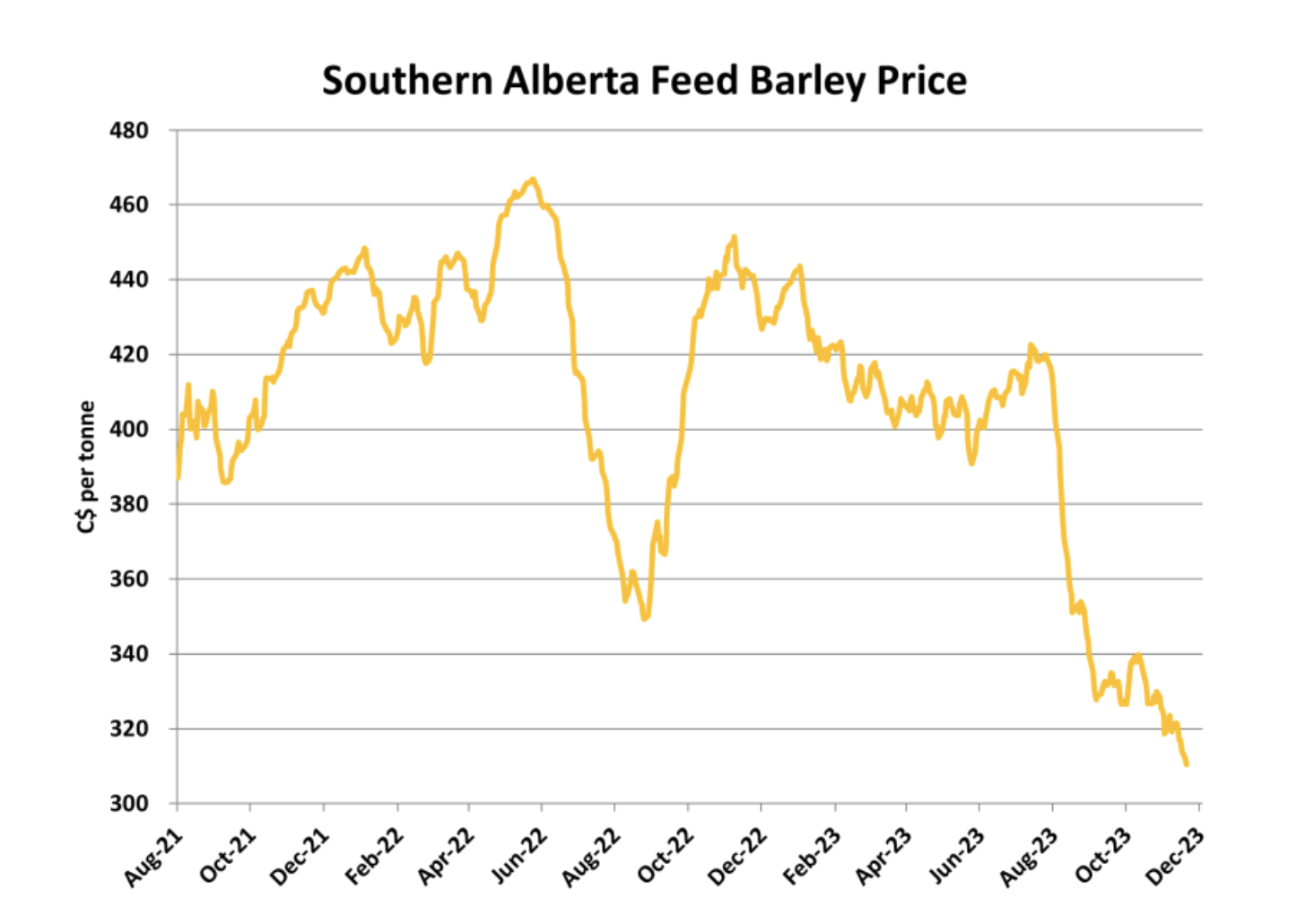

Issues haven’t all been on the export side, as the domestic feed market continues to weaken simultaneously. Feed barley prices seemed to stabilize in southern Alberta, but recently slipped below $315 per tonne at feedlots and feedmills.

The affordability of corn imports is increasing due to the convergence of softer corn futures and a strengthened Canadian dollar, thereby exerting downward pressure on feed barley prices. The widespread adoption of corn as feed in southern Alberta, driven by competitive prices, has coincided with a surge in U.S. corn imports to Western Canada over the summer. September’s data from Statistics Canada reveals the importation of more than 215,000 tonnes of corn, maintaining strong momentum. This trend is expected to continue, constraining domestic feed barley prices. Despite initial concerns prompting barley growers to sell more, we anticipate a slowdown during the holiday season as producers await developments in the new year.

Prices might stay stable in the short term, following the usual pattern, but keep an eye on the corn market, especially the uncertain South American crops. From a seasonality perspective, prospects could brighten in the longer term, as barley prices typically tend to peak in the late spring to early summer.