Barley Market Report: A Big 2025 Canadian Barley Crop Will Result in Larger Ending Stocks

This barley market report was provided by Leftfield Commodity Research.

Overview of the 2025 Canadian Barley Crop

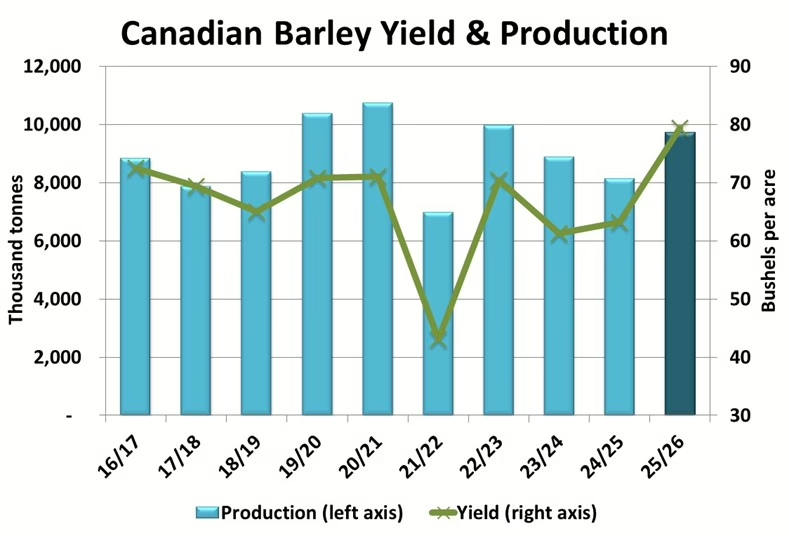

StatsCan made a big upward revision to the 2025 Canadian barley crop production estimate in December, now at 9.7 mln tonnes. This is 1.5 mln tonnes higher than the September figure, and 19% larger than the 2024 crop despite a 4.2% drop in seeded area as the yield was shown at a record 79.4 bu/acre. The adjustment was largely anticipated given widespread reports of big yields through most key barley growing regions. While the largest in three years, it’s not an unusually big crop, and only slightly higher than the 5-year average if the drought-reduced 2021 season is removed. Provincial government reports also point to quality being above-average, even though certain areas saw some challenging weather leading up to, and during, the harvest.

Record Yields and Production Estimates

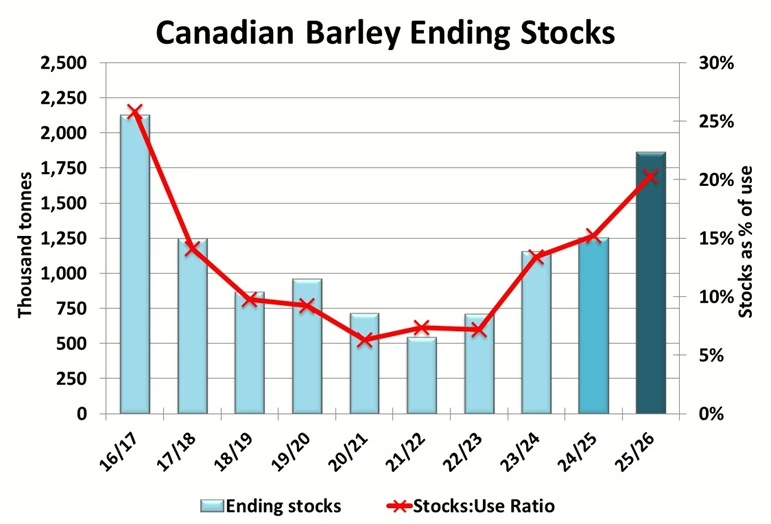

The large production combined with a slightly bigger old-crop carryin puts total Canadian barley supplies in 2025/26 at around 11.0 mln tonnes, the highest since 2020/21. But while stocks are comfortable, demand has been strong through the fall and early winter. US corn is uncompetitively priced in western Canada, which is reducing imports. The CGC reports barley exports running at the best pace in three years as of mid-December, while domestic malting volumes are also shown to be higher.

At the same time, it will be difficult to increase usage beyond current projections. Like barley, yields for other western Canadian cereals were also large, which increases domestic grain supplies and is resulting in some crops trying to ‘buy demand’ into feed markets via low prices. Current export forecasts are already quite aggressive, and Canadian barley will face competition from big crops in other key countries, particularly Australia (ABARES increased the Australian crop to a record 15.7 mln tonnes in their last update). A key part of the good export movement is the fact Canadian barley has been very competitive in global markets, something that erodes if local bids move materially higher. Total usage will be up in 2025/26, but not by as much as the increase in supply.

The result will be an increase in the 2025/26 carryout to as much as 1.8 mln tonnes, more than double the 5-year average and the largest in nearly a decade. Even if total demand ends up a little higher than currently projected, there is plenty of cushion before the Canadian barley balance sheet starts to get tight.

Price Outlook for Feed and Malt Barley

Despite expectations for a sizeable build in the carryout, prairie feed barley prices have held onto their post-harvest gains, staying relatively firm through the final weeks of 2025. Malt barley bids have been mostly flat, with domestic maltsters well covered for now. In addition to good demand, support has come from firming global barley values and a steady corn market. However, large Canadian inventories mean price upside may be limited in the short-term, with the potential for some seasonal strengthening into late winter and early spring.

Early indications suggest Canadian barley acres could increase in 2026, as prices have held up relatively well compared to most other crops. If that’s the case, supplies will be comfortable again in 2026/27, depending on yields. Of course, it’s still very early and much can change between now and when farmers finalize planting decisions. StatsCan is scheduled to provide their initial 2026 acreage estimate in early March.

Find more barley market reports here:

- Barley Market Report: A Big 2025 Canadian Barley Crop Will Result in Larger Ending Stocks

- Barley Market Report: Could Barley Demand Surprise to the Upside in 2025/26?

- Understanding Barley Price Trends: Marketing Planning Doesn’t Require a Crystal Ball

- Barley Market Report: Larger Canadian Barley Crop Sees Good Early Season Movement

- Barley Market Report: 2025 Canadian Barley Prices Face Harvest Pressure