Barley Market Report: Possible Impacts of US Tariffs on Canadian Barley

The uncertainty around the US putting steep import tariffs on Canada and Mexico continues to hang over agricultural markets. At the time of writing, both Canada and Mexico received a temporary reprieve, but the situation is constantly changing and there are still plenty of unknowns on how things will unfold in both the short and longer term. If tariffs eventually are implemented, there’s no predicting how long they will last, and it’s possible that pushback and lobbying within the US will cause some carveouts or exemptions, particularly as the negative effects for the US start to be felt.

One area of speculation is around who will ultimately end up paying the cost of the tariffs. For agricultural products, costs will be paid or absorbed through a combination of US processors, US consumers, Canadian processors and exporters, and Canadian farmers. How that gets distributed will vary by crop, and be influenced by how important the US is as an export market for Canada, and how reliant the US is on the Canadian supply.

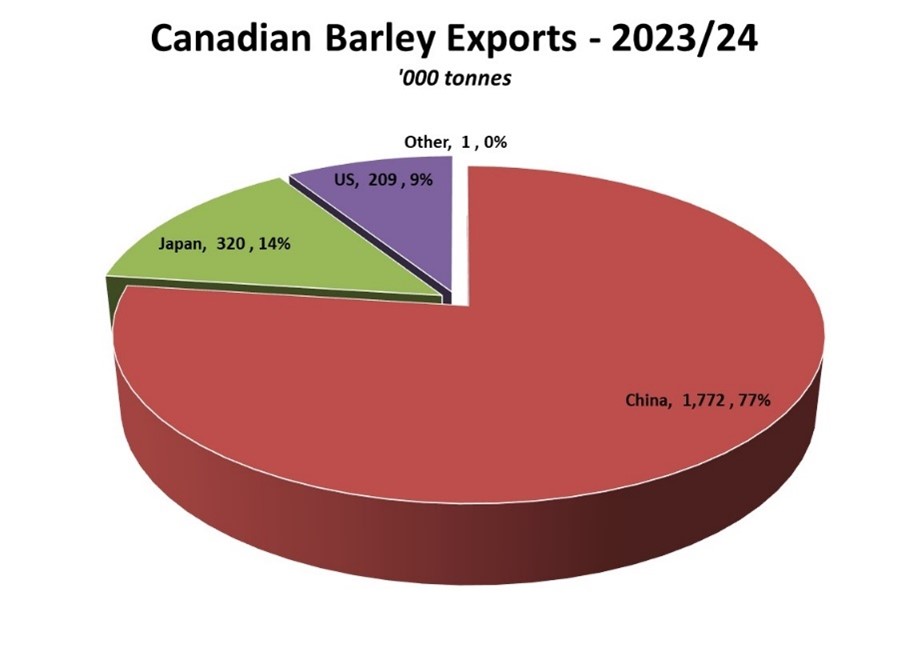

While no crop will go unscathed, barley is somewhat less directly vulnerable than some others. Canada’s exports of barley to the US were around 209,000 tonnes in 2023/24, less than 10% of total shipments (China is our primary export market, followed by Japan at a distant second). Volumes vary from one year to the next, but the 5-year average is around 250,000 tonnes, while total exports averaged 2.6 mln tonnes during that time.

Barley is also much less reliant on exports than many other Canadian crops, with domestic feed demand typically more than twice as large as total exports. The loss of any potential exports to the US will still be felt, but the negative effect of tariffs may be somewhat buffered for prairie barley prices.

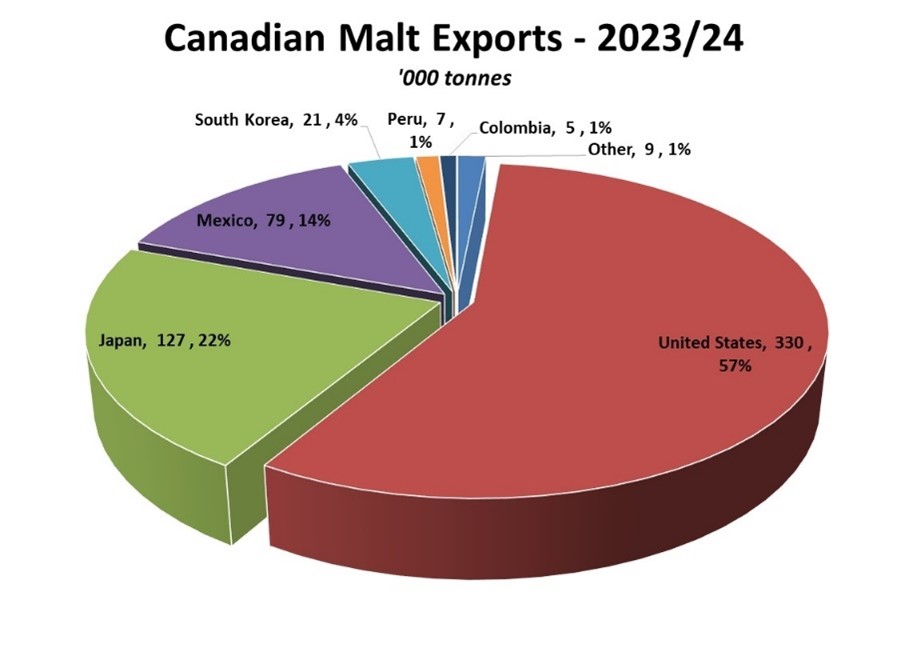

But while the US takes a smaller share of barley exports, it’s the largest destination for Canada’s malt exports, at 57% of the total in 2023/24. Canada also supplies most of the US malt imports, leaving them few alternatives in the short-term. This mutual reliance could see both sides sharing a portion of the cost burden to keep some exports moving, rather than having shipments dry up completely.

While we tend to think of the direct impacts of tariffs, Canadian markets will also experience ripple effects that are difficult to anticipate ahead of time. For example, most of the corn moving into the eastern prairies moves by truck. If there is less grain travelling south because tariffs reduce export demand, the ability to bring corn on a backhaul is reduced, making logistics more challenging. When combined with a weak Canadian dollar, it could result in lower corn imports, which in turn may bump up feed barley demand.

At the same time, the US is the most important export market for oats. If oat exports slow, that increases the supply of feed grains in western Canada, possibly hurting feed barley demand. This is within an environment where US trade actions with other countries will also impact Canadian grain markets. The net effects of all these dynamics will only be known after the fact, making the coming months an uncertain and volatile time in grain markets.

Find more barley market reports here.

Wondering what variety of malt barley to grow this year?

Wondering what variety of malt barley to grow this year?

Check out the Canadian Malting Barley Technical Centre’s Recommended Variety List for 2025-26.