Barley Market Report: The Impact of Australian Barley on Canadian Prospects

It’s no coincidence that Canadian barley exports surged the last three years, averaging nearly three million tonnes even with the 2021/22 drought year included. In mid-2020, a trade dispute between China and Australia erupted, resulting in China imposing an 80 per cent import tariff on Australian barley, among other items. This development was significant for both nations, given that Australia had been China’s main barley supplier.

The Canadian barley market benefited from this trade disruption, with exports jumping from 2.2 million tonnes in 2019/20 to 3.5 million tonnes in 2020/21. China accounted for more than 90 per cent of Canadian exports that year. Despite 2020/21 being a year with the largest barley crop in over a decade, both feed and malt barley prices in Western Canada increased.

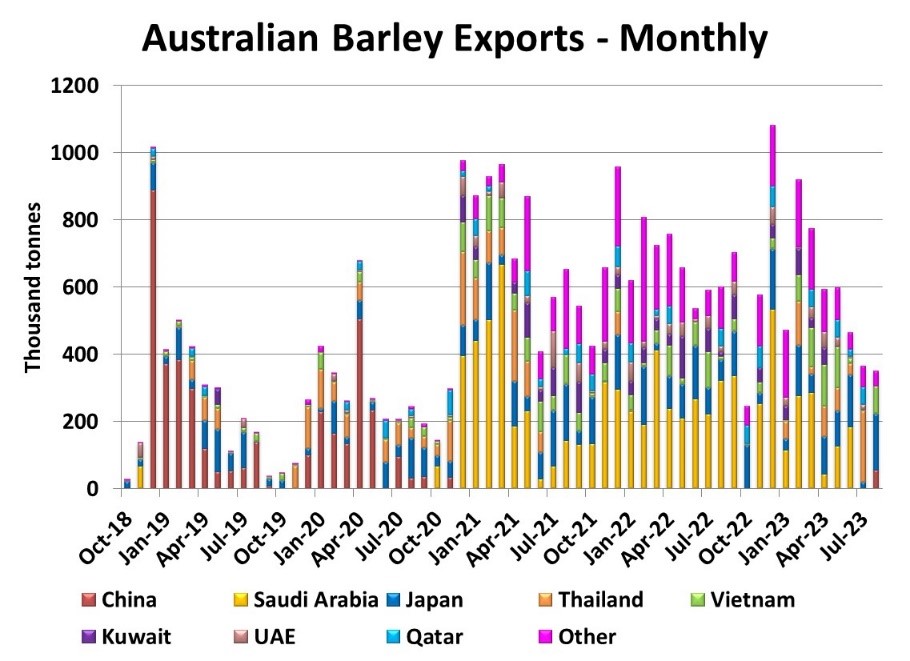

Unfortunately, good times couldn’t last forever, as China and Australia have resolved their differences, at least concerning barley. Although the tonnage reflected in trade data remains limited thus far, traders have reported numerous shipments of Australian barley being purchased by Chinese buyers, especially after the Australian harvest concludes.

During the trade dispute, Australian barley was traded at a sharp discount compared to other origins, including Canada. This helped Australian barley to secure markets in countries that were not previous customers. This included destinations such as Saudi Arabia, Thailand and Vietnam. Japan also bought more from Australia after Canadian barley was drawn into China.

In the 2023/24 season, Australian barley exports are anticipated to decline due to reduced harvesting, estimated at 10.5 million tonnes, compared with the previous average of 14.4 million tonnes. Despite this decrease, sizable inventories from last year’s big crop may still hit six million tonnes.

For the Canadian market, the main question is what will happen now that China is shifting at least some of its barley purchases back to Australia, adversely affecting Canadian export volumes? If a dominant customer like China, accounting for 80-90 per cent of Canadian exports the last three years, looks elsewhere for its barley needs, Canada must enhance competitiveness to maintain a presence.

With Canadian and Australian barley prices realigned, Canada is poised to regain part of the Japanese market. However, Canadian exports to Japan averaged 360,000 tonnes annually from 2017/18 to 2019/20, insufficient to fully address the issue caused by the Australia/China trade dispute.

Accessing other markets that increased Australian barley purchases won’t be straightforward. While some additional volumes could go to Middle Eastern countries, they are more inclined to buy from nearby sources such as Ukraine and Russia. Moreover, these countries predominantly purchase feed barley rather than malt barley, leading to lower prices.

Exporting Canadian barley to Southeast Asian destinations will only happen at discounted prices. These countries historically haven’t relied heavily on barley as a feed source and only did so in recent years because Australian barley was cheaper than feed wheat or corn.

The reality is that Canadian barley exports will likely be reduced in 2023/24. Early indications of this trend are visible through reduced shipping in the initial weeks of the marketing year. Canada’s 2023 barley crop is considerably smaller than last year, but fewer barley exports could mean 2023/24 ending stocks will be larger than the last year or two, keeping pressure on prices. While this doesn’t guarantee immediate price drops, the chances of a significant price rally in the coming months are low.