Barley Market Report: Could Barley Demand Surprise to the Upside in 2025/26?

This barley market report was provided by Leftfield Commodity Research.

Barley Prices Under Pressure Amid Large Supply

Canadian feed and malt barley prices are trading near the lower end of where they’ve been over the past several years, largely because the total supply is estimated to be the second-largest in 5 seasons (StatsCan will give an updated production estimate on December 4th, with most analysts assuming the crop is larger than their last figure of 8.2 mln tonnes). However, values have also come up off the harvest lows, helped in no small part by strong early season demand.

Demand Estimates and Carryout Projections

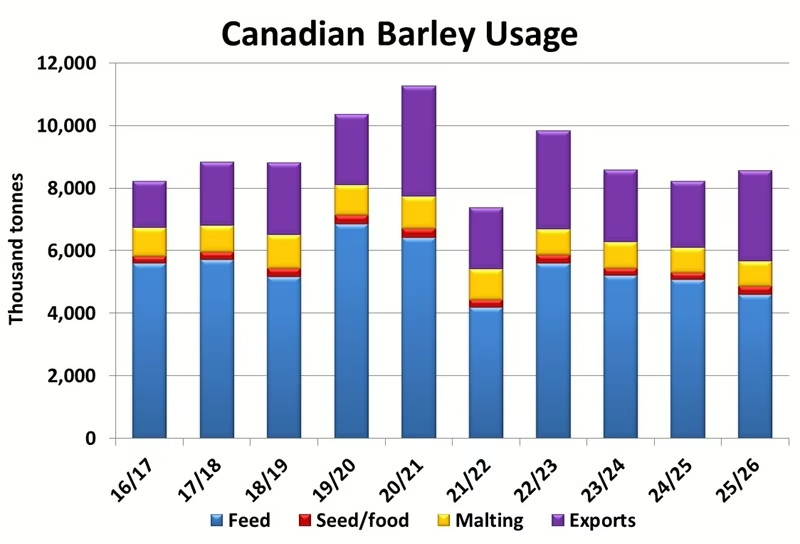

Current estimates point to total Canadian barley usage in 2025/26 at around 8.56 mln tonnes, up from 8.22 mln tonnes last year. When this demand figure is backed out of the supply assumptions, the carryout could end up close to 1.5 mln tonnes, the highest since 2016/17, and a level that suggests there is little price upside ahead. However, there is the potential for disappearance to be higher than assumed based on early season trends. If that is the case, the supply and demand balance could tighten up a bit by the end of the season.

Livestock Feeding Trends and Grain Competition

Livestock feeding is the largest demand component by a wide margin (although this is difficult to measure with accuracy, as the FWD part of the supply and disposition tables also acts as a ‘catch all’ to make the rest of the S&D balance). It’s possible feed usage is down a bit this season due to larger production of other grains in western Canada that are also working into livestock rations (wheat, oats, rye and corn on the eastern prairies), and in some cases are more competitively priced. At the same time, imported US corn has become expensive relative to local barley, which in turn will result in lower imports, particularly into Alberta feedlots. The net result could find more barley being fed by the end of the year.

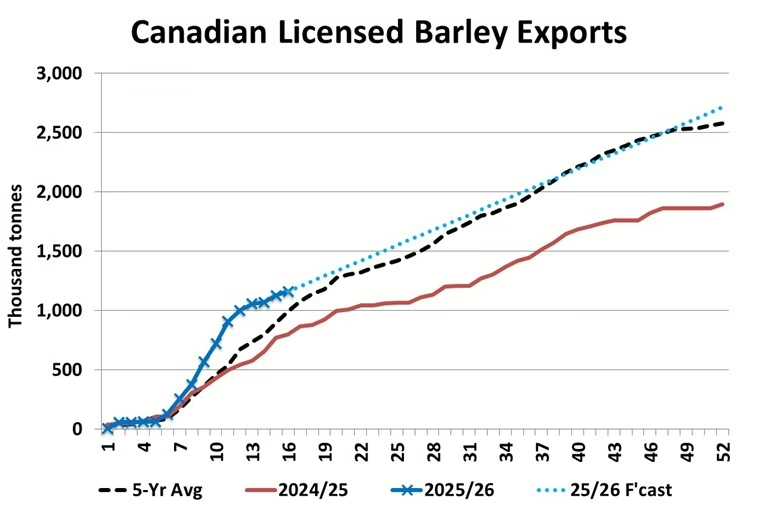

Strong Start for Canadian Barley Exports

Canadian barley exports are off to a strong start in 2025/26. CGC data shows shipments as of week 16 were 1.16 mln tonnes, the highest in four years, and already 40% of the way to meeting our fairly aggressive target of 2.90 mln tonnes for the season. Canadian barley has been competitive in global markets, which is resulting not only in good movement to the typical destinations (primarily China, as well as Japan), but also with the CGC reporting a shipment to Saudi Arabia in September, the first since 2016/17. But while early movement has been robust, it will be difficult to maintain the pace going forward, particularly given the large Australian barley crop that is being taken off.

Domestic Malting Shows Signs of Recovery

Finally, CGC domestic processing statistics suggests domestic malting volumes could be showing some recovery after several years of decline. While this is a small portion of total usage relative to exports and livestock feeding, it may point to some additional demand around the margins.

Price Outlook: Supported but Limited Upside

Early barley demand is encouraging, and a key reason why bids have seen a rebound off the seasonal lows. And it’s possible usage may end up higher than current estimates show. At the same time, part of the reason disappearance is up is because Canadian barley is competitively priced, which also means a significant rally could crimp usage. This suggests the next few months may see the market reasonably well supported, but also where there is a ceiling on upside potential.

Find more barley market reports here:

- Barley Market Report: Could Barley Demand Surprise to the Upside in 2025/26?

- Understanding Barley Price Trends: Marketing Planning Doesn’t Require a Crystal Ball

- Barley Market Report: Larger Canadian Barley Crop Sees Good Early Season Movement

- Barley Market Report: 2025 Canadian Barley Prices Face Harvest Pressure

- Barley Market Report: China Barley Imports Will Shape the Canadian Outlook for 2025/2026