Barley Market Report: Large Shifts in Canadian Barley Demand are Needed

By: Chuck Penner / LeftField Commodity Research

While we still don’t know just how small the Canadian barley crop will end up, expectations have dropped sharply over the growing season. Early on, it looked like the 2021 crop could easily be well above last year but those hopes had already started to fade by mid-June. By late July, crops were being written off or cut for greenfeed and the early harvest results are about as poor as expected.

Now it looks like the 2021 barley crop could be one-third (3.5 mln tonnes) smaller than last year. For buyers who had been counting on large supplies of Canadian barley, their plans will now have to change. For those who can’t reduce their demand for barley, costs are already a big concern. The demand outlook varies a lot, depending how the barley is used and when it is purchased.

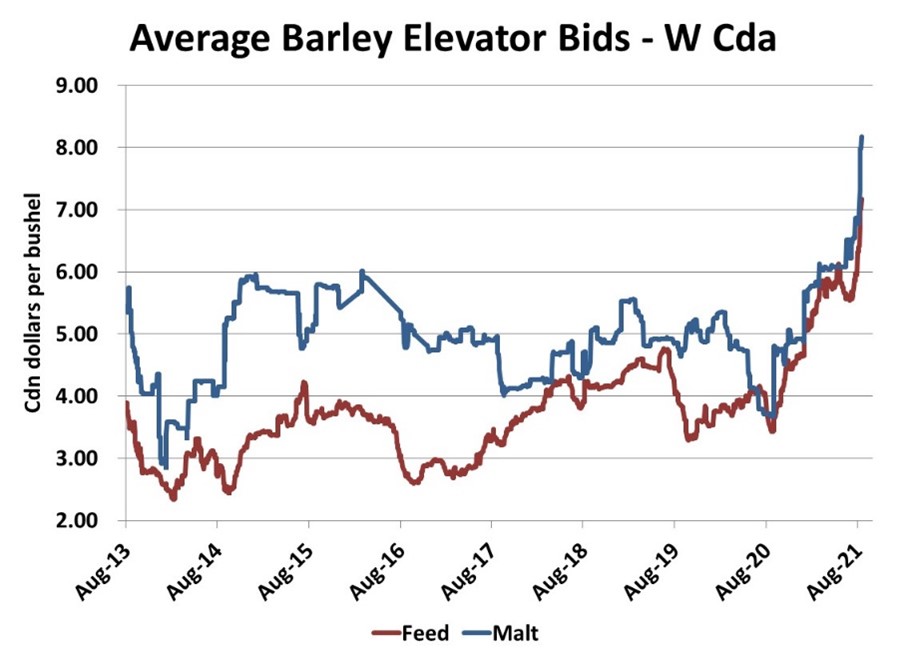

Back in spring, when large crops were still expected, exporters were making large new-crop (mostly feed) barley sales to China. Exactly how much was sold isn’t clear, but it was sizable, and barley was contracted from farmers to fill those sales. Now that crop failures have forced farmers to cancel or reduce their contracts, grain companies are scrambling to rebuild their coverage, which is causing bids to shoot higher. Keep in mind this chart shows an average of posted elevator bids; many farmers are selling at even higher levels.

The chart also shows malt barley bids have also spiked, mostly pushed higher by feed barley. Overall, there’s plenty of barley to meet demand from maltsters and malt barley exporters, but there are some complications. For one thing, the drought hasn’t been good for malt quality, causing thin kernels and high protein. Maltsters can work with this quality of barley but it isn’t ideal. More important though is that maltsters will need to keep bids aggressive to compete with the feed side of the market. In general, exports of malt barley will suffer while Canadian maltsters will manage to keep their plants running close to capacity.

Domestic feeders are already making large adjustments to deal with the smallest Canadian barley supplies on record and (in the case of cattle) a short hay crop. Where possible, other Canadian cereal grains are being booked to fill the gap, but those crops are also reduced this year, with very strong prices. There simply isn’t any feed wheat or oats available at a modest price.

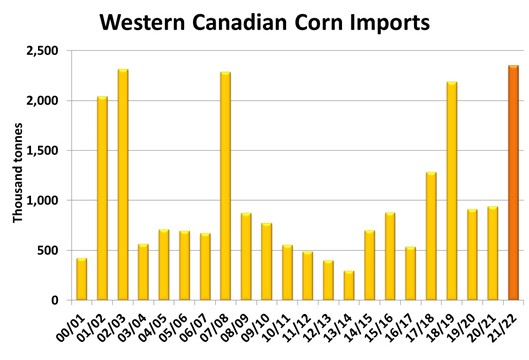

The main option for cattle and hog feeders looks like it will involve bringing in much more corn from the US. When western Canadian feed supplies have been tight in the past due to small crops, well over 2.0 mln tonnes of corn has been imported to fill the gap. This year, US corn will need to come from further south, since the crop in the US northern states was also hit with drought. The extra freight will add cost.

The large demand for US corn means the crop outlook there is even more important than usual for Canadian livestock producers. Besides just the actual corn prices, the strength (or weakness) of the Canadian dollar could also play a significant role and its recent declines certainly aren’t helpful.

Beyond the earlier export sales to China, not much Canadian barley is going to be moving offshore in 2021/22. The extremely strong demand from domestic feed users has largely priced Canadian barley out of export markets. Countries like Australia, Europe, Ukraine and Russia, to name a few, have good-sized barley crops in 2021 and should be able to meet most export demand.

So what does this mean for prices? Barley growers who have seen these record prices will be reluctant to sell if there are any signs of weakness. But because US corn will be flowing into western Canada at a heavy pace, it will be setting the floor (or ceiling) for feed barley in 2021/22. That’s why crop conditions south of the border and Chinese corn demand will have a direct effect on Canadian barley prices.